KUALA LUMPUR 29 Julai - Harga-harga saham di Bursa Malaysia ditutup

tinggi hari ini, dirangsang oleh belian berterusan ke atas saham-saham

mewah terpilih dan saham berharga murah, kata para peniaga. Sehingga jam 5 petang, FBM KLCI mengukuh 3.22 mata atau 0.24 peratus

untuk ditutup pada 1,358.41, sekali gus kekal tinggi untuk hari kelima

berturut-turut. Ia dibuka pada 1,355.78, naik 0.59 mata pada sesi pagi dan diniagakan

antara paras tinggi seharian 1,359.27 dan serendah 1,353.16 pada sesi

berkenaan. Pada penutup, Indeks Kewangan lega 6.64 mata kepada 12,334.58, Indeks

Perladangan merosot 6.30 mata kepada 6,410.64 dan Indeks Perusahaan

lebih rendah 23.35 mata kepada 2,649.83. Indeks FBM Emas menambah 23.28 mata kepada 9,201.65, Indeks FBM70

menokok 28.64 mata kepada 9,202.98 dan Indeks FBM Ace naik 4.55 mata

kepada 3,803.73. Saham-saham untung mengatasi saham rugi dengan 386 berbalas 345

sementara 279 kaunter tidak berubah, 358 tidak diniagakan dan 27 yang

digantung urus niaga. Jumlah dagangan mengukuh kepada 999.630 juta saham bernilai RM1.481

bilion daripada 847.160 juta saham bernilai RM1.251 bilion semalam. Saham-saham untung pula, Measat Global mengukuh 27 sen kepada RM4.07,

Petronas Dagangan menambah 23 sen kepada RM10.20 dan DiGi.Com lebih

tinggi 22 sen kepada RM24.68. Untuk saham berwajaran tinggi, Maybank

kekal pada RM7.70 sementara CIMB Group lebih rendah empat sen kepada

RM7.45. Sime Darby kerugian tujuh sen kepada RM7.69 dan Maxis turun satu sen kepada RM5.31. Jumlah dagangan di pasaran utama menambah kepada 904.895 juta saham

bernilai RM1.461 bilion daripada 759.561 juta saham bernilai RM1.234

bilion semalam. Jumlah dagangan waran pula naik kepada 50.583 juta saham bernilai

RM7.924 juta berbanding 29.511 juta unit bernilai RM4.103 juta sebelumnya. Jumlah dagangan di Pasaran ACE, merosot kepada 33.708 juta saham

bernilai RM5.529 juta daripada 52.326 juta saham bernilai RM9.379 juta

sebelumnya. Produk pengguna menguasai 91.676 juta saham yang diniagakan di

Pasaran Utama, produk perusahaan 154.943 juta, pembinaan 68.782 juta,

urus niaga dan perkhidmatan 268.680 juta, teknologi 45.917 juta,

infrastruktur 47.994 juta, kewangan 70.277 juta, perhotelan 6.254 juta,

hartanah 120.960 juta, perladangan 15.579 juta, perlombongan 87,000,

REIT 13.665 juta dan dana tertutup 82,700. - Bernama

Blog ini telah di kemaskini di http://seminarjutawansaham.blogspot.com

My Blog List

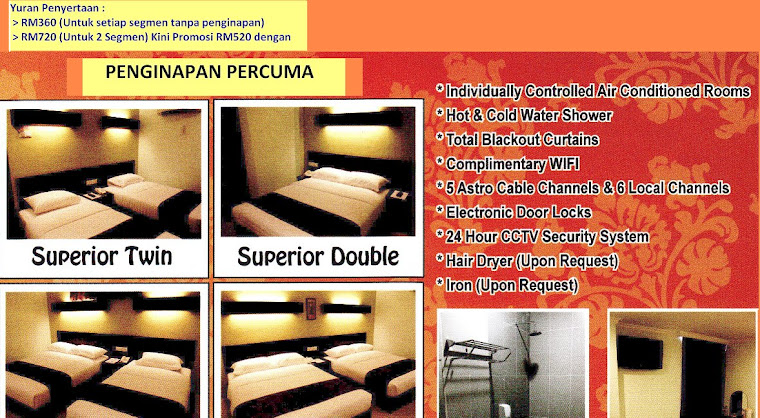

...kini mengadakan promosi bagi peserta yang ingin menyertai seminar untuk dua segmen dengan diskaun sebanyak RM200 serta penginapan percuma (untuk seminar di Pusat Latihan PUABUMI sahaja)......rebutlah peluang mempelajari ilmu pelaburan ini...

Penginapan percuma hanya untuk penyertaan dua segmen di Pusat Latihan PUABUMI Kemaman, Terengganu sahaja...

Barisan Penceramah

Kami bersedia untuk turun padang membongkar rahsia pelaburan di Bursa Malaysia

Destinasi Seminar

Pakej Eksklusif Istimewa ~ Seminar Jutawan Saham dan CPO siri ke 3 adalah pembuka untuk tahun 2011 ini di Pusat Latihan PUABUMI pada 8hb dan 9hb Januari 2011

Seminar Jutawan Saham & CPO akan berada di Santuary Resort Cherating pada 15 Januari 2011 ( segmen ekuiti ) dan 16 Januari 2011 ( segmen CPO )

Kem Pelaburan PUABUMI II akan berada di Hotel Midah Kuala Lumpur pada 13 Ogos 2011 ( segmen CPO ) dan 14 Ogos 2011 ( segmen Ekuiti )

Seminar Jutawan Saham & CPO akan berada di Suria City Hotel, Johor Bahru pada 29 Januari 2011 ( segmen ekuiti ) dan 30 Januari 2011 ( segmen CPO )

Friday, July 30, 2010

Thursday, July 29, 2010

Market Review

Consolidation mode. The FBM KLCI closed 2.96 points higher at 1,355.19, underpinned by financials, which benefited from positive news flow of a thinned down implementation of Basel 3. Today’s corporate news include Measat announcing that it has received a privatisation offer from its major shareholder for RM4.20 cash per share, WCT has proposed an issuance of RM600m serial fixed rate bonds, PLUS to dispose of the entire equity in PT Cimanggis tollway for RM20.2m, MRCB will consider injecting some of its assets into a real estate investment trust and PepsiCo has renewed CI Holdings’ bottoling rights for Pepsi beverages. Finally the US market closed 39.8 points lower on concerns of a slowing economic recovery as unemployment remains high. We expect our market to consolidate in a tight trading range given its strong recent uptrend.

Bursa kukuh di akhir dagangan

KUALA LUMPUR 28 Julai - Harga saham di Bursa Malaysia ditutup lebih

tinggi hari ini, yang disumbang oleh kenaikan saham berkaitan kewangan

seperti CIMB Group, kata para peniaga. Sehingga jam 5 petang, FBM KLCI meningkat 2.96 mata atau 0.22 peratus

untuk ditutup kepada paras ketinggian baharunya yang dicatat pada rali

2009-2010 kepada 1,355.19. Indeks FBM KLCI dibuka meningkat 0.42 mata kepada 1,352.65 pada

sebelah pagi dan diniagakan pada julat 5.51 mata antara paras ketinggian

harian 1,356.13 dan paras terendah harian 1,350.62 semasa sesi

dagangan. Semasa ditutup, Indeks Kewangan meningkat 60.60 mata kepada

12,341.22, Indeks Perladangan meningkat 9.34 mata kepada 6,416.94 dan

Indeks Perusahaan menokok 2.38 mata kepada 2,673.18. Indeks FBM Emas menokok 23.80 mata kepada 9,178.37, Indeks FBM70

meningkat 25.31 matas kepada 9,174.34 dan Indeks FBM Ace maju 8.15 mata

kepada 3,799.18. Kaunter untung mengatasi kaunter rugi sebanyak 445 kepada 264

manakala 278 kaunter tidak berubah, 377 tidak diniagakan dan 28 yang

lain digantung.Jumlah dagangan meningkat kepada 847.160 juta saham

bernilai RM1.251 bilion daripada 731.634 juta saham bernilai RM1.33

bilion semalam. Mendahului saham paling aktif ialah kaunter yang membuat kemunculan

sulung di Pasaran Utama, Ivory Properties, yang ditutup dagangan hari

pertama kepada RM1.30, yang meningkat 30 sen daripada harga tawarannya.

