Blog ini telah di kemaskini di http://seminarjutawansaham.blogspot.com

My Blog List

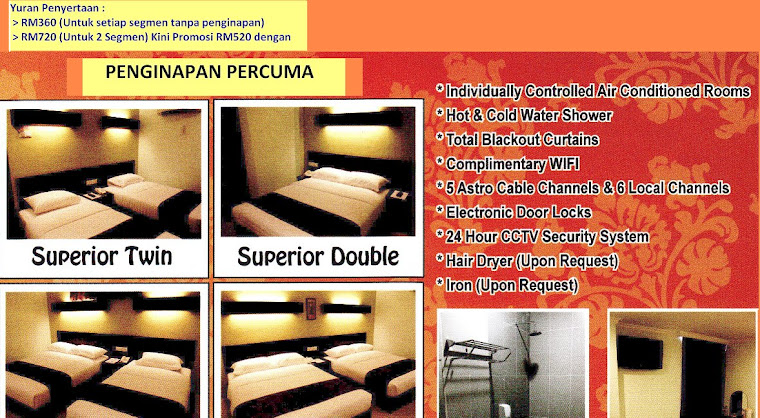

...kini mengadakan promosi bagi peserta yang ingin menyertai seminar untuk dua segmen dengan diskaun sebanyak RM200 serta penginapan percuma (untuk seminar di Pusat Latihan PUABUMI sahaja)......rebutlah peluang mempelajari ilmu pelaburan ini...

Penginapan percuma hanya untuk penyertaan dua segmen di Pusat Latihan PUABUMI Kemaman, Terengganu sahaja...

Barisan Penceramah

Kami bersedia untuk turun padang membongkar rahsia pelaburan di Bursa Malaysia

Destinasi Seminar

Pakej Eksklusif Istimewa ~ Seminar Jutawan Saham dan CPO siri ke 3 adalah pembuka untuk tahun 2011 ini di Pusat Latihan PUABUMI pada 8hb dan 9hb Januari 2011

Seminar Jutawan Saham & CPO akan berada di Santuary Resort Cherating pada 15 Januari 2011 ( segmen ekuiti ) dan 16 Januari 2011 ( segmen CPO )

Kem Pelaburan PUABUMI II akan berada di Hotel Midah Kuala Lumpur pada 13 Ogos 2011 ( segmen CPO ) dan 14 Ogos 2011 ( segmen Ekuiti )

Seminar Jutawan Saham & CPO akan berada di Suria City Hotel, Johor Bahru pada 29 Januari 2011 ( segmen ekuiti ) dan 30 Januari 2011 ( segmen CPO )

Thursday, September 30, 2010

Technical View

The HSI violated the mid-term downtrend line on 17 Sept 2010. On seeing the market continue to maintain its posture at above the bearish trend line for more than a week, we can now safely declare that the previous downtrend market has come to an end. After creating three major lower-lows since January this year, the market finally violated the previous major peak of 21,805.94 on the same day that the downtrend line was violated. The violation of the trend line coupled with the breakout from the recent high reaffirm the decisiveness of the shift in trend.

The uptrend started when sellers failed to push the market below the very critical support at the 19,423 pt-level in May this year. The HSI did dipped below the 19,423 pt-level for a number of trading days, but the violation never proved convincing enough. The index did not fall sharply lower subsequently but only languished slightly below the 19,423 pt-level for a while. The subsequent rebound from there finally brought the index to the current level.

A relevant paragraph from our last update on HSI about a month ago stated that: “it is obvious that the longer-term technical outlook of the HSI will remain bearish as long as it fails to crack above the mid-term downtrend line.” As the downtrend line has been confirmed violated and it seems decisively taken out, we now shift out near-term technical view on HSI from bearish to bullish.

We note that our view has only been changed after the HSI has already risen by close to 3,000 pts from the critical low of the 19,423 pt-level. This is the downside of technical and trend analysis. The turnaround signal can only be detected after the trend has shifted given that the HSI was previously descending within a broad “Descending Triangle”. The two lines that form the “Descending Triangle” were still far apart when the breakout occurred on 17 September 2010.

Going forward, look for all the previous major highs as the upside hurdles. We still view the 22,291 pt-level or the April high as the immediate resistance as the index only managed to eke out this level yesterday. The next resistance is seen at the 22,670 pt-level followed by the 23,099 pt-level. To the downside, look for an immediate support at the 22,000 pt-level followed by the 21,801 pt-level.

The uptrend started when sellers failed to push the market below the very critical support at the 19,423 pt-level in May this year. The HSI did dipped below the 19,423 pt-level for a number of trading days, but the violation never proved convincing enough. The index did not fall sharply lower subsequently but only languished slightly below the 19,423 pt-level for a while. The subsequent rebound from there finally brought the index to the current level.

A relevant paragraph from our last update on HSI about a month ago stated that: “it is obvious that the longer-term technical outlook of the HSI will remain bearish as long as it fails to crack above the mid-term downtrend line.” As the downtrend line has been confirmed violated and it seems decisively taken out, we now shift out near-term technical view on HSI from bearish to bullish.

We note that our view has only been changed after the HSI has already risen by close to 3,000 pts from the critical low of the 19,423 pt-level. This is the downside of technical and trend analysis. The turnaround signal can only be detected after the trend has shifted given that the HSI was previously descending within a broad “Descending Triangle”. The two lines that form the “Descending Triangle” were still far apart when the breakout occurred on 17 September 2010.

Going forward, look for all the previous major highs as the upside hurdles. We still view the 22,291 pt-level or the April high as the immediate resistance as the index only managed to eke out this level yesterday. The next resistance is seen at the 22,670 pt-level followed by the 23,099 pt-level. To the downside, look for an immediate support at the 22,000 pt-level followed by the 21,801 pt-level.

Market Review

Consolidation phase. The FBM KLCI put on just 2 points at 1461.78 points yesterday in relatively thin trading, off its high of 1466.29 points. Gainers beat losers by 430 to 283, with the most of the top 20 active stocks registering gains. Today’s news headlines are Putrajaya Perdana receives a Mandatory Take-Over Offer from Petrosaudi International for cash consideration of RM4.85 per share, Kimlun Corporation receives a RM70m contract from MRCB to construct a college building, Hai-O Enterprise reported a significant drop in 1Q net profit, Zelan sold 4.2m IJM Corp shares in the open market at RM5.12 average price. There were not many leads from the Europe and US markets, which closed marginally lower last night. Hence, local stocks may continue to consolidate, with immediate support at 1439 pts and resistance at 1479 points.

Dagangan Bursa ditutup teguh

KUALA LUMPUR 29 Sept - Harga saham di Bursa Malaysia ditutup lebih

tinggi hari ini berikutan lantunan sederhana, yang disokong oleh

pembelian terpilih pada saham berkaitan kewangan dan perladangan, kata

para peniaga.Mereka berkata sentimen pasaran disokong oleh rali pada

bursa serantau.

Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur (FBM KLCI) meningkat

2.14 mata atau 0.15 peratus untuk ditutup kepada 1,461.78. Ia dibuka

meningkat 4.68 mata kepada 1,464.32.Indeks utama bergerak antara paras

terendah harian 1,459.12 dan paras tertinggi harian 1,466.29.

Seorang peniaga berkata pasaran tempatan pada peringkat awalnya

menjejaki kenaikan mendadak di bursa serantau, yang menyaksikan

Singapura, Thailand dan Indonesia mencecah ketinggian baharu.

Indeks FBM Emas meningkat 25.95 mata kepada 9,789.92 dan FBM Top 100

meningkat 22.01 mata kepada 9,569.98.

Indeks FBM Ace turun 5.82 mata kepada 3,846.14. Indeks Perladangan

meningkat 34.89 mata kepada 6,797.52 dan Indeks Perusahaan meningkat

17.24 mata kepada 2,808.09.Indeks Kewangan merosot 9.78 mata kepada

13,285.56.

Kaunter untung mengatasi kaunter rugi sebanyak 430 kepada 283

manakala 306 kaunter tidak diniagakan, 331 tidak diniaga dan 30 yang

lain digantung.

Secara keseluruhannya, jumlah dagangan turun kepada 905.084 juta

saham bernilai RM1.449 bilion daripada 976.982 juta saham bernilai

RM1.351 bilion pada Selasa.

Di kalangan saham aktif, Karambunai meningkat 1.5 sen kepada 13 sen

manakala Time dotCom dan Unisem-WA menokok 3.0 sen setiap satu

masing-masing kepada 63 sen dan 59 sen. Talam turun 0.5 sen kepada 9.5

sen dan Axiata Group turun 4.0 sen kepada RM4.40.

Jumlah dagangan di Pasaran Utama meningkat kepada 726.810 juta saham

bernilai RM1.409 bilion daripada 686.260 juta saham bernilai RM1.298

bilion pada selasa. Waran merosot kepada 106.061 juta unit bernilai

RM19.528 juta daripada 205.774 juta unit bernilai RM34.929 juta semalam.

Perolehan di pasaran ACE merosot kepada 60.973 juta saham bernilai

RM11.561 juta daripada 74.683 juta saham bernilai RM11.138 juta sebelum

ini.

Produk pengguna mencatatkan 18.947 juta saham diniagakan di Pasaran

Utama, produk perusahaan 104.593 juta, pembinaan 70.955 juta, dagang dan

perkhidmatan 211.183 juta, teknologi 54.698 juta, prasarana 37.812

juta, kewangan 40.364 juta, hotel 1.537 juta, hartanah 169.433 juta,

perladangan 12.830 juta, perlombongan 318,000, REIT 4.029 juta dan dana

tertutup 112,700.

