BLOG TELAH DI KEMASKINI DI LAMAN BARU...

Blog ini telah di kemaskini di http://seminarjutawansaham.blogspot.com

My Blog List

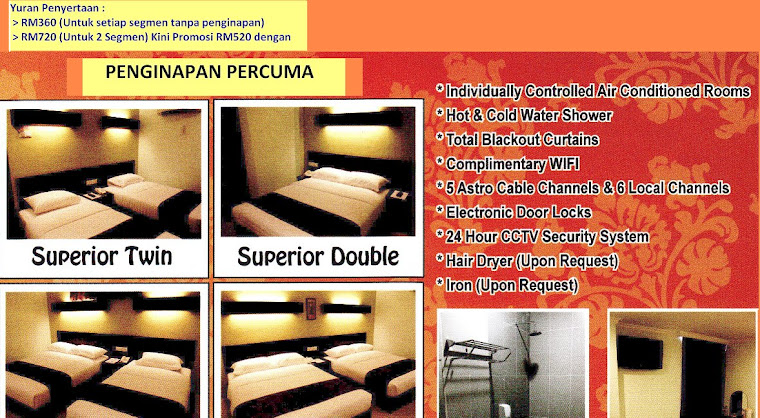

...kini mengadakan promosi bagi peserta yang ingin menyertai seminar untuk dua segmen dengan diskaun sebanyak RM200 serta penginapan percuma (untuk seminar di Pusat Latihan PUABUMI sahaja)......rebutlah peluang mempelajari ilmu pelaburan ini...

Penginapan percuma hanya untuk penyertaan dua segmen di Pusat Latihan PUABUMI Kemaman, Terengganu sahaja...

Barisan Penceramah

Kami bersedia untuk turun padang membongkar rahsia pelaburan di Bursa Malaysia

Destinasi Seminar

Pakej Eksklusif Istimewa ~ Seminar Jutawan Saham dan CPO siri ke 3 adalah pembuka untuk tahun 2011 ini di Pusat Latihan PUABUMI pada 8hb dan 9hb Januari 2011

Seminar Jutawan Saham & CPO akan berada di Santuary Resort Cherating pada 15 Januari 2011 ( segmen ekuiti ) dan 16 Januari 2011 ( segmen CPO )

Kem Pelaburan PUABUMI II akan berada di Hotel Midah Kuala Lumpur pada 13 Ogos 2011 ( segmen CPO ) dan 14 Ogos 2011 ( segmen Ekuiti )

Seminar Jutawan Saham & CPO akan berada di Suria City Hotel, Johor Bahru pada 29 Januari 2011 ( segmen ekuiti ) dan 30 Januari 2011 ( segmen CPO )

Tuesday, December 13, 2011

Friday, December 9, 2011

Monday, December 5, 2011

Seminar Pelaburan - Teknik Goldfinger RM

Atas

sebab-sebab teknikal, Seminar Jutawan CPO Edisi Emas di Sungai Petani

ditangguhkan. Pada mereka yang telah mendaftar sila hubungi 019-200 9622

untuk keterangan lanjut.

Tuesday, November 29, 2011

Friday, January 21, 2011

Market Review

Healthy technical correction? The FBM KLCI ended at 1,566.51, down 3.53 pts on an extended technical sell-off of most counters, especially financial and small-cap stocks. Market breadth was negative, with losers beating winners 545 to 293 while 270 counters were unchanged, 283 untraded and 36 suspended. Among the key market news are the persistently high prices of coal could cut the TNB's 2011 earnings by as much as 20%, OSK eyes Thai brokerage, Perak MB said Vale project may cost up to RM14bn and likely to start in July or August, EPF buys London’s Fleet Street at RM720m, Bina Puri unit wins RM62.8m contract, Puncak Niaga fails to get Indian jobs, OilCorp set to be delisted on 25 Jan 2011, and Nepline Bhd, Maxbiz Corp Bhd and Prime Utilities Bhd reprimanded for breaching various regulations. Overnight, US stocks erased most of their losses as Morgan Stanley, Home Depot Inc. and builders rallied, DJIA closed almost unchanged at 11,811.8. However, as the Singapore and Hong Kong bourses posted their biggest drop in many weeks yesterday, we expect to see some selling pressure in local bourse today.

Wednesday, January 19, 2011

Technical View

The FBM KLCI continued to consolidate healthily following a gain of some 45 pts in the first week of the year. Although the market shed 4.45 pts yesterday, the market action was still confined within the recent consolidation range. Thus far, the market has been able to retain most of the 45 pts of gains. The FBM KLCI has not only been trending sideways in a constructive manner for more than a week, but what is more important is that the index has remained within the uptrend channel. This is because we view market action within the uptrend channel as insignificant as we will continue to expect the FBM KLCI to trend higher as long as it maintains a posture within the channel. Meanwhile, the index’s current constructive posture is a signal that there is a great possibility that it would be able to create a new record high soon. From the current level, the 1,572 pt-level is the immediate resistance. To the downside, immediate support still lies at the 1,551 pt-level, followed by the 1,532 pt-level.

Tuesday, December 13, 2011

Friday, December 9, 2011

Monday, December 5, 2011

Seminar Pelaburan - Teknik Goldfinger RM

Atas

sebab-sebab teknikal, Seminar Jutawan CPO Edisi Emas di Sungai Petani

ditangguhkan. Pada mereka yang telah mendaftar sila hubungi 019-200 9622

untuk keterangan lanjut.

Tuesday, November 29, 2011

Friday, January 21, 2011

Market Review

Healthy technical correction? The FBM KLCI ended at 1,566.51, down 3.53 pts on an extended technical sell-off of most counters, especially financial and small-cap stocks. Market breadth was negative, with losers beating winners 545 to 293 while 270 counters were unchanged, 283 untraded and 36 suspended. Among the key market news are the persistently high prices of coal could cut the TNB's 2011 earnings by as much as 20%, OSK eyes Thai brokerage, Perak MB said Vale project may cost up to RM14bn and likely to start in July or August, EPF buys London’s Fleet Street at RM720m, Bina Puri unit wins RM62.8m contract, Puncak Niaga fails to get Indian jobs, OilCorp set to be delisted on 25 Jan 2011, and Nepline Bhd, Maxbiz Corp Bhd and Prime Utilities Bhd reprimanded for breaching various regulations. Overnight, US stocks erased most of their losses as Morgan Stanley, Home Depot Inc. and builders rallied, DJIA closed almost unchanged at 11,811.8. However, as the Singapore and Hong Kong bourses posted their biggest drop in many weeks yesterday, we expect to see some selling pressure in local bourse today.

Wednesday, January 19, 2011

Technical View

The FBM KLCI continued to consolidate healthily following a gain of some 45 pts in the first week of the year. Although the market shed 4.45 pts yesterday, the market action was still confined within the recent consolidation range. Thus far, the market has been able to retain most of the 45 pts of gains. The FBM KLCI has not only been trending sideways in a constructive manner for more than a week, but what is more important is that the index has remained within the uptrend channel. This is because we view market action within the uptrend channel as insignificant as we will continue to expect the FBM KLCI to trend higher as long as it maintains a posture within the channel. Meanwhile, the index’s current constructive posture is a signal that there is a great possibility that it would be able to create a new record high soon. From the current level, the 1,572 pt-level is the immediate resistance. To the downside, immediate support still lies at the 1,551 pt-level, followed by the 1,532 pt-level.