Ia dibuka meningkat 15 sen kepada RM1.15.Jadi Imaging meningkat 2.5 sen

kepada 30 sen, AirAsia meningkat 7.0 sen kepada RM1.51 dan Berjaya

Corporation menokok 6.0 sen kepada RM1.09. Jumlah dagangan Pasaran Utama meningkat kepada 759.561 juta saham

bernilai RM1.234 bilion daripada 633.941 juta saham bernilai RM1.316

bilion semalam. Perolehan di Pasaran ACE merosot kepada 52.326 juta saham bernilai

RM9.379 juta berbanding dengan 59.135 juta saham bernilai RM10.835 juta

sebelum ini. Jumlah dagangan waran merosot kepada 29.511 juta unit

bernilai RM4.103 juta daripada 32.849 juta unit bernilai RM4.906 juta semalam. Produk pengguna mencatatkan 77.599 juta saham diniagakan di Pasaran

Utama, produk perusahaan 133.551 juta, pembinaan 62.274 juta, dagang dan

perkhidmatan 216.484 juta, teknologi 28.314 juta, prasarana 10.347

juta, kewangan 63.225 juta, hotel 1.809 juta, hartanah 132.875 juta,

perladangan 14.875 juta, perlombongan 32,000, REIT 18.115 juta, dan dana

tertutup 62,600. - Bernama

Wednesday, July 28, 2010

Technical View 28 July 2010

The FBM KLCI was trading listlessly in the vicinity of the peak of 2010-2009 rally, which was expected when the market is situated at around a key level. At the end the session, the index carved out a “Doji Star”, which represents indecision in the market. Remember that the 1,350 pt-level is not just a random level, as there were previously three failed breakout attempts at this level during the March-May period.

Anyhow, yesterday was just a day whereby buyers and sellers were trying to dominate each other at this meaningful level. The immediate technical outlook of the FBM KLCI remains bullish.

From the current level, continue to look for the next tough resistance at the 1,395 pt-level. Initial support is now seen at the 1,350 pt-level, followed by the 1,332 pt-level and the 1,326 pt-level.

Anyhow, yesterday was just a day whereby buyers and sellers were trying to dominate each other at this meaningful level. The immediate technical outlook of the FBM KLCI remains bullish.

From the current level, continue to look for the next tough resistance at the 1,395 pt-level. Initial support is now seen at the 1,350 pt-level, followed by the 1,332 pt-level and the 1,326 pt-level.

Belian saham mewah Bursa bercampur-campur

KUALA LUMPUR 27 Julai - Harga-harga saham di Bursa Malaysia ditutup

bercampur-campur hari ini dengan indeks utama berada pada zon positif,

disokong oleh belian lewat saham-saham mewah terpilih, kata para

peniaga. Pada pukul 5 petang, Indeks FBM KLCI naik 0.41 mata atau 0.03 peratus

untuk ditutup pada 1,352.23, selepas dibuka 0.65 mata lebih tinggi pada

1,352.47.Indeks utama diniagakan dalam lingkungan 8.94 mata antara

paras tertinggi harian 1357.23 dan terendah 1348.29 semasa sesi urus

niaga. Pada penutup, Indeks Kewangan susut 18.47 mata kepada 12,280.62 dan

Indeks Perusahaan turun 5.06 mata kepada 2,670.80 sementara Indeks

Perladangan menokok 12.62 mata kepada 6,407.60. Indeks FBM Emas mengukuh 3.79 mata kepada 9,154.57 dan Indeks FBM70

menambah 0.60 mata kepada 9,149.03 tetapi Indeks FBM Ace kerugian 10.98

mata kepada 3,791.03. Saham-saham rugi mengatasi saham untung dengan 381 berbalas 308

sementara 285 kaunter tidak berubah, 390 tidak diniagakan dan 26 yang

lain digantung urus niaga. Jumlah dagangan turun kepada 731.634 juta saham bernilai RM1.33

bilion daripada 850.663 juta saham bernilai RM1.122 bilion semalam.Di kalangan saham aktif, Berjaya Corporation kekal pada RM1.03 sementara AirAsia mengembang dua sen kepada RM1.44. Kenmark Industrial

kehilangan satu sen kepada tujuh sen manakala Jadi Imaging Holdings

menambah 1.5 sen kepada 27.5 sen. Di kalangan saham yang paling untung ialah Nestle yang mengembang

RM1.36 kepada RM38.60, dan Cycle & Carriage Bintang serta Measat

Global yang meningkat 31 sen, masing-masing kepada RM6.08 dan RM3.80. Jumlah dagangan di pasaran utama merosot kepada 633.941 juta saham

bernilai RM1.316 bilion daripada 748.439 juta saham bernilai RM1.102

bilion semalam. Perolehan dagangan di Pasaran ACE rendah sedikit kepada 59.135 juta saham bernilai RM10.835 juta berbanding 59.410 juta saham bernilai

RM11.476 juta sebelumnya.Jumlah waran pula turun kepada 32.849 juta unit

bernilai RM4.906 juta daripada 39.218 juta unit bernilai RM7.146 juta

semalam. Produk pengguna menguasai 74.720 juta saham yang diniagakan di

Pasaran Utama, produk perindustrian 116.502 juta, pembinaan 45.446 juta,

urus niaga dan perkhidmatan 203.294 juta, teknologi 35.135 juta,

infrastruktur 15.715 juta, kewangan 43.422 juta, perhotelan 869,200,

hartanah 62.907 juta, perladangan 24.754 juta, perlombongan 10,000, REIT

11.005 juta dan dana tertutup 162,800.- Bernama

Tuesday, July 27, 2010

Technical View 27 July 2010

Yesterday, the FBM KLCI created a new high in the 2009-2010 rally. Remember that there had previously been three failed breakout attempts at the 1,350 pt-level during the March-May period. Although the index only violated the 1,350 pt-level marginally, it could turn out to be a major market action which could lead to further upside for the market.

The immediate technical outlook of the FBM KLCI is bullish. The rebound starting from the May low was actually not a bear rebound as we had expected. This is the second time since March 2009 that a major breakdown experienced by the FBM KLCI did not lead to the kind of sharp decline that we normally see. To re-cap, the first violation of the critical 50-day MAV line in February this year also did not cause the FBM KLCI to retrace drastically from the moving average line.

From the current level, look for the next tough resistance at the 1,395 pt-level. Initial support is now seen at the 1,350 pt-level, followed by the 1,332 pt-level and the 1,326 pt-level.

The immediate technical outlook of the FBM KLCI is bullish. The rebound starting from the May low was actually not a bear rebound as we had expected. This is the second time since March 2009 that a major breakdown experienced by the FBM KLCI did not lead to the kind of sharp decline that we normally see. To re-cap, the first violation of the critical 50-day MAV line in February this year also did not cause the FBM KLCI to retrace drastically from the moving average line.