- Bernama

Wednesday, September 29, 2010

Technical View

It was a lackluster day as far as the FBM KLCI was concerned and the broader market was no better. There were 493 decliners compared to 244 advancers. As there was no follow through buying after Monday’s 13.52-pt gain to confirm the “Morning Star”, we are still unsure if the index could continue to extend the current rally without a further pullback.

After creating the “Morning Star”, we would need the index to crack above the recent high of 1,479.6 pts to confirm the bullish reversal signal. If not, a dip below the recent low of 1,445.33 would increase the odds of the index falling further after it violated the steeper uptrend last Thursday. Hence, we would need the market to breach either one of these two levels in order to determine its immediate direction.

To see how market sentiment could have improved after Monday’s 13.52 pts of gains, we will analyze the market’s behavior over the last three sessions prior to yesterday. Last Thursday, the FBM KLCI closed lower by nearly 18 pts in an obviously bearish session. The next trading day, the index gapped down by 6.5 pts at the opening bell, but only lost 0.39 pts during the entire session.

From the candlestick theory perspective, it was an indecisive day. On Monday, the market gapped up and closed higher by 13.52 pts. All in all, the bearishness last Thursday was followed by an indecisive session on Friday and bullish market action on Monday. Hence, there is still a possibility that market sentiment will continue to improve from the current level.

Meanwhile, our view remains the same, i.e. the FBM KLCI’s near-term technical outlook will stay firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart. Hence, even another 40 pt-drop or so would not cause a dent in the rising trend.

The market’s immediate resistance is now seen at the recent high of 1,479.6 pts while the next resistance lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, the 1,439 pt-level is now the initial support, followed by the 1,428 pt-level.

After creating the “Morning Star”, we would need the index to crack above the recent high of 1,479.6 pts to confirm the bullish reversal signal. If not, a dip below the recent low of 1,445.33 would increase the odds of the index falling further after it violated the steeper uptrend last Thursday. Hence, we would need the market to breach either one of these two levels in order to determine its immediate direction.

To see how market sentiment could have improved after Monday’s 13.52 pts of gains, we will analyze the market’s behavior over the last three sessions prior to yesterday. Last Thursday, the FBM KLCI closed lower by nearly 18 pts in an obviously bearish session. The next trading day, the index gapped down by 6.5 pts at the opening bell, but only lost 0.39 pts during the entire session.

From the candlestick theory perspective, it was an indecisive day. On Monday, the market gapped up and closed higher by 13.52 pts. All in all, the bearishness last Thursday was followed by an indecisive session on Friday and bullish market action on Monday. Hence, there is still a possibility that market sentiment will continue to improve from the current level.

Meanwhile, our view remains the same, i.e. the FBM KLCI’s near-term technical outlook will stay firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart. Hence, even another 40 pt-drop or so would not cause a dent in the rising trend.

The market’s immediate resistance is now seen at the recent high of 1,479.6 pts while the next resistance lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, the 1,439 pt-level is now the initial support, followed by the 1,428 pt-level.

Market Review

Weaker sentiment. The FBM KLCI succumbed to profit taking, closing 5.07 points lower to 1,459.6, taking the cue from weakness in the regional markets. Selling was witnessed in key heavyweights such as Tenaga and Axiata. Today’s corporate news are Bank Negara Malaysia has rejected Primus’ Ng Wing Fai from being re-appointed EON Capital director, Selangor’s Menteri Besar has hinted that the state is unlikely to agree on a water tariff hike in Selangor, Gamuda reported a 77% y-o-y growth in 4QFY10 earnings that were within expectations and Genting Malaysia has paid USD380m for the New York rcaino upfront licensing fee. Overnight, the Dow Jones closed marginally higher, underpinned by hopes of further stimulus action by the Fed to help tackle the US’ persistently high unemployment.

Bursa lemah di akhir dagangan

KUALA LUMPUR 28 Sept - Harga saham di Bursa Malaysia ditutup lebih

rendah hari ini setelah kebanyakan saham wajaran tinggi berehat seketika

berikutan prestasi lemah bursa serantau, kata para peniaga.

Dalam dagangan jajaran kecil, Indeks komposit Kuala Lumpur FTSE Bursa

Malaysia (FBM KLCI) turun 5.07 mata, atau 0.35 peratus, untuk ditutup

pada 1,459.64.

Indeks utama dibuka 1.30 mata lebih rendah pada 1,463.41 pada sebelah

pagi.Indeks FBM Emas susut 41.59 mata kepada 9,763.97, FBM Top 100

turun 39.58 mata kepada 9,547.97 dan Indeks FBM Ace berkurangan 14.98

mata kepada 3,851.96.

Indeks Kewangan jatuh 20.78 mata kepada 13,295.34, Indeks Perladangan

susut 22.17 mata kepada 6,762.63 dan Indeks Perusahaan berkurangan 9.78

mata kepada 2,790.85.

Saham rugi mengatasi saham untung pada 493 berbanding 244 manakala

289 kaunter kekal, 327 tidak didagangkan dan 30 yang lain digantung.

Jumlah dagangan keseluruhannya turun kepada 976.982 juta saham

bernilai RM1.351 bilion daripada 1.158 bilion bernilai RM1.623 bilion

semalam.

Antara saham aktif, Karambunai turun 1.5 sen kepada 11.5 sen, SAAG

Consolidated susut setengah sen kepada lapan sen manakala Genting

Malaysia-CL jatuh dua sen kepada 17 sen.

Kencana-CD naik enam sen kepada 22 sen dan Unisem-CA menambah 1.5 sen

kepada 7.5 sen.

Antara saham wajaran tinggi, Tenaga Nasional turun 12 sen kepada

RM8.88, Axiata susut enam sen kepada RM4.44 dan IOI Corp jatuh lima sen

kepada RM5.50.

Genting Malaysia susut empat sen kepada RM3.41 dan Gamuda rugi

sembilan sen kepada RM3.80.

Jumlah dagangan di Pasaran Utama turun kepada 686.260 juta saham

bernilai RM1.298 bilion daripada 923.307 juta saham bernilai RM1.575

bilion pada Isnin.

Waran meningkat kepada 205.774 juta unit bernilai RM34.929 juta

daripada 133.755 juta unit bernilai RM27.104 juta semalam. JPerolehan

dagangan di pasaran ACE susut kepada 74.683 juta saham bernilai RM11.138

juta daripada 91.722 juta saham bernilai RM12.726 juta sebelumnya.

Barangan pengguna menguasai 29.238 juta saham didagangkan di Pasaran

Utama, barangan perusahaan 132.117 juta, pembinaan 81.162 juta,

perdagangan dan perkhidmatan 205.143 juta, teknologi 43.744 juta,

infrastruktur 15.482 juta, kewangan 36.710 juta, hotel 2.758 juta,

hartanah 101.102 juta, perladangan 15.815 juta, perlombongan 854,700,

REIT 22.046 juta dan dana tertutup 89,900.

- Bernama

Tuesday, September 28, 2010

Bursa kukuh di akhir dagangan

KUALA LUMPUR 27 Sept - Harga saham di Bursa Malaysia ditutup lebih

kukuh hari ini dengan Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur

(FBM KLCI) meningkat 0.9 peratus sejajar dengan pasaran serantau, kata

para peniaga.

Berlaku sdikit tawar menawar pada saham berkaitan kewangan dan

perladangan apabila kenaikan harga yang kukuh di Wall Street Jumaat

lepas telah membantu merangsang pembelian pada bursa tempatan hari ini.

FBM KLCI ditutup meningkat 13.52 mata kepada 1,464.71. Indeks utama

bergerak dalam jajaran sempit antara 1,456.30 dan 1,467.18 mata

sepanjang hari ini, selepas dibuka meningkat 7.54 mata kepada 1,458.73.

Indeks FBM Emas melonjak 80.56 mata kepada 9,805.56, Indeks FBM 100

meningkat 83.16 mata kepada 9,587.55 dan Indeks FBM Ace menokok 18.28

mata kepada 3,866.94.

Indeks Kewangan meningkat 140.65 mata kepada 13,316.12, Indeks

Perladangan meningkat 49.93 mata kepada 6,784.80 dan Indeks Perusahaan

menokok 18.67 mata kepada 2,800.63.

Kaunter untung mengatasi kaunter rugi sebanyak 469 kepada 292

manakala 276 kaunter tidak berubah, 308 tidak diniagakan dan 30 yang

lain digantung.

Perolehan keseluruhan dicatatkan 1.158 bilion saham bernilai RM1.623

bilion, yang meningkat daripada 1.727 bilion saham bernilai RM1.531

bilion pada Jumaat lepas.

Karambunai merupakan kaunter aktif , menyaksikan sahamnya merosot 5.0

sen kepada 13 sen, SAAG Consolidated dan Asian Pac Holdings turun 0.5

sen setiap satu masing-masing kepada 8.5 sen dan 11.5 sen manakala

Genting Malaysia-CL meningkat 0.5 sen kepada 19 sen dan Talam

Corporation tidak berubah pada harga 10 sen.

Jumlah dagangan di Pasaran Utama merosot kepada 923.307 juta saham

bernilai RM1.575 bilion berbanding dengan 1.508 bilion saham bernilai

RM1.492 bilion pada Jumaat lepas.

Waran meningkat kepada 133.755 juta saham bernilai RM27.104 juta

berbanding dengan 116.036 juta saham bernilai RM21.836 juta yang

dicatatkan sebelum ini. Perolehan di Pasaran ACE meningkat sedikit

kepada 91.722 juta sahams bernilai RM12.726 juta daripada 91.247 juta

saham bernilai RM10.575 juta Jumaat lepas.