From the current level, look for the next tough resistance at the 1,395 pt-level. Initial support is now seen at the 1,350 pt-level, followed by the 1,332 pt-level and the 1,326 pt-level.

Market Review

Scaling new high. The FBM KLCI gained 6.14 points to close at 1,351.82. Khazanah Nasional Bhd has won the bid for control over Asia’s largest hospital chain, Parkway Holdings Ltd, after Fortis accepted its higher cash offer of S$3.95 (RM9.25)/share. Mudajaya Group Bhd’s shares slumped after a news report said it was being probed by the Securities Commission while GPRO Technology Bhd plans to acquire precision casting and injection moulding specialist AB Technology SB at an indicative price of about RM140m through the issuance of new GPRO shares. Leong Hup Holdings Bhd plans to spend up to RM30m in 2010 to set up a broiler farm in the Bio Desaru Food Valley project while the International Trade and Industry Ministry said that foreign direct investment (FDI) inflow totalled RM5.06bn in 1Q10, nearly matching that in the entire 2009 inflow of RM5.66bn. Finally, the US markets jumped on FedEx's improved forecasts and a better-than-expected housing market report. Crude oil price, however , was flat at USD78.98/barrel.

Pengambilan untung Bursa bercampur-campur

KUALA LUMPUR 26 Julai - Harga-harga saham Bursa Malaysia ditutup

bercampur-campur hari ini apabila sebilangan pelabur mengambil

keuntungan selepas kenaikan, kata peniaga. Pada 5 petang, FBM KLCI menokok 6.14 mata atau 0.46 peratus untuk

ditutup pada 1,351.82, paras penutup tertingginya tahun ini.Indeks utama

bergerak antara 1,352.94 dan 1,348.58 hari ini selepas dibuka 4.86 mata

lebih tinggi pada 1,350.54. Indeks Kewangan naik 111.97 mata kepada 12,299.09, Indeks Perladangan

naik 14.89 mata kepada 6,394.98 dan Indeks Industri bertambah 8.14 mata

kepada 2,675.86. Indeks FBM Emas meningkat 24.21 mata kepada 9,150.78 tetapi Indeks

FBM70 merosot 14.51 mata kepada 9,148.43 dan Indeks FBM Ace susut 14

mata kepada 3,802.01. Kaunter rugi mengatasi untung dengan 355 berbanding 336 sementara 274

kaunter tidak berubah, 400 tidak didagangkan dan 24 yang lain

digantung. Jumlah dagangan menyusut kepada 850.663 juta saham bernilai RM1.122

bilion daripada 993.351 juta saham bernilai RM1.430 bilion Jumaat lepas. Di kalangan saham aktif, Tiger Synergy Bhd-OR naik setengah sen

kepada satu sen sementara Time dotCom tidak berubah pada 59.5 sen. Time Engineering susut satu sen kepada 44.5 sen, IFCA MSC merosot 2.5

sen kepada 19.5 sen dan Talam Corporation kekal pada 11.5 sen. Jumlah dagangan pasaran utama menyusut kepada 748.439 juta saham

bernilai RM1.102 bilion daripada 899.788 juta saham, bernilai RM1.404

bilion Jumaat lepas. Perolehan dagangan pada pasaran ACE, bagaimanapun, meningkat kepada 59.410 juta saham bernilai RM11.476 juta berbanding 46.741 juta saham

bernilai RM12.539 juta sebelumnya. Dagangan warant juga meningkat pada 39.218 juta unit bernilai RM7.146

juta berbanding 36.073 juta saham bernilai RM7.221 juta Jumaat lepas. Barangan pengguna mewakili 64.079 juta saham yang didagangkan di

Pasaran Utama, produk industri 206.640 juta, pembinaan 61.931 juta,

dagangan dan perkhidmatan 182.334 juta, teknologi 42.995 juta, prasarana

51.511 juta, kewangan 41.248 juta, hotel 2.055 juta, harta 65.117 juta,

perladangan 17.621 juta, perlombongan 15,000, REIT 12.702 juta dan dana

tertutup 191,600. - Bernama

Monday, July 26, 2010

Technical View 26 July 2010

The FBM KLCI’s current technical posture suggests that the key index could be cracking the peak of the 2009-2010 rally soon. The peak is situated at the 1,350 pt-level and the market is now very close to it. In fact, the futures index has surpassed the peak of the 2009-2010 rally last Friday. Remember there were three failed breakout attempts at the 1,350 pt-level during the March-May period. It is amazing that the FBM KLCI could actually return back to the current level after having experienced a major technical breakdown by violating the “Neckline” support line.

Similar to the recent rebound back above the “Neckline” experienced by the palm oil futures market, the FBM KLCI is also experiencing something very unusual. Firstly, the breakdown from the “Neckline” of the “Triple Top” is supposed to be a very reliable mid-term reversal pattern which would normally lead to further downside. However, the downdraft following the breakdown was brief and the retracement was only about 100 pts off the 1,350 pt-peak. Secondly, the FBM KLCI has been actually trending against the DJIA in a major way since last month. While the DJIA continued to trend lower within a broad downtrend channel, the FBM KLCI continued to go higher. Last but not least, the DJIA did look like it is in the process of creating a major “Head and Shoulder” bearish formation. The combination of these three factors has kept us maintaining our near-term bearish bias view for quite a while despite the fact that the FBM KLCI is obviously trending up.

We will now see if the FBM KLCI can violate the 1,350 pt-level. We are dropping our bearish bias view now. The rebound starting from the May low was actually not a bear rebound as we had been expecting. This is the second time since March 2009 that a major breakdown experienced by the FBM KLCI did not lead to the kind of sharp decline that we normally saw in the past. To re-cap, the first violation of the critical 50-day MAV line in February this year also did not cause the FBM KLCI to retrace drastically from the moving average line.

From the current level, there is a tough resistance at the 1,350 pt-level. Next hurdle would be the 1,395 pt-level while initial support is still situated at the 1,332 pt-level, followed by the 1,326 pt-level.

Similar to the recent rebound back above the “Neckline” experienced by the palm oil futures market, the FBM KLCI is also experiencing something very unusual. Firstly, the breakdown from the “Neckline” of the “Triple Top” is supposed to be a very reliable mid-term reversal pattern which would normally lead to further downside. However, the downdraft following the breakdown was brief and the retracement was only about 100 pts off the 1,350 pt-peak. Secondly, the FBM KLCI has been actually trending against the DJIA in a major way since last month. While the DJIA continued to trend lower within a broad downtrend channel, the FBM KLCI continued to go higher. Last but not least, the DJIA did look like it is in the process of creating a major “Head and Shoulder” bearish formation. The combination of these three factors has kept us maintaining our near-term bearish bias view for quite a while despite the fact that the FBM KLCI is obviously trending up.

We will now see if the FBM KLCI can violate the 1,350 pt-level. We are dropping our bearish bias view now. The rebound starting from the May low was actually not a bear rebound as we had been expecting. This is the second time since March 2009 that a major breakdown experienced by the FBM KLCI did not lead to the kind of sharp decline that we normally saw in the past. To re-cap, the first violation of the critical 50-day MAV line in February this year also did not cause the FBM KLCI to retrace drastically from the moving average line.

From the current level, there is a tough resistance at the 1,350 pt-level. Next hurdle would be the 1,395 pt-level while initial support is still situated at the 1,332 pt-level, followed by the 1,326 pt-level.

Market Review

Higher closing. The FBM KLCI jumped 9.63 points to close at 1,345.68. Malaysia Marine and Heavy Engineering Holdings Bhd (MMHE) will offer 25%, or 408m shares, of the enlarged paid-up of 1.6 billion shares for sale under IPO and expects the listing to be completed by 4QCY10. Tanjong plc plans to double its power generation capacity from the current 4,000 megawatt (MW) in the next 4-5 years by expanding its power generation assets in Middle East, North Africa and Asia. Malaysia Airports Holdings Bhd (MAHB) expects an average growth of 12% in passenger traffic volume this year which is in line with the global economic recovery, while Kumpulan Wang Persaraan (KWAP) recently emerged as a substantial shareholder of Gamuda Bhd with a 5.16% stake. Finally, the US markets were up on Friday after a report showed that most of Europe's big banks have passed the stress tests, which helped to ease investor worries about the strength of the global economic recovery. Crude oil price, however, fell USD0.32 to close at USD78.98/barrel.

Harga saham uji paras 1,350 mata

KUALA LUMPUR 25 Julai - Harga saham di Bursa

Malaysia dijangka meningkat minggu depan menguji paras 1,350 mata dengan

pelabur runcit sebagai peserta utama dalam pasaran, kata para peniaga. Pong Teng Siew daripada Jupiter Securities Sdn. Bhd. berkata, harga

komoditi tinggi, seperti minyak sawit, akan menyokong kaunter berkaitan

perladangan dan memberikan rangsangan kepada pasaran.Menurutnya, antara kaunter yang dijangka mendapat perhatian minggu

depan ialah Sime Darby, IOI Corp dan Kuala Lumpur Kepong. Kenaikan itu juga akan disokong oleh saham bank, yang baru-baru ini

menyaksikan kekurangan minat meskipun Public Bank mencatatkan keuntungan

sebelum cukai tinggi sebanyak RM981.98 juta dalam suku keduanya di atas

pendapatan RM2.679 bilion, katanya. Saham perbankan lain seperti CIMB dan Hong Leong dijangka kekal

menjadi antara saham pilihan berikutan jangkaan pertumbuhan suku kedua

kukuh dalam industri tersebut, kata Teng Siew.Keputusan kewangan menggalakkan yang dicatatkan oleh DiGi juga merangsang beberapa minat belian dalam kaunter tersebut pada minggu ini.Seorang penganalisis lain berkata faktor-faktor luar seperti prestasi

di Wall Street dan pasaran saham serantau juga perlu diambil kira

kerana ia juga boleh menyediakan hala tuju kepada bursa tempatan. Pada Jumaat, bursa tempatan melantun semula sebagai memberi reaksi

kepada aliran meningkat di Wall Street, selepas para pelabur agak

berhati-hati pada Khamis terhadap kenyataan Pengerusi Rizab Persekutuan

AS Ben Bernanke bahawa ekonomi AS berdepan dengan prospek "tidak menentu

yang luar biasa". "Pasaran tempatan berada dalam sentimen neutral dan bergerak menghala ke arah positif. Sebarang pengunduran dijangka terhad

dengan sokongan indeks utama dilihat pada paras 1,340 mata dan paras

ketahanan pada 1,350 mata," kata penganalisis itu. Bagi minggu yang baru berakhir ini, FBM KLCI utama meningkat sebanyak

9.63 mata kepada 1,345.68. Menurut para peniaga, ia merupakan minggu

yang baik bagi penyenaraian baharu. EA Holdings Bhd, syarikat pegangan pelaburan, pengurusan dan

perkhidmatan perundingan memulakan dagangan sulungnya pada 20 Julai pada

45 sen, di mana premium 20 sen mengatasi harga tawarannya pada 25 sen.

Saham tersebut ditutup tinggi minggu ini pada 70 sen. Bagi asas Jumaat ke Jumaat, FBM KLCI meningkat 9.03 mata kepada

1,345.68 daripada 1,336.65 sebelumnya. Indeks FBM Emas naik 78.14 mata kepada 9,126.57, FBM70 meningkat

77.44 mata kepada 9,162.94 dan Indeks FBM Ace menokok 51.40 mata kepada

3,816.01. Indeks Kewangan menambah 86.51 mata kepada 12,187.12, Indeks

Perladangan menokok 90.59 mata kepada 6,380.09 dan Indeks Perusahaan

naik 12.69 mata kepada 2,667.72. Jumlah dagangan bagi minggu ini naik kepada 4.175 bilion saham

bernilai RM6.527 bilion daripada 3.4 bilion saham bernilai RM5.937

bilion minggu sebelumnya. Jumlah dagangan di Pasaran Utama meningkat kepada 4.237 bilion saham

bernilai RM6.384 bilion daripada 3.101 bilion saham bernilai RM5.879

bilion sebelumnya. Jumlah dagangan Pasaran Ace menokok kepada 273.18 juta saham bernilai

RM216.745 juta daripada 143.064 juta saham bernilai RM19.081 juta pada minggu sebelumnya. Waran naik kepada 176.124 juta unit bernilai RM29.516 juta daripada

131.56 juta unit bernilai RM21.985 juta sebelumnya. - BERNAMA

Friday, July 23, 2010

Technical View 23 July 2010

Last month, the palm oil futures market experienced an extremely critical breakdown at the RM2,393 / tonne level, which completed the massive “Double Top” formation that took more than 6 months to complete. Theoretically, the accuracy of this massive bearish reversal pattern should be very high. Palm oil prices should have fallen much further after violating the RM2,393 / tonne level, which is the “Neckline” of the “Double Top”

Surprisingly, in less than a month after taking out the critical RM2,393 / tonne level, prices actually bounced back above the “Neckline”. This is highly unusual, both theoretically and in the actual trading environment. The return back above the “Neckline” coupled with the violation of the downtrend line stretching from the RM2,722 / tonne level basically completely overturned the previous highly bearish scenario.

In June, it was still a very bearish technical landscape for the palm oil futures market. And after yesterday, we are seeing a very different technical picture. Near-term technical outlook of the palm oil futures market has now become bullish. We believe the recent rebound back above the “Neckline” has caught almost every technician off guard.

From the current level, there is immediate support at the RM2,393 / tonne level, followed by the RM2,270 / tonne level. To the upside, immediate resistance is now seen at the RM2,600 / tonne level and followed by the RM2,660 / tonne level.

Surprisingly, in less than a month after taking out the critical RM2,393 / tonne level, prices actually bounced back above the “Neckline”. This is highly unusual, both theoretically and in the actual trading environment. The return back above the “Neckline” coupled with the violation of the downtrend line stretching from the RM2,722 / tonne level basically completely overturned the previous highly bearish scenario.

In June, it was still a very bearish technical landscape for the palm oil futures market. And after yesterday, we are seeing a very different technical picture. Near-term technical outlook of the palm oil futures market has now become bullish. We believe the recent rebound back above the “Neckline” has caught almost every technician off guard.

From the current level, there is immediate support at the RM2,393 / tonne level, followed by the RM2,270 / tonne level. To the upside, immediate resistance is now seen at the RM2,600 / tonne level and followed by the RM2,660 / tonne level.

Market Review

Market down on Fed’s view? The FBM KLCI eased 4.97 pts to 1,336.05 as investors turned jittery when Federal Reserve chairman Ben Bernanke in his Congressional testimony on Wednesday said the US economy faced "unusually uncertain" prospects. Losers outnumbered gainers 388 to 318 while 251 counters were unchanged, 410 untraded and 27 were suspended. Nonetheless, with DJIA’s 201.77-pt surge overnight to close at 10,322.3 pts on improving profit forecasts and accelerating growth in the European manufacturing and services industry, we may see buying interest return to the market across the region today. Today’s key highlights are EONCap to call a shareholders meeting on 19 Aug to decide Hong Leong Banks takeover offer, Bank Negara reserves at RM309.9bn, Nagamas signs MOU with Yongzhou City People’s Government to undertake an international multi-trade project in China, Bank Rakyat’s 1H earnings rise 24%, NSTP to be delisted on 30 July and Bursa reprimands Tiger and Tracoma.