Produk pengguna mencatatkan 37.706 juta saham diniagakan di Pasaran

Utama, produk perusahaan 118.126 juta, pembinaan 67.649 juta, dagang dan

perkhidmatan 285.189 juta, teknologi 26.687 juta, prasarana 23.129

juta, kewangan 62.089 juta, hotel 4.871 juta, hartanah 278.419 juta,

perladangan 16.331 juta, perlombongan 4,900, REIT 2.962 juta dan dana

tertutup 142,700. - Bernama

Monday, September 27, 2010

Technical View

The fairy tale of the FBM KLCI stretching gains above the steeper uptrend with the daily RSI staying at above the 70 pt-level came to an end last Friday. After last Thursday’s 17.62-pt loss followed by the opening gap-down of 6.5 pts last Friday, the steeper trend line was violated. Another round of sharp dip would confirm this violation.

It looks like the market will not be able to continue its stretching gains without further pulling back after the daily RSI reached its most overbought level since the bull market started in March 2009.

This week, we shall see if the market can rebound back above the steeper uptrend line. Anyhow, as we have said before, even if the FBM KLCI retraced by another 40 pts or so, the pullback would not alter the stock market’s near-term bullish technical landscape.

Our view remains the same, i.e. the FBM KLCI’s near-term technical outlook will stay firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance is now seen at the recent high of 1,479.6 pts. Next resistance lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, the 1,439 pt-level is now the initial support, followed by the 1,428 pt-level.

It looks like the market will not be able to continue its stretching gains without further pulling back after the daily RSI reached its most overbought level since the bull market started in March 2009.

This week, we shall see if the market can rebound back above the steeper uptrend line. Anyhow, as we have said before, even if the FBM KLCI retraced by another 40 pts or so, the pullback would not alter the stock market’s near-term bullish technical landscape.

Our view remains the same, i.e. the FBM KLCI’s near-term technical outlook will stay firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance is now seen at the recent high of 1,479.6 pts. Next resistance lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, the 1,439 pt-level is now the initial support, followed by the 1,428 pt-level.

Market Review

Lower finish. The FBM KLCI fell 6.89 points to close at 1,451.19 after investors locked in their profits on some of the heavyweights. YTL Cement Bhd is acquiring a 35.16% equity interest in Perak-Hanjoong Simen SB for RM200m cash, Sunway Holdings Bhd will launch its third property project with a gross development value of RM1.1bn in Singapore soon and Karambunai denies that it has submitted a proposal to the Government to build a casino in Karambunai. Meanwhile, the Sarawak state Govt offers to buy the Bakun dam for RM6bn and total passengers at KLIA in July rose to 3.0m from 2.7m y-o-y. Finally, the US markets surged on Friday as demand for capital goods increased more than expected while crude oil price also ended higher, with crude oil price surging up USD1.31 to USD76.49.

Pelabur dijangka 'tunggu dan lihat'

KUALA LUMPUR 26 Sept. - Harga-harga saham di Bursa Malaysia dijangka

bergerak dalam jajaran sempit minggu depan apabila para pelabur

mengambil sikap tunggu dan lihat ekoran kebimbangan berlarutan tentang

kelemahan ekonomi AS dan Eropah.

Ketua Penyelidikan Runcit Maybank Investment Bank, Lee Cheng Hooi,

berkata, sokongan bagi Indeks Komposit Kuala Lumpur FTSE Bursa Malaysia

(FBM KLCI) mungkin pada paras 1,430 hingga 1,450 manakala halangan pada

paras di antara 1,462 dengan 1,480.

"Pelabur-pelabur ingin berurus niaga di kaunter-kaunter berharga

rendah dan akan muncul kegiatan membeli dan menjual berselang seli,"

kata Cheng Hooi kepada Bernama.

Ketua Penyelidikan Jupiter Securities, Pong Teng Siew berkata,

pelabur-pelabur melanggani saham secara berpilih-pilih.

Menurut Teng Siew, ada pandangan yang mengatakan Program Transformasi

Ekonomi (ETP) yang diumumkan kerajaan baru-baru ini akan memberi faedah

kepada syarikat-syarikat pembinaan yang dijangka menjadi tarikan

pelabur.

"Bagaimanapun, ETP tidak memberikan kesan serta merta ke atas pasaran

pada keseluruhannya kerana pelabur-pelabur menunggu perincian khusus

tentang pelaksanaan jangka panjangnya," kata Teng Siew.

Minggu ini, FBM KLCI mencecah tahap tertinggi baharu selepas dua

setengah tahun pada Selasa, dengan disokong oleh prestasi teguh

pasaran-pasaran serantau dan berikutan pengumuman ETP.

Namun demikian, kegiatan mengambil untung muncul tiga hari

berturut-turut berikutnya, dengan kaunter-kaunter mewah mencatatkan

kejatuhan besar.

Sentimen juga lemah dengan berita penilaian yang tidak

memberangsangkan daripada Jawatankuasa Pasaran Terbuka Persekutuan Rizab

Persekutuan AS yang membayangkan bahawa pemulihan ekonomi AS kini

lembap.

Kebimbangan yang berlanjutan tentang krisis hutang Eropah dan

kelemahan ekonomi juga menghantui sentimen pelabur.

Pada Jumaat, pasaran berjaya menebus sebahagian daripada kejatuhan

sebelumnya dalam sesi dagangan petang berikutan kegiatan membeli saham

murah.

Berdasarkan Jumaat ke Jumaat, FBM KLCI turun 15.78 mata kepada

1,451.19 daripada 1,466.97.

Indeks FBM Emas susut 79.62 mata kepada 9,725 daripada 9,804.62,

Indeks FBM 100 jatuh 89.64 mata kepada 9,504.39 daripada 9,594.03 dan

Indeks FBM Ace hilang 31.40 mata kepada 3,848.66 daripada 3,880.06.

Indeks Kewangan jatuh 199.79 mata kepada 13,175.47 daripada

13,375.26, Indeks Perladangan turun 120.36 mata kepada 6,734.87 daripada

6,855.23 dan Indeks Perusahaan susut 5.96 mata kepada 2,781.60 daripada

2,787.92.

Jumlah dagangan mingguan bertambah kepada 5.958 bilion saham bernilai

RM7.865 bilion daripada 3.575 bilion saham bernilai RM7.460 bilion.

Pasaran Utama mencatatkan peningkatan jumlah dagangan kepada 4.548

bilion unit bernilai RM7.574 bilion daripada 2.891 bilion unit bernilai

RM7.316 bilion.

Pasaran Ace menyaksikan jumlah dagangan meningkat kepada 469.517 juta

saham bernilai RM62.606 juta daripada 307.57 juta saham bernilai

RM48.627 juta.

Waran bertambah kepada 889.66 juta unit bernilai RM193.161 juta

daripada 343.327 juta unit bernilai RM67.835 juta. - Bernama

Friday, September 24, 2010

Technical View

The FBM KLCI fell by almost 20 pts in the late afternoon session. Market participants finally rushed out of the market after 5 days of constructive sideways trading. The index, however, managed to rebound off the intra-day low as it found support near the steeper uptrend line and ended the day with a 16.67-pt loss Prior to the retracement, the index had advanced by more than 100 pts since the low in August, and to add, the more than 30 pts gained on last Monday and Tuesday.

Remember we have been talking about the FBM KLCI having previously added more than 100 pts, with the daily RSI trading at above the 70 pt-level. And, the indicator also closed at the highest level since the bull market started in March 2009. The 16.67-pt pullback brought the RSI back below the 70 pt-level, closing at the 65.7 pt-level yesterday. Nevertheless, the index still maintained its position at above the steeper uptrend line.

Of course, judging from yesterday’s selling momentum the market is at risk of violating this steeper uptrend line soon, or possibly even violating it today. However, as we mentioned many times before, the FBM KLCI can still march higher without pulling back further as long as the market maintains its posture at above the steeper uptrend line.

Anyhow, the FBM KLCI’s near-term technical outlook will remain firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance still lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, there is immediate support at the 1,457 pt-level, followed by the 1,439 pt-level.

Remember we have been talking about the FBM KLCI having previously added more than 100 pts, with the daily RSI trading at above the 70 pt-level. And, the indicator also closed at the highest level since the bull market started in March 2009. The 16.67-pt pullback brought the RSI back below the 70 pt-level, closing at the 65.7 pt-level yesterday. Nevertheless, the index still maintained its position at above the steeper uptrend line.

Of course, judging from yesterday’s selling momentum the market is at risk of violating this steeper uptrend line soon, or possibly even violating it today. However, as we mentioned many times before, the FBM KLCI can still march higher without pulling back further as long as the market maintains its posture at above the steeper uptrend line.

Anyhow, the FBM KLCI’s near-term technical outlook will remain firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance still lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, there is immediate support at the 1,457 pt-level, followed by the 1,439 pt-level.

Market Review

Correction mode to continue? The FBM KLCI lost 16.67 pts to 1,458.08, dragged by losses in major heavyweights. Losers led gainers by 523 to 221 while 254 counters were unchanged, 354 untraded and 36 suspended. Among the key market news today are Sarawak government bids for Bakun, Proton rules out Lotus sale, US investors can now trade directly in Bursa after Malaysia’s market is recognized by the US Securities and Exchange Commission, EPF may buy Visa’s HQ in UK, Zelan sells 7m IJM shares in open mart, Kumpulan Euro sells 100m Talam shares, DXN sets a 50% dividend payout policy and HELP’s 3Q net profit rises 11%. Overnight, the DJIA slipped 76.89 pts to end at 10,662.4 as concerns grew that the global recovery is losing steam and the outlook for bank profits is worsening. Irish bonds slid after the nation’s economy unexpectedly shrank. Therefore, we would expect regional bourses to continue to experience profit taking today.