Jualan besar-besaran Bursa lemah

KUALA LUMPUR 22 Julai - Jualan besar-besaran saham kewangan dan

perladangan di kaunter saham berwajaran tinggi, menyaksikan harga saham

di Bursa Malaysia ditutup rendah hari ini. Pelabur bimbang dan bersikap berhati-hati terhadap kenyataan

Pengerusi Rizab Persekutuan Ben Bernanke bahawa ekonomi Amerika Syarikat

(US) berhadapan dengan prospek "luar biasa tidak menentu". Ulasan

beliau dibuat semasa pelabur sudah sibuk dengan pemulihan ekonomi US

yang tertangguh, selain penyiaran keputusan "ujian stres" ke atas 91

bank Eropah, esok," kata seorang peniaga. Pada 5 petang, petunjuk pasaran Indeks Komposit Kuala Lumpur (KLCI)

ditutup 4.97 mata lebih rendah kepada 1,336.05, selepas dibuka dalam

jajaran kecil antara 1,332.92 dan 1,339.98 mata. Indeks FBM Emas turun 29.36 mata kepada 9,066.55, Indeks FBM Ace

turun 6.77 mata kepada 3,796.74 manakala Indeks FBM70 susut 18.98 mata

kepada 9,126.46.Indeks Kewangan turun 34.49 mata kepada 12,126.62,

Indeks Perusahaan susut 17.91 mata kepada 2,657.56 dan Indeks

Perladangan turun 9.24 mata kepada 6,336.61. Kaunter rugi mengatasi kaunter untung sebanyak 388 berbanding 318

manakala 251 kaunter tidak berubah, 410 tidak diniagakan dan 27 lagi

digantung. Jumlah dagangan berkurangan kepada 872.860 juta saham bernilai

RM1.145 bilion berbanding 874.875 juta saham bernilai RM1.268 bilion

semalam. Antara kaunter aktif, Kenmark meningkat 3.5 sen kepada 10 sen, Tatt

Giat yang baru disenaraikan menokok tiga sen kepada 61 sen manakala Ho

Wah menambah setengah sen kepada 16 sen. Jumlah dagangan di Pasaran Utama meningkat kepada 781.394 juta saham

bernilai RM1.128 bilion berbanding 770.316 juta saham bernilai RM1.243

bilion semalam. Perolehan jumlah dagangan di Pasaran ACE meningkat kepada 58.147 juta

saham bernilai RM11.421 juta berbanding 57.443 juta unit bernilai

RM16.664 juta yang direkodkan pada Rabu.Waran berkurangan kepada 30.759

juta saham bernilai RM4.573 juta berbanding 42.123 juta saham bernilai

RM6.675 juta semalam. Barangan pengguna menyumbang sejumlah 168.942 juta saham yang

diniagakan di Pasaran Utama, barangan perusahaan 203.507 juta, pembinaan

64.362 juta, perdagangan dan perkhidmatan 180.691 juta, teknologi

30.012 juta, infrastruktur 15.064 juta, kewangan 28.215 juta, hotel

709,500, hartanah 69.579 juta, perladangan 10.981 juta, perlombongan

tiada, REIT 9.190 juta dan dana tertutup 136,300. - Bernama

Thursday, July 22, 2010

Technical View 22 July 2010

The USD/RM trend remains the same as we had previously updated in April. The USD continued to be pressured by the 200-day MAV line and an obvious downtrend can be seen on the daily chart. Having failed to break below the RM3.17/USD level after many attempts since April, a strong support has been created at the RM3.17/USD level.

We maintain our bearish view towards the USD/RM currency market as the USD continues to be pressured by the 200-day MAV line.

From the current level, a very strong support lies at the RM3.17/USD level. Should this level be violated, it is very likely that the USD will depreciate at a quicker pace. Below RM3.17/USD, the RM3.14/USD level is the next support. To the upside, there is immediate resistance at the RM3.23/USD level, followed by the RM3.27/USD level.

We maintain our bearish view towards the USD/RM currency market as the USD continues to be pressured by the 200-day MAV line.

From the current level, a very strong support lies at the RM3.17/USD level. Should this level be violated, it is very likely that the USD will depreciate at a quicker pace. Below RM3.17/USD, the RM3.14/USD level is the next support. To the upside, there is immediate resistance at the RM3.23/USD level, followed by the RM3.27/USD level.

Market Review

Bargain hunting in selected blue chips. The FBM KLCI rose 3.35 pts to 1,341.02 on follow-through interest in selected blue chips, with foreign funds and institutions remaining in the market. Gainers outnumbered losers by 442 to 298, 277 counters were unchanged, 348 untraded and 26 suspended. Today’s key market

news include CPI rose 1.6% y-o-y in June, Wilmar buys NatOleo for RM450m, sources said Far East Consortium International plans to include five Malaysian hotels in a planned listing in Hong Kong, Khazanah unit, Integrated Healthcare Holdings, says it has secured 50.5% approval to date from Parkway shareholders who have voted for its partial offer, Malaysia Mosaics agrees to privatization proposal by its substantial shareholders, Mudajaya is said to see the entry of a new substantial shareholder, 1 Mont’ Kiara is believed to have been sold for RM333m, and Ivory’s public issue oversubscribed by 2.19 times. Overnight, US stocks slid with the DJIA closing 109.43 pts lower to 10,120.5, as Federal Reserve Chairman Ben S. Bernanke said the economy outlook remains “unusually uncertain” without offering additional measures to stimulate growth. Therefore, we may see investors moving sideways pending any fresh leads.

Saham mewah rangsang Bursa ditutup tinggi

KUALA LUMPUR 21 Julai - Bursa Malaysia ditutup lebih tinggi berikutan

minat belian berterusan pada saham berwajaran tinggi terpilih hari ini. Para peniaga berkata Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur

(FBM KLCI) kekal di atas paras 1,340 mata sepanjang hari ini apabila

peningkatan harga pada stok semalaman AS merangsang para pemain termasuk

dana asing dan institusi untuk kekal di dalam pasaran. Sehingga jam 5 petang, Indeks FBM KLCI meningkat 3.35 mata kepada

1,341.02 berbanding dengan penutup semalam."FBM KLCI meningkat 4.32 mata

lagi semalam dan menghampiri paras 1,350 mata. Indek FBM Emas menokok 25.32 mata kepada 9,095.91, Indeks FBM Ace

meningkat 26.89 mata kepada 3,803.51 dan Indeks FBM70 meningkat 33.90

mata kepada 9,145.44. Indeks Kewangan melonjak 40.54 mata kepada 12,161.11, Indeks

Perusahaan meningkat 4.77 mata kepada 2,657.56 dan Indeks Perladangan meningkat 48.76 mata kepada 6,345.85. Kaunter untung mengatasi kaunter rugi sebanyak 442 kepada 298 manakala 277 kaunter tidak berubah, 348 tidak diniagakan dan 26 yang

digantung. Perolehan dicatatkan lebih rendah kepada 874.875 juta saham bernilai

RM1.268 bilion berbanding dengan 1.126 bilion saham bernilai RM1.321

bilion semalam. Di kalangan kaunter aktif, SAAG meningkat 0.5 sen kepada 8.0 sen,

Berjaya Corp merosot 3.0 sen kepada RM1.10, Jadi Imaging menokok 2.0 sen

kepada 25 sen manakala Sinotop meningkat 6.5 sen kepada 34 sen. Bagi saham berwajaran tinggi, Maybank meningkat 3.0 sen kepada RM7.70, CIMB meningkat 9.0 kepada RM7.23 manakala Sime Darby tidak

berubah pada harga RM7.74. Jumlah dagangan Pasaran Utama turun kepada 770.316 juta saham

bernilai RM1.243 bilion berbanding dengan 1.015 bilion saham bernilai

RM1.292 bilion semalam. Perolehan di Pasaran ACE juga merosot kepada 57.443 juta saham

bernilai RM16.664 juta berbanding dengan 74.536 juta unit bernilai

RM21.572 juta Selasa.Waran meningkat kepada 42.123 juta saham bernilai

RM6.675 juta daripada 30.565 juta saham bernilai RM4.532 juta semalam. Produk pengguna mencatatkan 121.377 juta saham diniagakan di Pasaran Utama, produk perusahaan 166.920 juta, pembinaan 73.933 juta, dagang dan

perkhidmatan 221.422 juta, teknologi 44.154 juta, prasarana 21.927

juta, kewangan 8.937 juta, hotel 2.633 juta, hartanah 53.777 juta,

perladangan 14.905 juta, perlombongan 3,000, REIT 10.293 juta dan dana

tertutup 30,000. - Bernama

Wednesday, July 21, 2010

Technical View 21 July 2010

After shrugging off the DJIA’s 261.49-pt losses two days ago, the FBM KLCI picked up another 4.32 pts yesterday and got closer to the 1,350 pt-level, or the 2009-2010 peak. In the chart, it looks like the index is ready to run back above the 1,340 pt-level.

We mentioned yesterday that while the DJIA is obviously trending down within a broad downtrend channel and the index is already 10% off the 2009-2010 rally, the FBM KLCI is indeed only about 20 pts away from breaking out from the 2009-2010 rally peak. To our best memory, this is the first time that we saw such resilient performance from the FBM KLCI in at least 8 years. Meanwhile, we maintain our bearish view while watching the DJIA’s immediate trend.

From the current level, there is a tough resistance at the 1,350 pt-level. Immediate support is still situated at the 1,332 pt-level, followed by the 1,326 pt-level.

From the current level, there is a tough resistance at the 1,350 pt-level. Immediate support is still situated at the 1,332 pt-level, followed by the 1,326 pt-level.

Market Review

Ending higher. The FBM KLCI closed 4.32 points higher at 1,337.7, supported by key heavyweights Tenaga, Genting and Public Bank. Market trading volume was encouraging, with 1.12bn shares traded. Today’s key headlines include Khazanah disposing of a 5% stake in Telekom Malaysia at RM3.23/share, Public Bank and Digi reported quarterly earnings that were in line with expectations, the Selangor government has disputed claims by the Federal Government of a state-wide water shortage by 2014 if the Pahang- Selangor water transfer project was not up and running by then, Silver Bird to undertake a proposed private placement of up to 19.5m new shares, Axis REIT plans to raise RM132m next month as part of its capital management plans and MISC has proposed to acquire four new vessels for RM1.4bn. Overnight, the Dow closed 0.74% higher on optimism of stronger than expected home building leading indicators. We expect our market to remain range bound today given the lack of fresh leads.

Pantulan teknikal Bursa ditutup kukuh

KUALA LUMPUR 20 Julai - Pantulan teknikal menyaksikan harga-harga

saham ditutup tinggi hari ini, disokong oleh faktor luaran, termasuk

pemulihan Wall Street. Pada 5 petang, Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur

ditutup 4.32 mata lebih tinggi pada 1,337.67, selepas dibuka 1.18 mata

lebih tinggi pada 1,334.532, dengan minat berterusan bertumpu terhadap

saham berwajaran tinggi dan saham berharga rendah terpilih. Seorang penganalisis berkata Wall Street mencatat pantulan teknikal

susulan peningkatan semalam Dow Jones Industrial Index sebanyak 56.53

mata. Indeks FBM Emas meningkat 29.85 mata kepada 9,070.59, Indeks FBM Ace

menokok 33.21 mata kepada 3,776.62 manakala Indeks FBM70 meningkat 14.64

mata kepada 9,111.54. Indeks Kewangan meningkat 34.76 mata kepada 12,120.57, Indeks

Perusahaan menambah 8.97 mata kepada 2,652.79 manakala Indeks

Perladangan melonjak 42.04 mata kepada 6,297.09. Kaunter untung mengatasi kaunter rugi sebanyak 466 berbanding 278

manakala 250 kaunter tidak berubah, 371 tidak diniagakan dan 23 yang

lain digantung. Jumlah dagangan meningkat kepada 1.126 bilion saham bernilai RM1.321

bilion berbanding 848.631 juta saham bernilai RM1.330 bilion, yang dicatatkan semalam. Antara saham aktif, SAAG rugi setengah sen kepada 7.5 sen, Talam

menokok 1.5 sen kepada 12 sen manakala Time DotCom susut 2.5 sen kepada

56.5 sen. Saham berwajaran tinggi, Maybank susut dua sen kepada RM7.67,

CIMB menambah tiga sen kepada RM7.14 dan Sime Darby susut satu sen kepada RM7.74. Jumlah dagangan di Pasaran Utama melonjak kepada 1.015 bilion saham

bernilai RM1.292 bilion, berbanding 770.898 juta saham bernilai RM1.316

bilion, yang direkodkan pada Isnin. Perolahan dagangan di Pasaran ACE meningkat kepada 74.536 juta unit,

bernilai RM21.572 juta berbanding 36.312 juta unit pada Isnin bernilai

RM4.567 juta.Waran bagaimanapun susut kepada 30.565 juta saham bernilai

RM4.532 juta berbanding 36.601 juta saham bernilai RM6.513 juta yang

dicatatkan sebelumnya. Barangan pengguna menyumbang sebanyak 81.543 juta saham yang

diniagakan di Pasaran Utama, barangan perusahaan 217.385 juta, pembinaan

79.662 juta, perdagangan dan perkhidmatan 315.863 juta, teknologi

28.200 juta, infrastruktur 50.949 juta, kewangan 45.201 juta, hotel

3.699 juta, hartanah 164.025 juta, perladangan 14.475 juta, perlombongan

12,000, REIT 14.311 juta dan dana tertutup 145,900. - Bernama

Tuesday, July 20, 2010

Technical View 20 July 2010

We thought that the FBM KLCI would have gapped down at least 10 pts at the opening bell yesterday after the DJIA sank by 261.49 pts last Friday. The index had previously been on a seven-day winning stretch over the last two weeks, gaining 47.6 pts in the process. We had expected the retracement to be much sharper than the 3.3 pt-loss. Even the futures index was down only marginally by 0.5 pts. All we can say is that there were no major signs of panic selling yesterday, not even during the first hour of trading. Genting, IJM and IOI succumbed to strong selling pressure in the morning although the momentum was not aggressive. In contrast, there were a few notable gainers in the top-volume list. The Shanghai Composite Index, which rebounded more than 2% yesterday, could have helped support regional market sentiment.

Another point to note is that while the DJIA is obviously trending down within a broad downtrend channel and the index is already 10% off the 2009-2010 rally, the FBM KLCI is indeed only 20 pts away from breaking out from the 2009-2010 rally peak. To our best memory, this is the first time that we saw such resilient performance from the FBM KLCI over at least the last 8 years.