Kerugian saham mewah Bursa rendah

KUALA LUMPUR 23 Sept - Harga saham ditutup rendah, ditarik oleh

kerugian dalam saham wajaran tinggi utama, kata para peniaga.Indeks

Komposit Kuala Lumpur FTSE Bursa Malaysia (FBM KLCI) turun 16.67 mata

kepada 1,458.08 selepas dibuka 0.95 mata lebih tinggi pada 1,475.7.

Peniaga-peniaga itu berkata berlaku pembetulan setelah bursa mencecah

paras tertinggi baharu selepas dua setengah tahun pada Selasa dengan

pelabur mengikuti kejatuhan di Wall Street ekoran penilaian yang tidak

memberangsangkan oleh Jawatankuasa Pasaran Terbuka Persekutuan Rizab

Persekutuan pada Selasa yang mengatakan pemulihan ekonomi AS telah

menjadi perlahan.

Indeks Perusahaan susut 17.70 mata kepada 2,780.64, Indeks Kewangan

turun 95.681 mata kepada 13,237.18 dan Indeks Perladangan berkurangan

134.3 mata kepada 6,743.45.

Indeks Emas FBM Emas susut 101.37 mata kepada 9,749.8, Indeks FBM Ace

jatuh 24.63 mata kepada 3,782.09 manakala FBM70 berkurangan 67.62 mata

kepada 9,572.70.

Jumlah dagangan lebih rendah pada 999.443 juta saham bernilai RM1.416

bilion daripada 1.332 bilion saham bernilai RM2.021 bilion semalam.

Saham rugi mengatasi untung pada 523 berbanding 221 manakala 254

kaunter tidak berubah, 354 tidak didagangkan dan 36 yang lain digantung.

Gamuda rugi empat sen kepada RM3.84 dengan kegiatan pengambilan

untung selepas kenaikan baru-baru ini seiring dengan sentimen pasaran

yang rendah.

Bagi saham aktif, Karambunai naik empat sen kepada 12 sen, KNM Group

menokok setengah sen kepada 47 sen, Compugates Holdings susut setengah

sen kepada 6.5 sen dan Tiger Synergy kekal pada 12.5 sen.

Jumlah dagangan di pasaran utama susut kepada 778.141 juta saham

bernilai RM1.375 bilion daripada 911.735 juta saham bernilai RM1.938

bilion semalam.

Waran berkurangan kepada 143.883 juta unit bernilai RM27.047 juta

daripada 335.974 juta unit bernilai RM65.870 juta. Jumlah dagangan di

pasaran ACE turun kepada 69.072 juta saham bernilai RM8.832 juta

daripada 74.577 juta saham bernilai RM9.534 juta.

Barangan pengguna menguasai 28.9 juta saham yang didagangkan di

Pasaran Utama; barangan perusahaan 163.8 juta; pembinaan 63.9 juta;

dagangan dan perkhidmatan 197.2 juta; teknologi 21.1 juta; infrastruktur

18.5 juta; kewangan 38.9 juta; hotel 4.04 juta; hartanah 215.2 juta;

perladangan 14.1 juta; perlombongan 0; REIT 12.3 juta; dan dana tertutup

54,000. - Bernama

Thursday, September 23, 2010

Technical View

The FBM KLCI has established a 5-day sideways trading pattern. The consolidation phase for the more than 30 pts gained last Monday and Tuesday has been very constructive as the market has thus retained the bulk of those gains.

As mentioned before, we believe that whether or not the index could stay above the steeper uptrend would determine if the market can still march higher from here without pulling back sharply.

Meanwhile, the odds remain high that the index could continue to stretch its gains near the daily RSI’s 80-pt overbought level. The indicator closed at the 80.2 pt-level yesterday. Although the RSI has reached its highest level since the bull market started in March 2009, market participants are still exhibiting no signs of rushing out of the market.

The FBM KLCI’s near-term technical outlook will remain firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance still lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, there is immediate support at the 1,457 pt-level, followed by the 1,439 pt-level.

As mentioned before, we believe that whether or not the index could stay above the steeper uptrend would determine if the market can still march higher from here without pulling back sharply.

Meanwhile, the odds remain high that the index could continue to stretch its gains near the daily RSI’s 80-pt overbought level. The indicator closed at the 80.2 pt-level yesterday. Although the RSI has reached its highest level since the bull market started in March 2009, market participants are still exhibiting no signs of rushing out of the market.

The FBM KLCI’s near-term technical outlook will remain firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance still lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, there is immediate support at the 1,457 pt-level, followed by the 1,439 pt-level.

Market Review

Range-bound. The FBM KLCI lost 1 point to 1474.75 points yesterday in a mixed broad market as gainers outnumbered losers by 398 to 364. Today’s news headlines: include SMR Technologies winning a RM89.5m Ministry of Education contract, KPJ to acquire Australian retirement village operator Jeta Gardens Waterford Trust for RM19m cash, and Tan Chong to acquire a 74% stake in Nissan Vietnam for USD7.4m cash. The US and Europe bourses finished slightly easier last night and without fresh leads, local stocks are likely to be directionless today. The key support and resistance points are at 1457 points and 1500 points respectively.

Tekanan jualan Bursa bercampur-campur

KUALA LUMPUR 22 Sept - Harga saham ditutup bercampur-campur hari ini

setelah pasaran mengalami tekanan jualan selepas kenaikan baru-baru ini,

kata para peniaga.

Indeks Komposit Kuala Lumpur FTSE Bursa Malaysia (FBM KLCI) susut

1.24 mata kepada 1,474.75 susulan kegiatan pengambilan untung.

Ketua penyelidikan Jupiter Securities Pong Teng Siew berkata Program

Transformasi Ekonomi (ETP) yang diumumkan semalam tidak memberi kesan

segera kepada pasaran kerana para pelabur masih menantikan butiran

perlaksanaan jangka panjangnya.

"Bagaimanapun, terdapatnya jangkaan yang beberapa syarikat pembinaan

seperti Gamuda akan mendapat manfaat daripada ETP berkenaan," kata

beliau.

Indeks Perladangan susut 45.33 mata kepada 6,877.75 dan Indeks

Perusahaan turun 3.03 mata kepada 2,798.34.

Indeks Kewangan naik 1.061 mata kepada 13,332.86 manakala Indeks FBM

Ace rugi 36.47 mata kepada 3,806.72 tetapi FBM70 susut 11.17 mata kepada

9,640.32.

Indeks FBM Emas susut 2.86 mata kepada 9,851.17. Jumlah dagangan

meningkat kepada 1.332 bilion saham bernilai RM2.021 bilion daripada

1.049 bilion saham bernilai RM1.513 bilion semalam.

Saham untung mengatasi rugi pada 398 berbanding 363 manakala 280

kaunter tidak berubah, 311 tidak didagangkan dan 35 lagi digantung.

Antara saham aktif, Genting Malaysia rugi 14 sen kepada RM3.50, KNM

Group naik 1.5 sen kepada 46.5 sen, Zelan menambah tiga sen kepada 69

sen dan Eastern and Oriental meningkat empat sen kepada RM1.18.

Jumlah dagangan di pasaran utama meningkat kepada 911.735 juta saham

bernilai RM1.938 bilion daripada 722.142 juta saham, bernilai RM1.438

bilion semalam.

Waran meningkat kepada 335.974 juta unit bernilai RM65.870 juta

daripada 199.798 juta unit, bernilai RM50.497 juta semalam. Jumlah

dagangan di pasaran ACE turun kepada 74.577 juta saham bernilai RM9.534

juta daripada 115.567 juta saham, bernilai RM16.123 juta semalam.

Barangan pengguna menguasai 33.3 juta saham yang didagangkan di

pasaran utama; barangan perusahaan 159.4 juta; pembinaan 173.9 juta;

dagangan dan perkhidmatan 281 juta; teknologi 24.7 juta; infrastruktur

13.2 juta; kewangan 51.5 juta; hotel 6.8 juta; hartanah 151.2 juta;

perladangan 12.4 juta; perlombongan 11,800; REIT 4.2 juta; dan dana

tertutup. 15,500.- Bernama

Wednesday, September 22, 2010

Technical View

The FBM KLCI spiked up about 10 pts in early in the morning session but all its gains slowly evaporated from then, with the index even dipping briefly into negative territory. The market settled with a 4.59-pt gain at the close. It was the fourth day of consolidation for the FBM KLCI and this consolidation phase still looks very healthy.

We believe that whether or not the index could stay above the steeper uptrend would determine if the market can still march higher from here without pulling back sharply. Note that the market has advanced more than 100 pts over the past one month or so without a meaningful correction. Even a 50-pt correction from the current level would not alter the bullish technical landscape. However, as long as the market can stay at above the steeper uptrend line, there is always a possibility that the index may stretch its gains further, even at around the overbought territory. Note that the recent more than 100-pt gain actually happened at above the 70 pts RSI level.

The FBM KLCI’s near-term technical outlook will remain firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance still lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, there is immediate support at the 1,457 pt-level, followed by the 1,439 pt-level.

We believe that whether or not the index could stay above the steeper uptrend would determine if the market can still march higher from here without pulling back sharply. Note that the market has advanced more than 100 pts over the past one month or so without a meaningful correction. Even a 50-pt correction from the current level would not alter the bullish technical landscape. However, as long as the market can stay at above the steeper uptrend line, there is always a possibility that the index may stretch its gains further, even at around the overbought territory. Note that the recent more than 100-pt gain actually happened at above the 70 pts RSI level.

The FBM KLCI’s near-term technical outlook will remain firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance still lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, there is immediate support at the 1,457 pt-level, followed by the 1,439 pt-level.