Meanwhile, we maintain our near-term bearish bias view and continue to monitor how the index will consolidate the strong rebound from the recent low of 1,294.37 pts. As we mentioned before, while the FBM KLCI is trading some 20 pts below the peak of the 2009-2010 rally, the DJIA is obviously still trending down within a broad downtrend channel. From the current level, there is a tough resistance at the 1,350 pt-level. Immediate support is still situated at the 1,332 pt-level, followed by the 1,326 pt-level.

Another point to note is that while the DJIA is obviously trending down within a broad downtrend channel and the index is already 10% off the 2009-2010 rally, the FBM KLCI is indeed only 20 pts away from breaking out from the 2009-2010 rally peak. To our best memory, this is the first time that we saw such resilient performance from the FBM KLCI over at least the last 8 years.

Meanwhile, we maintain our near-term bearish bias view and continue to monitor how the index will consolidate the strong rebound from the recent low of 1,294.37 pts. As we mentioned before, while the FBM KLCI is trading some 20 pts below the peak of the 2009-2010 rally, the DJIA is obviously still trending down within a broad downtrend channel. From the current level, there is a tough resistance at the 1,350 pt-level. Immediate support is still situated at the 1,332 pt-level, followed by the 1,326 pt-level.

Market Review

Drifting. The FBM KLCI closed more than 3 points lower at the start of the new week, with market sentiment weighed down by plantation counters and Tenaga Nasional. The number of gainers and losers were about even, with investors mostly taking the cue from external developments. Today’s key headlines are: (i) Help proposing a 3-for-5 bonus issue; (ii) Axiata selling its 89% stake in Multinet, Pakistan for USD15m; and (iii) MAS is in a RM2.2bn engine deal with Pratt & Whitney. The Dow closed marginally higher overnight as optimism on corporate earnings overshadowed a slump in homebuilder confidence. We expect the market to continue on its range bound trading today in the absence of notable leads.

Bursa bercampur-campur di akhir dagangan

KUALA LUMPUR 19 Julai - Harga di Bursa Malaysia ditutup

bercampur-campur hari ini berikutan sokongan belian lewat bagi saham

wajaran tinggi seperti Genting, BAT dan Digi.Com saham, kata para peniaga. Indeks Komposit Kuala Lumpur FTSE Bursa Malaysia ditutup 3.30 mata

lebih rendah pada 1,333.35 selepas turun naik dalam kawasan negatif

sepanjang hari. Seorang peniaga berkata pasaran Wall Street yang lemah, jatuh 261.41

mata kepada 10,097.90 pada Jumaat, mempengaruhi sentimen tempatan.

Indeks S&P 500 susut 31.60 mata kepada 1064.88 dan Nasdaq Komposit

berkurangan 70.03 mata kepada 2179.05 pada Jumaat. Indeks FBM Emas susut

7.69 mata kepada 9,040.74 dan Indeks FBM Ace berkurangan 21.20 mata

kepada 3,743.41. Sementara itu, FBM70 meningkat 11.40 mata kepada 9,096.90.Indeks

Kewangan susut 14.80 mata kepada 12,085.81, Indeks Perusahaan turun

11.21 mata kepada 2,643.82 dan Indeks Perladangan berkurangan 34.45 mata

kepada 6,255.05. Kaunter untung mengatasi kauntung rugi sebanyak 327 berbanding 324

manakala 269 kaunter tidak berubah, 447 tidak diniagakan dan 27 yang

lain digantung. Jumlah dagangan meningkat kepada 848.631 juta saham, bernilai RM1.330

bilion daripada 793.61 juta saham bernilai RM1.196 bilion, yang

dicatatkan pada Jumaat lepas. Di kalangan kaunter cergas, Titan Chemicals naik 34 sen kepada

RM2.19, Time Engineering menokok dua sen kepada 47.5 sen manakala Time

DotCom menambah 4.5 sen kepada 59 sen. Jumlah dagangan Pasaran Utama meningkat kepada 770.898 juta saham

bernilai RM1.316 bilion, daripada 702.001 juta saham bernilai RM1.177

bilion, yang dicatatkan pada Jumaat minggu lepas. Perolehan dagangan di Pasaran ACE menokok kepada 36.312 juta unit

bernilai RM4.567 juta daripada 30.809 juta unit bernilai RM4.143 juta.Bagaimanapun, waran turun kepada 36.601 juta saham bernilai RM6.513

juta daripada 54.518 juta saham bernilai RM10.01 juta pada Jumaat

minggu lepas. Barangan pengguna menyumbang 45.441 juta saham yang diniagakan di

Pasaran Utama, barangan perusahaan 188.927 juta, pembinaan 65.149 juta,

perdagangan dan perkhidmatan 222.454 juta, teknologi 29.383 juta,

prasarana 39.920 juta, kewangan 66.824 juta, hotel 380,200, harta 90.140

juta, perladangan 10.872 juta, perlombongan 41,700, REITs 11.199 juta

dan dana tertutup 162,700.- Bernama

Monday, July 19, 2010

Technical View 19 July 2010

Although the FBM KLCI was stuck in a very tight range last Friday, the key index spent almost the whole session above the flat-line. Despite the index’s lackluster performance, the overall market sentiment was actually very positive. Notable strong gainers were spotted in the top gainer list.

Meanwhile, we maintain our near-term bearish bias view. We will continue to monitor how the index will consolidate the strong rebound from the recent low of 1,294.37 pts. As we mentioned before, while the FBM KLCI is now trading about 15 pts below the peak of the 2009-2010 rally, the DJIA is obviously still trending downwards within a broad downtrend channel.

From the current level, there is tough resistance at the 1,350 pt-level. Immediate support is now seen at the 1,332 pt-level, followed by the 1,326 pt-level.

Meanwhile, we maintain our near-term bearish bias view. We will continue to monitor how the index will consolidate the strong rebound from the recent low of 1,294.37 pts. As we mentioned before, while the FBM KLCI is now trading about 15 pts below the peak of the 2009-2010 rally, the DJIA is obviously still trending downwards within a broad downtrend channel.

From the current level, there is tough resistance at the 1,350 pt-level. Immediate support is now seen at the 1,332 pt-level, followed by the 1,326 pt-level.

Market Review

Finishing higher. The FBM KLCI rose 2.57 points to close at 1,336.65 supported by mild bargain hunting. Maxis Bhd plans to increase its household penetration in the East Coast to 80% by adding 50% more transmission sites, South Korea’s Honam Petrochemical has acquired a 72.3% stake in Titan Chemical for RM2.35 a share and will launch a MGO for the remaining shares in Titan while Bina Puri-UEMC JV has been appointed the main contractor for the construction of the new permanent LCCT complex at KLIA for a total contract value of RM997.2m and Signaland SB has extended an MGO to acquire all the ordinary shares in Southern Steel for RM2.05 per share. Finally, both the US markets and crude oil price fell on Friday as Bank of America and General Electric’s results missed estimates. Crude oil price was lower by USD0.61 at USD76.01/barrel.

Harga Saham Dijangka Tinggi

KUALA LUMPUR 18 Julai - Harga saham di Bursa Malaysia dijangka

meningkat minggu depan berikutan rasa optimis pelabur terhadap bursa

tempatan, ditambah pula data korporat yang positif serta inisiatif

kerajaan untuk merancakkan ekonomi, kata para peniaga. Ketua Penyelidikan MIMB Investment Bank Bhd. Chan Ken Yew berkata,

pada masa ini, tersebar banyak berita mengenai penswastaan yang

memastikan kadar faedah positif. Katanya, minat pelabur dijangka tertumpu kepada sektor makanan dan

minuman serta sektor peruncitan. "Pada minggu depan, minat dijangka akan terhad kepada kaunter

bermodal kecil dan sederhana. Kita akan turut melihat kepada pelaburan

pusingan," katanya kepada Bernama. Ken Yew berkata, kaunter yang dipacu pengguna kemungkinan menjadi

sumber pertumbuhan. "Malaysia kini menjadi ekonomi yang dipacu penggunaan awam. Kini, ia

mencatatkan kira-kira 33 peratus daripada keluaran dalam negara kasar.