Market Review

Scaling higher. Buying momentum on the FBM KLCI remained robust, with buying interest in Genting Malaysia, Genting Bhd and BAT pushing the index 6.30 points higher to close at 1,475.9. Today’s corporate news are largely centred on projects and key areas mapped out in the Economic Transformation Programme, which among others include the proposed mass rapid transit system, building of a 7km shopping strip and cleaning up of the city’s rivers. Other corporate news are Genting Malaysia has obtained approval from the British Gambling Commission for the proposed acquisition of Genting Singapore’s UK casino operations, Malaysian Marine and Heavy Engineering is expected to be listed by end-October at an indicative IPO price of RM3.80 and HSL has secured a RM98.2m construction contract in Sarawak. Overnight, the Dow rose by a marginal 0.07% with the anticipation of additional stimulus measures by the Federal Reserve. Given yesterday’s strong buying, we expect the local bourse to trade range bound with an upside bias today.

FBM KLCI ke paras tertinggi baru

KUALA LUMPUR 21 Sept - Harga-harga saham di Bursa Malaysia, yang

disokong oleh minat belian yang kukuh, mendorong Indeks Komposit Kuala

Lumpur FTSE Bursa Malaysia (FBM KLCI) meningkat ke paras tertinggi

baharu sejak dua setengah tahun lepas.

Indeks berkenaan mengakhiri dagangan lebih tinggi pada 1,475.99.

Bagaimanapun, kaunter-kaunter kewangan, Maybank, Public Bank dan CIMB

mengalami tekanan jualan.

Peniaga-peniaga berkata Program Transformasi Ekonomi (ETP), yang

bertujuan meningkatkan pertumbuhan ekonomi Malaysia pada kadar enam

peratus setiap tahun di antara 2011 dengan 2020, merangsang sentimen

pasaran.

Prestasi kukuh Wall Street dan pasaran-pasaran Asia juga merangsang

sentimen pasaran di bursa tempatan.

Indeks Perladangan meningkat 36.36 mata kepada 6,923.08 dan Indeks

Perusahaan menokok 11.87 mata kepada 2,801.37.

Bagaimanapun, Indeks Kewangan susut 16.32 mata kepada 13,331.80,

Indeks FBM Ace turun 36.75 mata kepada 3,843.19 tetapi Indeks FBM70

melonjak 42.30 mata kepada 9,651.49. Jumlah dagangan bertambah kepada

1.049 bilion saham bernilai RM1.513 bilion, daripada 850.799 juta saham

bernilai RM1.381 bilion yang dicatatkan semalam.

Saham untung mengatasi saham rugi dengan jumlah 368 berbanding 345

manakala 319 kaunter tidak berubah, 322 tidak diniagakan dan 30 yang

lain digantung urus niaga.

Antara saham cergas, KNM Group naik setengah sen kepada 45 sen,

Tejari Technologies turun 2.5 sen kepada 18.5 sen, Asiaep menambah

setengah sen kepada 8.5 sen dan Berjaya Corporation mengukuh tujuh sen

kepada RM1.14.

Jumlah dagangan dalam pasaran utama bertambah kepada 722.142 juta

saham, bernilai RM1.438 bilion daripada 628.999 juta saham bernilai

RM1.329 bilion semalam.

Waran bertambah kepada 199.798 juta unit bernilai RM50.497 juta

daripada 93.969 juta unit bernilai RM27.91 juta yang dicatatkan semalam.

Pasaran ACE mencatatkan penyusutan jumlah dagangan kepada 115.567 juta

saham bernilai RM16.123 juta daripada 119.054 juta saham bernilai

RM17.542 juta yang dicatatkan sebelumnya.

Barangan pengguna menguasai 43.15 juta saham yang diniagakan dalam

Pasaran Utama; barangan perusahaan 165.8 juta; pembinaan 60.48 juta;

perdagangan dan perkhidmatan 254.4 juta; teknologi 33.5 juta; prasarana

21.4 juta; kewangan 40.5 juta; hotel 5.2 juta; harta 68.7 juta;

perladangan 11 juta; perlombongan 4,000; REIT 17.5 juta; dan dana

tertutup 115,200. - Bernama

Tuesday, September 21, 2010

Thursday, September 30, 2010

Technical View

The HSI violated the mid-term downtrend line on 17 Sept 2010. On seeing the market continue to maintain its posture at above the bearish trend line for more than a week, we can now safely declare that the previous downtrend market has come to an end. After creating three major lower-lows since January this year, the market finally violated the previous major peak of 21,805.94 on the same day that the downtrend line was violated. The violation of the trend line coupled with the breakout from the recent high reaffirm the decisiveness of the shift in trend.

The uptrend started when sellers failed to push the market below the very critical support at the 19,423 pt-level in May this year. The HSI did dipped below the 19,423 pt-level for a number of trading days, but the violation never proved convincing enough. The index did not fall sharply lower subsequently but only languished slightly below the 19,423 pt-level for a while. The subsequent rebound from there finally brought the index to the current level.

A relevant paragraph from our last update on HSI about a month ago stated that: “it is obvious that the longer-term technical outlook of the HSI will remain bearish as long as it fails to crack above the mid-term downtrend line.” As the downtrend line has been confirmed violated and it seems decisively taken out, we now shift out near-term technical view on HSI from bearish to bullish.

We note that our view has only been changed after the HSI has already risen by close to 3,000 pts from the critical low of the 19,423 pt-level. This is the downside of technical and trend analysis. The turnaround signal can only be detected after the trend has shifted given that the HSI was previously descending within a broad “Descending Triangle”. The two lines that form the “Descending Triangle” were still far apart when the breakout occurred on 17 September 2010.

Going forward, look for all the previous major highs as the upside hurdles. We still view the 22,291 pt-level or the April high as the immediate resistance as the index only managed to eke out this level yesterday. The next resistance is seen at the 22,670 pt-level followed by the 23,099 pt-level. To the downside, look for an immediate support at the 22,000 pt-level followed by the 21,801 pt-level.

The uptrend started when sellers failed to push the market below the very critical support at the 19,423 pt-level in May this year. The HSI did dipped below the 19,423 pt-level for a number of trading days, but the violation never proved convincing enough. The index did not fall sharply lower subsequently but only languished slightly below the 19,423 pt-level for a while. The subsequent rebound from there finally brought the index to the current level.

A relevant paragraph from our last update on HSI about a month ago stated that: “it is obvious that the longer-term technical outlook of the HSI will remain bearish as long as it fails to crack above the mid-term downtrend line.” As the downtrend line has been confirmed violated and it seems decisively taken out, we now shift out near-term technical view on HSI from bearish to bullish.

We note that our view has only been changed after the HSI has already risen by close to 3,000 pts from the critical low of the 19,423 pt-level. This is the downside of technical and trend analysis. The turnaround signal can only be detected after the trend has shifted given that the HSI was previously descending within a broad “Descending Triangle”. The two lines that form the “Descending Triangle” were still far apart when the breakout occurred on 17 September 2010.

Going forward, look for all the previous major highs as the upside hurdles. We still view the 22,291 pt-level or the April high as the immediate resistance as the index only managed to eke out this level yesterday. The next resistance is seen at the 22,670 pt-level followed by the 23,099 pt-level. To the downside, look for an immediate support at the 22,000 pt-level followed by the 21,801 pt-level.

Market Review

Consolidation phase. The FBM KLCI put on just 2 points at 1461.78 points yesterday in relatively thin trading, off its high of 1466.29 points. Gainers beat losers by 430 to 283, with the most of the top 20 active stocks registering gains. Today’s news headlines are Putrajaya Perdana receives a Mandatory Take-Over Offer from Petrosaudi International for cash consideration of RM4.85 per share, Kimlun Corporation receives a RM70m contract from MRCB to construct a college building, Hai-O Enterprise reported a significant drop in 1Q net profit, Zelan sold 4.2m IJM Corp shares in the open market at RM5.12 average price. There were not many leads from the Europe and US markets, which closed marginally lower last night. Hence, local stocks may continue to consolidate, with immediate support at 1439 pts and resistance at 1479 points.

Dagangan Bursa ditutup teguh

KUALA LUMPUR 29 Sept - Harga saham di Bursa Malaysia ditutup lebih

tinggi hari ini berikutan lantunan sederhana, yang disokong oleh

pembelian terpilih pada saham berkaitan kewangan dan perladangan, kata

para peniaga.Mereka berkata sentimen pasaran disokong oleh rali pada

bursa serantau.

Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur (FBM KLCI) meningkat

2.14 mata atau 0.15 peratus untuk ditutup kepada 1,461.78. Ia dibuka

meningkat 4.68 mata kepada 1,464.32.Indeks utama bergerak antara paras

terendah harian 1,459.12 dan paras tertinggi harian 1,466.29.

Seorang peniaga berkata pasaran tempatan pada peringkat awalnya

menjejaki kenaikan mendadak di bursa serantau, yang menyaksikan

Singapura, Thailand dan Indonesia mencecah ketinggian baharu.

Indeks FBM Emas meningkat 25.95 mata kepada 9,789.92 dan FBM Top 100

meningkat 22.01 mata kepada 9,569.98.

Indeks FBM Ace turun 5.82 mata kepada 3,846.14. Indeks Perladangan

meningkat 34.89 mata kepada 6,797.52 dan Indeks Perusahaan meningkat

17.24 mata kepada 2,808.09.Indeks Kewangan merosot 9.78 mata kepada

13,285.56.

Kaunter untung mengatasi kaunter rugi sebanyak 430 kepada 283

manakala 306 kaunter tidak diniagakan, 331 tidak diniaga dan 30 yang

lain digantung.

Secara keseluruhannya, jumlah dagangan turun kepada 905.084 juta

saham bernilai RM1.449 bilion daripada 976.982 juta saham bernilai

RM1.351 bilion pada Selasa.

Di kalangan saham aktif, Karambunai meningkat 1.5 sen kepada 13 sen

manakala Time dotCom dan Unisem-WA menokok 3.0 sen setiap satu

masing-masing kepada 63 sen dan 59 sen. Talam turun 0.5 sen kepada 9.5

sen dan Axiata Group turun 4.0 sen kepada RM4.40.

Jumlah dagangan di Pasaran Utama meningkat kepada 726.810 juta saham

bernilai RM1.409 bilion daripada 686.260 juta saham bernilai RM1.298

bilion pada selasa. Waran merosot kepada 106.061 juta unit bernilai

RM19.528 juta daripada 205.774 juta unit bernilai RM34.929 juta semalam.

Perolehan di pasaran ACE merosot kepada 60.973 juta saham bernilai

RM11.561 juta daripada 74.683 juta saham bernilai RM11.138 juta sebelum

ini.

Produk pengguna mencatatkan 18.947 juta saham diniagakan di Pasaran

Utama, produk perusahaan 104.593 juta, pembinaan 70.955 juta, dagang dan

perkhidmatan 211.183 juta, teknologi 54.698 juta, prasarana 37.812

juta, kewangan 40.364 juta, hotel 1.537 juta, hartanah 169.433 juta,

perladangan 12.830 juta, perlombongan 318,000, REIT 4.029 juta dan dana

tertutup 112,700.

- Bernama

Wednesday, September 29, 2010

Technical View

It was a lackluster day as far as the FBM KLCI was concerned and the broader market was no better. There were 493 decliners compared to 244 advancers. As there was no follow through buying after Monday’s 13.52-pt gain to confirm the “Morning Star”, we are still unsure if the index could continue to extend the current rally without a further pullback.

After creating the “Morning Star”, we would need the index to crack above the recent high of 1,479.6 pts to confirm the bullish reversal signal. If not, a dip below the recent low of 1,445.33 would increase the odds of the index falling further after it violated the steeper uptrend last Thursday. Hence, we would need the market to breach either one of these two levels in order to determine its immediate direction.

To see how market sentiment could have improved after Monday’s 13.52 pts of gains, we will analyze the market’s behavior over the last three sessions prior to yesterday. Last Thursday, the FBM KLCI closed lower by nearly 18 pts in an obviously bearish session. The next trading day, the index gapped down by 6.5 pts at the opening bell, but only lost 0.39 pts during the entire session.

From the candlestick theory perspective, it was an indecisive day. On Monday, the market gapped up and closed higher by 13.52 pts. All in all, the bearishness last Thursday was followed by an indecisive session on Friday and bullish market action on Monday. Hence, there is still a possibility that market sentiment will continue to improve from the current level.

Meanwhile, our view remains the same, i.e. the FBM KLCI’s near-term technical outlook will stay firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart. Hence, even another 40 pt-drop or so would not cause a dent in the rising trend.

The market’s immediate resistance is now seen at the recent high of 1,479.6 pts while the next resistance lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, the 1,439 pt-level is now the initial support, followed by the 1,428 pt-level.

After creating the “Morning Star”, we would need the index to crack above the recent high of 1,479.6 pts to confirm the bullish reversal signal. If not, a dip below the recent low of 1,445.33 would increase the odds of the index falling further after it violated the steeper uptrend last Thursday. Hence, we would need the market to breach either one of these two levels in order to determine its immediate direction.

To see how market sentiment could have improved after Monday’s 13.52 pts of gains, we will analyze the market’s behavior over the last three sessions prior to yesterday. Last Thursday, the FBM KLCI closed lower by nearly 18 pts in an obviously bearish session. The next trading day, the index gapped down by 6.5 pts at the opening bell, but only lost 0.39 pts during the entire session.

From the candlestick theory perspective, it was an indecisive day. On Monday, the market gapped up and closed higher by 13.52 pts. All in all, the bearishness last Thursday was followed by an indecisive session on Friday and bullish market action on Monday. Hence, there is still a possibility that market sentiment will continue to improve from the current level.

Meanwhile, our view remains the same, i.e. the FBM KLCI’s near-term technical outlook will stay firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart. Hence, even another 40 pt-drop or so would not cause a dent in the rising trend.

The market’s immediate resistance is now seen at the recent high of 1,479.6 pts while the next resistance lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, the 1,439 pt-level is now the initial support, followed by the 1,428 pt-level.

Market Review

Weaker sentiment. The FBM KLCI succumbed to profit taking, closing 5.07 points lower to 1,459.6, taking the cue from weakness in the regional markets. Selling was witnessed in key heavyweights such as Tenaga and Axiata. Today’s corporate news are Bank Negara Malaysia has rejected Primus’ Ng Wing Fai from being re-appointed EON Capital director, Selangor’s Menteri Besar has hinted that the state is unlikely to agree on a water tariff hike in Selangor, Gamuda reported a 77% y-o-y growth in 4QFY10 earnings that were within expectations and Genting Malaysia has paid USD380m for the New York rcaino upfront licensing fee. Overnight, the Dow Jones closed marginally higher, underpinned by hopes of further stimulus action by the Fed to help tackle the US’ persistently high unemployment.

Bursa lemah di akhir dagangan

KUALA LUMPUR 28 Sept - Harga saham di Bursa Malaysia ditutup lebih

rendah hari ini setelah kebanyakan saham wajaran tinggi berehat seketika

berikutan prestasi lemah bursa serantau, kata para peniaga.

Dalam dagangan jajaran kecil, Indeks komposit Kuala Lumpur FTSE Bursa

Malaysia (FBM KLCI) turun 5.07 mata, atau 0.35 peratus, untuk ditutup

pada 1,459.64.

Indeks utama dibuka 1.30 mata lebih rendah pada 1,463.41 pada sebelah

pagi.Indeks FBM Emas susut 41.59 mata kepada 9,763.97, FBM Top 100

turun 39.58 mata kepada 9,547.97 dan Indeks FBM Ace berkurangan 14.98

mata kepada 3,851.96.

Indeks Kewangan jatuh 20.78 mata kepada 13,295.34, Indeks Perladangan

susut 22.17 mata kepada 6,762.63 dan Indeks Perusahaan berkurangan 9.78

mata kepada 2,790.85.

Saham rugi mengatasi saham untung pada 493 berbanding 244 manakala

289 kaunter kekal, 327 tidak didagangkan dan 30 yang lain digantung.

Jumlah dagangan keseluruhannya turun kepada 976.982 juta saham

bernilai RM1.351 bilion daripada 1.158 bilion bernilai RM1.623 bilion

semalam.

Antara saham aktif, Karambunai turun 1.5 sen kepada 11.5 sen, SAAG

Consolidated susut setengah sen kepada lapan sen manakala Genting

Malaysia-CL jatuh dua sen kepada 17 sen.

Kencana-CD naik enam sen kepada 22 sen dan Unisem-CA menambah 1.5 sen

kepada 7.5 sen.

Antara saham wajaran tinggi, Tenaga Nasional turun 12 sen kepada

RM8.88, Axiata susut enam sen kepada RM4.44 dan IOI Corp jatuh lima sen

kepada RM5.50.

Genting Malaysia susut empat sen kepada RM3.41 dan Gamuda rugi

sembilan sen kepada RM3.80.

Jumlah dagangan di Pasaran Utama turun kepada 686.260 juta saham

bernilai RM1.298 bilion daripada 923.307 juta saham bernilai RM1.575

bilion pada Isnin.

Waran meningkat kepada 205.774 juta unit bernilai RM34.929 juta

daripada 133.755 juta unit bernilai RM27.104 juta semalam. JPerolehan

dagangan di pasaran ACE susut kepada 74.683 juta saham bernilai RM11.138

juta daripada 91.722 juta saham bernilai RM12.726 juta sebelumnya.

Barangan pengguna menguasai 29.238 juta saham didagangkan di Pasaran

Utama, barangan perusahaan 132.117 juta, pembinaan 81.162 juta,

perdagangan dan perkhidmatan 205.143 juta, teknologi 43.744 juta,

infrastruktur 15.482 juta, kewangan 36.710 juta, hotel 2.758 juta,

hartanah 101.102 juta, perladangan 15.815 juta, perlombongan 854,700,

REIT 22.046 juta dan dana tertutup 89,900.

- Bernama

Tuesday, September 28, 2010

Bursa kukuh di akhir dagangan

KUALA LUMPUR 27 Sept - Harga saham di Bursa Malaysia ditutup lebih

kukuh hari ini dengan Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur

(FBM KLCI) meningkat 0.9 peratus sejajar dengan pasaran serantau, kata

para peniaga.

Berlaku sdikit tawar menawar pada saham berkaitan kewangan dan

perladangan apabila kenaikan harga yang kukuh di Wall Street Jumaat

lepas telah membantu merangsang pembelian pada bursa tempatan hari ini.

FBM KLCI ditutup meningkat 13.52 mata kepada 1,464.71. Indeks utama

bergerak dalam jajaran sempit antara 1,456.30 dan 1,467.18 mata

sepanjang hari ini, selepas dibuka meningkat 7.54 mata kepada 1,458.73.

Indeks FBM Emas melonjak 80.56 mata kepada 9,805.56, Indeks FBM 100

meningkat 83.16 mata kepada 9,587.55 dan Indeks FBM Ace menokok 18.28

mata kepada 3,866.94.

Indeks Kewangan meningkat 140.65 mata kepada 13,316.12, Indeks

Perladangan meningkat 49.93 mata kepada 6,784.80 dan Indeks Perusahaan

menokok 18.67 mata kepada 2,800.63.

Kaunter untung mengatasi kaunter rugi sebanyak 469 kepada 292

manakala 276 kaunter tidak berubah, 308 tidak diniagakan dan 30 yang

lain digantung.

Perolehan keseluruhan dicatatkan 1.158 bilion saham bernilai RM1.623

bilion, yang meningkat daripada 1.727 bilion saham bernilai RM1.531

bilion pada Jumaat lepas.

Karambunai merupakan kaunter aktif , menyaksikan sahamnya merosot 5.0

sen kepada 13 sen, SAAG Consolidated dan Asian Pac Holdings turun 0.5

sen setiap satu masing-masing kepada 8.5 sen dan 11.5 sen manakala

Genting Malaysia-CL meningkat 0.5 sen kepada 19 sen dan Talam

Corporation tidak berubah pada harga 10 sen.

Jumlah dagangan di Pasaran Utama merosot kepada 923.307 juta saham

bernilai RM1.575 bilion berbanding dengan 1.508 bilion saham bernilai

RM1.492 bilion pada Jumaat lepas.

Waran meningkat kepada 133.755 juta saham bernilai RM27.104 juta

berbanding dengan 116.036 juta saham bernilai RM21.836 juta yang

dicatatkan sebelum ini. Perolehan di Pasaran ACE meningkat sedikit

kepada 91.722 juta sahams bernilai RM12.726 juta daripada 91.247 juta

saham bernilai RM10.575 juta Jumaat lepas.

Produk pengguna mencatatkan 37.706 juta saham diniagakan di Pasaran

Utama, produk perusahaan 118.126 juta, pembinaan 67.649 juta, dagang dan

perkhidmatan 285.189 juta, teknologi 26.687 juta, prasarana 23.129

juta, kewangan 62.089 juta, hotel 4.871 juta, hartanah 278.419 juta,

perladangan 16.331 juta, perlombongan 4,900, REIT 2.962 juta dan dana

tertutup 142,700. - Bernama

Monday, September 27, 2010

Technical View

The fairy tale of the FBM KLCI stretching gains above the steeper uptrend with the daily RSI staying at above the 70 pt-level came to an end last Friday. After last Thursday’s 17.62-pt loss followed by the opening gap-down of 6.5 pts last Friday, the steeper trend line was violated. Another round of sharp dip would confirm this violation.

It looks like the market will not be able to continue its stretching gains without further pulling back after the daily RSI reached its most overbought level since the bull market started in March 2009.

This week, we shall see if the market can rebound back above the steeper uptrend line. Anyhow, as we have said before, even if the FBM KLCI retraced by another 40 pts or so, the pullback would not alter the stock market’s near-term bullish technical landscape.

Our view remains the same, i.e. the FBM KLCI’s near-term technical outlook will stay firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance is now seen at the recent high of 1,479.6 pts. Next resistance lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, the 1,439 pt-level is now the initial support, followed by the 1,428 pt-level.

It looks like the market will not be able to continue its stretching gains without further pulling back after the daily RSI reached its most overbought level since the bull market started in March 2009.

This week, we shall see if the market can rebound back above the steeper uptrend line. Anyhow, as we have said before, even if the FBM KLCI retraced by another 40 pts or so, the pullback would not alter the stock market’s near-term bullish technical landscape.

Our view remains the same, i.e. the FBM KLCI’s near-term technical outlook will stay firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance is now seen at the recent high of 1,479.6 pts. Next resistance lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, the 1,439 pt-level is now the initial support, followed by the 1,428 pt-level.

Market Review

Lower finish. The FBM KLCI fell 6.89 points to close at 1,451.19 after investors locked in their profits on some of the heavyweights. YTL Cement Bhd is acquiring a 35.16% equity interest in Perak-Hanjoong Simen SB for RM200m cash, Sunway Holdings Bhd will launch its third property project with a gross development value of RM1.1bn in Singapore soon and Karambunai denies that it has submitted a proposal to the Government to build a casino in Karambunai. Meanwhile, the Sarawak state Govt offers to buy the Bakun dam for RM6bn and total passengers at KLIA in July rose to 3.0m from 2.7m y-o-y. Finally, the US markets surged on Friday as demand for capital goods increased more than expected while crude oil price also ended higher, with crude oil price surging up USD1.31 to USD76.49.

Pelabur dijangka 'tunggu dan lihat'

KUALA LUMPUR 26 Sept. - Harga-harga saham di Bursa Malaysia dijangka

bergerak dalam jajaran sempit minggu depan apabila para pelabur

mengambil sikap tunggu dan lihat ekoran kebimbangan berlarutan tentang

kelemahan ekonomi AS dan Eropah.

Ketua Penyelidikan Runcit Maybank Investment Bank, Lee Cheng Hooi,

berkata, sokongan bagi Indeks Komposit Kuala Lumpur FTSE Bursa Malaysia

(FBM KLCI) mungkin pada paras 1,430 hingga 1,450 manakala halangan pada

paras di antara 1,462 dengan 1,480.

"Pelabur-pelabur ingin berurus niaga di kaunter-kaunter berharga

rendah dan akan muncul kegiatan membeli dan menjual berselang seli,"

kata Cheng Hooi kepada Bernama.

Ketua Penyelidikan Jupiter Securities, Pong Teng Siew berkata,

pelabur-pelabur melanggani saham secara berpilih-pilih.

Menurut Teng Siew, ada pandangan yang mengatakan Program Transformasi

Ekonomi (ETP) yang diumumkan kerajaan baru-baru ini akan memberi faedah

kepada syarikat-syarikat pembinaan yang dijangka menjadi tarikan

pelabur.

"Bagaimanapun, ETP tidak memberikan kesan serta merta ke atas pasaran

pada keseluruhannya kerana pelabur-pelabur menunggu perincian khusus

tentang pelaksanaan jangka panjangnya," kata Teng Siew.

Minggu ini, FBM KLCI mencecah tahap tertinggi baharu selepas dua

setengah tahun pada Selasa, dengan disokong oleh prestasi teguh

pasaran-pasaran serantau dan berikutan pengumuman ETP.

Namun demikian, kegiatan mengambil untung muncul tiga hari

berturut-turut berikutnya, dengan kaunter-kaunter mewah mencatatkan

kejatuhan besar.

Sentimen juga lemah dengan berita penilaian yang tidak

memberangsangkan daripada Jawatankuasa Pasaran Terbuka Persekutuan Rizab

Persekutuan AS yang membayangkan bahawa pemulihan ekonomi AS kini

lembap.

Kebimbangan yang berlanjutan tentang krisis hutang Eropah dan

kelemahan ekonomi juga menghantui sentimen pelabur.

Pada Jumaat, pasaran berjaya menebus sebahagian daripada kejatuhan

sebelumnya dalam sesi dagangan petang berikutan kegiatan membeli saham

murah.

Berdasarkan Jumaat ke Jumaat, FBM KLCI turun 15.78 mata kepada

1,451.19 daripada 1,466.97.

Indeks FBM Emas susut 79.62 mata kepada 9,725 daripada 9,804.62,

Indeks FBM 100 jatuh 89.64 mata kepada 9,504.39 daripada 9,594.03 dan

Indeks FBM Ace hilang 31.40 mata kepada 3,848.66 daripada 3,880.06.

Indeks Kewangan jatuh 199.79 mata kepada 13,175.47 daripada

13,375.26, Indeks Perladangan turun 120.36 mata kepada 6,734.87 daripada

6,855.23 dan Indeks Perusahaan susut 5.96 mata kepada 2,781.60 daripada

2,787.92.

Jumlah dagangan mingguan bertambah kepada 5.958 bilion saham bernilai

RM7.865 bilion daripada 3.575 bilion saham bernilai RM7.460 bilion.

Pasaran Utama mencatatkan peningkatan jumlah dagangan kepada 4.548

bilion unit bernilai RM7.574 bilion daripada 2.891 bilion unit bernilai

RM7.316 bilion.

Pasaran Ace menyaksikan jumlah dagangan meningkat kepada 469.517 juta

saham bernilai RM62.606 juta daripada 307.57 juta saham bernilai

RM48.627 juta.

Waran bertambah kepada 889.66 juta unit bernilai RM193.161 juta

daripada 343.327 juta unit bernilai RM67.835 juta. - Bernama

Friday, September 24, 2010

Technical View

The FBM KLCI fell by almost 20 pts in the late afternoon session. Market participants finally rushed out of the market after 5 days of constructive sideways trading. The index, however, managed to rebound off the intra-day low as it found support near the steeper uptrend line and ended the day with a 16.67-pt loss Prior to the retracement, the index had advanced by more than 100 pts since the low in August, and to add, the more than 30 pts gained on last Monday and Tuesday.

Remember we have been talking about the FBM KLCI having previously added more than 100 pts, with the daily RSI trading at above the 70 pt-level. And, the indicator also closed at the highest level since the bull market started in March 2009. The 16.67-pt pullback brought the RSI back below the 70 pt-level, closing at the 65.7 pt-level yesterday. Nevertheless, the index still maintained its position at above the steeper uptrend line.

Of course, judging from yesterday’s selling momentum the market is at risk of violating this steeper uptrend line soon, or possibly even violating it today. However, as we mentioned many times before, the FBM KLCI can still march higher without pulling back further as long as the market maintains its posture at above the steeper uptrend line.

Anyhow, the FBM KLCI’s near-term technical outlook will remain firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance still lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, there is immediate support at the 1,457 pt-level, followed by the 1,439 pt-level.

Remember we have been talking about the FBM KLCI having previously added more than 100 pts, with the daily RSI trading at above the 70 pt-level. And, the indicator also closed at the highest level since the bull market started in March 2009. The 16.67-pt pullback brought the RSI back below the 70 pt-level, closing at the 65.7 pt-level yesterday. Nevertheless, the index still maintained its position at above the steeper uptrend line.

Of course, judging from yesterday’s selling momentum the market is at risk of violating this steeper uptrend line soon, or possibly even violating it today. However, as we mentioned many times before, the FBM KLCI can still march higher without pulling back further as long as the market maintains its posture at above the steeper uptrend line.

Anyhow, the FBM KLCI’s near-term technical outlook will remain firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance still lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, there is immediate support at the 1,457 pt-level, followed by the 1,439 pt-level.

Market Review

Correction mode to continue? The FBM KLCI lost 16.67 pts to 1,458.08, dragged by losses in major heavyweights. Losers led gainers by 523 to 221 while 254 counters were unchanged, 354 untraded and 36 suspended. Among the key market news today are Sarawak government bids for Bakun, Proton rules out Lotus sale, US investors can now trade directly in Bursa after Malaysia’s market is recognized by the US Securities and Exchange Commission, EPF may buy Visa’s HQ in UK, Zelan sells 7m IJM shares in open mart, Kumpulan Euro sells 100m Talam shares, DXN sets a 50% dividend payout policy and HELP’s 3Q net profit rises 11%. Overnight, the DJIA slipped 76.89 pts to end at 10,662.4 as concerns grew that the global recovery is losing steam and the outlook for bank profits is worsening. Irish bonds slid after the nation’s economy unexpectedly shrank. Therefore, we would expect regional bourses to continue to experience profit taking today.

Kerugian saham mewah Bursa rendah

KUALA LUMPUR 23 Sept - Harga saham ditutup rendah, ditarik oleh

kerugian dalam saham wajaran tinggi utama, kata para peniaga.Indeks

Komposit Kuala Lumpur FTSE Bursa Malaysia (FBM KLCI) turun 16.67 mata

kepada 1,458.08 selepas dibuka 0.95 mata lebih tinggi pada 1,475.7.

Peniaga-peniaga itu berkata berlaku pembetulan setelah bursa mencecah

paras tertinggi baharu selepas dua setengah tahun pada Selasa dengan

pelabur mengikuti kejatuhan di Wall Street ekoran penilaian yang tidak

memberangsangkan oleh Jawatankuasa Pasaran Terbuka Persekutuan Rizab

Persekutuan pada Selasa yang mengatakan pemulihan ekonomi AS telah

menjadi perlahan.

Indeks Perusahaan susut 17.70 mata kepada 2,780.64, Indeks Kewangan

turun 95.681 mata kepada 13,237.18 dan Indeks Perladangan berkurangan

134.3 mata kepada 6,743.45.

Indeks Emas FBM Emas susut 101.37 mata kepada 9,749.8, Indeks FBM Ace

jatuh 24.63 mata kepada 3,782.09 manakala FBM70 berkurangan 67.62 mata

kepada 9,572.70.

Jumlah dagangan lebih rendah pada 999.443 juta saham bernilai RM1.416

bilion daripada 1.332 bilion saham bernilai RM2.021 bilion semalam.

Saham rugi mengatasi untung pada 523 berbanding 221 manakala 254

kaunter tidak berubah, 354 tidak didagangkan dan 36 yang lain digantung.

Gamuda rugi empat sen kepada RM3.84 dengan kegiatan pengambilan

untung selepas kenaikan baru-baru ini seiring dengan sentimen pasaran

yang rendah.

Bagi saham aktif, Karambunai naik empat sen kepada 12 sen, KNM Group

menokok setengah sen kepada 47 sen, Compugates Holdings susut setengah

sen kepada 6.5 sen dan Tiger Synergy kekal pada 12.5 sen.

Jumlah dagangan di pasaran utama susut kepada 778.141 juta saham

bernilai RM1.375 bilion daripada 911.735 juta saham bernilai RM1.938

bilion semalam.

Waran berkurangan kepada 143.883 juta unit bernilai RM27.047 juta

daripada 335.974 juta unit bernilai RM65.870 juta. Jumlah dagangan di

pasaran ACE turun kepada 69.072 juta saham bernilai RM8.832 juta

daripada 74.577 juta saham bernilai RM9.534 juta.

Barangan pengguna menguasai 28.9 juta saham yang didagangkan di

Pasaran Utama; barangan perusahaan 163.8 juta; pembinaan 63.9 juta;

dagangan dan perkhidmatan 197.2 juta; teknologi 21.1 juta; infrastruktur

18.5 juta; kewangan 38.9 juta; hotel 4.04 juta; hartanah 215.2 juta;

perladangan 14.1 juta; perlombongan 0; REIT 12.3 juta; dan dana tertutup

54,000. - Bernama

Thursday, September 23, 2010

Technical View

The FBM KLCI has established a 5-day sideways trading pattern. The consolidation phase for the more than 30 pts gained last Monday and Tuesday has been very constructive as the market has thus retained the bulk of those gains.

As mentioned before, we believe that whether or not the index could stay above the steeper uptrend would determine if the market can still march higher from here without pulling back sharply.

Meanwhile, the odds remain high that the index could continue to stretch its gains near the daily RSI’s 80-pt overbought level. The indicator closed at the 80.2 pt-level yesterday. Although the RSI has reached its highest level since the bull market started in March 2009, market participants are still exhibiting no signs of rushing out of the market.

The FBM KLCI’s near-term technical outlook will remain firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance still lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, there is immediate support at the 1,457 pt-level, followed by the 1,439 pt-level.

As mentioned before, we believe that whether or not the index could stay above the steeper uptrend would determine if the market can still march higher from here without pulling back sharply.

Meanwhile, the odds remain high that the index could continue to stretch its gains near the daily RSI’s 80-pt overbought level. The indicator closed at the 80.2 pt-level yesterday. Although the RSI has reached its highest level since the bull market started in March 2009, market participants are still exhibiting no signs of rushing out of the market.

The FBM KLCI’s near-term technical outlook will remain firmly bullish as long as it stays above the new uptrend line, as is marked in the above chart.

The market’s immediate resistance still lies at the psychological 1,500 pt-barrier, followed by the 1,524.69 pt-level. To the downside, there is immediate support at the 1,457 pt-level, followed by the 1,439 pt-level.

Market Review

Range-bound. The FBM KLCI lost 1 point to 1474.75 points yesterday in a mixed broad market as gainers outnumbered losers by 398 to 364. Today’s news headlines: include SMR Technologies winning a RM89.5m Ministry of Education contract, KPJ to acquire Australian retirement village operator Jeta Gardens Waterford Trust for RM19m cash, and Tan Chong to acquire a 74% stake in Nissan Vietnam for USD7.4m cash. The US and Europe bourses finished slightly easier last night and without fresh leads, local stocks are likely to be directionless today. The key support and resistance points are at 1457 points and 1500 points respectively.

Tekanan jualan Bursa bercampur-campur

KUALA LUMPUR 22 Sept - Harga saham ditutup bercampur-campur hari ini

setelah pasaran mengalami tekanan jualan selepas kenaikan baru-baru ini,

kata para peniaga.

Indeks Komposit Kuala Lumpur FTSE Bursa Malaysia (FBM KLCI) susut

1.24 mata kepada 1,474.75 susulan kegiatan pengambilan untung.

Ketua penyelidikan Jupiter Securities Pong Teng Siew berkata Program

Transformasi Ekonomi (ETP) yang diumumkan semalam tidak memberi kesan

segera kepada pasaran kerana para pelabur masih menantikan butiran

perlaksanaan jangka panjangnya.

"Bagaimanapun, terdapatnya jangkaan yang beberapa syarikat pembinaan

seperti Gamuda akan mendapat manfaat daripada ETP berkenaan," kata

beliau.

Indeks Perladangan susut 45.33 mata kepada 6,877.75 dan Indeks

Perusahaan turun 3.03 mata kepada 2,798.34.

Indeks Kewangan naik 1.061 mata kepada 13,332.86 manakala Indeks FBM

Ace rugi 36.47 mata kepada 3,806.72 tetapi FBM70 susut 11.17 mata kepada

9,640.32.

Indeks FBM Emas susut 2.86 mata kepada 9,851.17. Jumlah dagangan

meningkat kepada 1.332 bilion saham bernilai RM2.021 bilion daripada

1.049 bilion saham bernilai RM1.513 bilion semalam.

Saham untung mengatasi rugi pada 398 berbanding 363 manakala 280

kaunter tidak berubah, 311 tidak didagangkan dan 35 lagi digantung.

Antara saham aktif, Genting Malaysia rugi 14 sen kepada RM3.50, KNM

Group naik 1.5 sen kepada 46.5 sen, Zelan menambah tiga sen kepada 69

sen dan Eastern and Oriental meningkat empat sen kepada RM1.18.

Jumlah dagangan di pasaran utama meningkat kepada 911.735 juta saham

bernilai RM1.938 bilion daripada 722.142 juta saham, bernilai RM1.438

bilion semalam.

Waran meningkat kepada 335.974 juta unit bernilai RM65.870 juta

daripada 199.798 juta unit, bernilai RM50.497 juta semalam. Jumlah

dagangan di pasaran ACE turun kepada 74.577 juta saham bernilai RM9.534

juta daripada 115.567 juta saham, bernilai RM16.123 juta semalam.

Barangan pengguna menguasai 33.3 juta saham yang didagangkan di

pasaran utama; barangan perusahaan 159.4 juta; pembinaan 173.9 juta;

dagangan dan perkhidmatan 281 juta; teknologi 24.7 juta; infrastruktur

13.2 juta; kewangan 51.5 juta; hotel 6.8 juta; hartanah 151.2 juta;

perladangan 12.4 juta; perlombongan 11,800; REIT 4.2 juta; dan dana

tertutup. 15,500.- Bernama

Wednesday, September 22, 2010

Technical View