Kita juga mempunyai penduduk yang masih muda yang kemungkinan menjadi

pengguna," katanya. Mengenai faktor luaran, katanya kesan secara langsung terhadap negara

ini dijangka minimum kerana Bursa Malaysia agak berdaya tahan

berbanding dengan bursa serantau yang lain. Beliau menjangka tahap sokongan pada minggu depan dijangka pada paras

1,300 dan paras halangan pada paras 1,350. Ken Yew berkata, langkah kerajaan mengurangkan subsidi secara

berperingkat-peringkat kemungkinan menambah baik ekonomi negara ini di

masa depan. Pada Khamis, kerajaan telah mengurangkan subsidi petrol, diesel, gas

petroleum cecair dan gula sebagai sebahagian daripada strateginya untuk

menghapuskan subsidi secara berperingkat-peringkat. Bagi minggu baru berakhir, FBM KLCI meningkat 2.57 mata kepada

1,336.65. Berasaskan Jumaat ke Jumaat, FBM KLCI meningkat 12.34 mata kepada

1,336.65 berbanding dengan 1,324.31 sebelum ini. Indeks FBM Emas melonjak 117.55 mata kepada 9,048.43, FBM70 menokok

157.23 mata kepada 9,085.5 dan Indeks FBM Ace meningkat 2.88 mata kepada

3,764.61. Indeks Kewangan meningkat 148.94 mata kepada 12,100.61, Indeks

Perladangan meningkat 15.56 mata kepada 6,289.50 dan Indeks Perusahaan

meningkat 21.18 mata kepada 2,655.03. Jumlah dagangan bagi minggu ini meningkat kepada 3.40 bilion saham

bernilai RM5.94 bilion daripada 2.81 bilion saham bernilai RM5.02 bilion

pada minggu lepas. Jumlah dagangan di Pasaran Utama meningkat kepada 3.10 bilion unit

bernilai RM5.88 bilion daripada 2.50 bilion unit bernilai RM4.96 bilion

sebelum ini. Jumlah dagangan Pasaran ACE merosot kepada 143.06 juta saham bernilai

RM19.08 juta daripada 207.64 juta saham bernilai RM37.02 juta pada

Jumaat lepas. Waran melonjak kepada 131.56 juta unit bernilai RM21.99 juta daripada

83.08 juta unit bernilai RM9.95 juta sebelum ini. -Bernama

Sunday, July 18, 2010

Jadilah Perunding Unit Amanah bersama PUABUMI

Persatuan Perunding Unit Amanah Bumiputera Malaysia (PUABUMI)

mewakili hampir semua fund mgrs di Malaysia spt CIMB, TA, OSK-UOB, Ing, Prudential, Hwang DBS, Affin, CMS, Amanah Raya, Alliance, ASMInvestment, ecmlibra, Interpacific, KAF, PHEIM, RHB dan lain2...

Mempunyai wakil dan seminar tetap di Melaka, KT, KK, Kuching, Sibu, KL, Ipoh, JB, Sg Petani, Kuantan, Kota Bharu

hubungi... Razali Mohamad (019-2009622)

mewakili hampir semua fund mgrs di Malaysia spt CIMB, TA, OSK-UOB, Ing, Prudential, Hwang DBS, Affin, CMS, Amanah Raya, Alliance, ASMInvestment, ecmlibra, Interpacific, KAF, PHEIM, RHB dan lain2...

Mempunyai wakil dan seminar tetap di Melaka, KT, KK, Kuching, Sibu, KL, Ipoh, JB, Sg Petani, Kuantan, Kota Bharu

hubungi... Razali Mohamad (019-2009622)

Friday, July 16, 2010

Technical View 16 July 2010

The FBM KLCI pierced through the previous peak of 1,335 pts two days ago but retreated to below it yesterday as the key index ended its 7 consecutive days of advances. As we mentioned before, the rally from the recent low of 1,294.37 pts had been over-stretched and the market finally took a breather yesterday.

Yesterday’s market action proves that it was indeed a tricky violation of the previous peak at the 1,335 pt-level because the breakout happened after the key index recorded 7 consecutive days of gains Hence, the violation of the previous peak has not been confirmed and we maintain our bearish view towards the near-term market. We will see how the FBM KLCI will continue to consolidate its massive gains over the 7 following yesterday’s retracement.

From the current level, the 1,335 pt-level is the immediate resistance and there is tough resistance at the 1,350 pt-level. Immediate support is now seen at the 1,332 pt-level, followed by the 1,326 ptlevel.

Yesterday’s market action proves that it was indeed a tricky violation of the previous peak at the 1,335 pt-level because the breakout happened after the key index recorded 7 consecutive days of gains Hence, the violation of the previous peak has not been confirmed and we maintain our bearish view towards the near-term market. We will see how the FBM KLCI will continue to consolidate its massive gains over the 7 following yesterday’s retracement.

From the current level, the 1,335 pt-level is the immediate resistance and there is tough resistance at the 1,350 pt-level. Immediate support is now seen at the 1,332 pt-level, followed by the 1,326 ptlevel.

Market Review

Regional drag. Profit-taking set in yesterday, dragging the FBM KLCI down by 7 points to 1334 points, led by Tanjong, Genting, CIMB and YTL. Regional markets were also weaker, with the Nikkei and the Hang Seng Index losing 1.1% and 1.5% respectively while the Shanghai Composite lost 1.9%. Today’s news headlines are China's GDP grew by 11.1% in 1H this year, the Malaysian Government cuts subsidy on fuel, cooking gas and sugar, Datuk Mohd Bakke Salleh is appointed Sime Darby's CEO with immediate effect while Datuk Sabri Ahmad takes over as Felda Holding's MD. The US market clawed back and ended flat last night after losing more than 100 points in early trading while European bourses were in pullback mode. Should the FBM KLCI weaken further and break its immediate support level at 1332 points, the next support is seen at 1326 points.

Pembetulan teknikal Bursa tinggi

KUALA LUMPUR 15 Julai - Harga saham di Bursa Malaysia lebih rendah

pada akhir dagangan hari ini kerana pembetulan teknikal berikutan

kenaikan dalam tujuh hari berturut-turut dari minggu lepas, kata

peniaga.

Pada akhir sesi petang, Indeks Komposit Kuala Lumpur FTSE Bursa

Malaysia (FBM KLCI) turun tujuh mata atau 0.522 peratus kepada 1,334.08,

diseret turun oleh kejatuhan di kaunter-kaunter berwajaran tinggi

seperti Genting Malaysia dan CIMB Group. Indeks utama itu dibuka 1.5 mata lebih rendah pada 1,339.58 pagi tadi

berbanding 1,341.08 pada penutupan semalam. Sepanjang hari ini, ia

bergerak di antara 1,331.2 dengan 1,340.11. Pada penutupan dagangan hari ini, Indeks Perusahaan susut 3.79 mata

kepada 2,659.48, Indeks Perladangan turun 20.87 mata kepada 6,299.38 dan

Indeks Kewangan jatuh 42.91 mata kepada 12,048.68. Indeks FBM Emas merosot 33.649 mata kepada 9,019.41, Indeks FBM70

menokok 7.94 mata kepada 9,061.79 dan Indeks FBM Ace susut 19.12 mata

kepada 3,766.32. Saham rugi mengatasi saham untung dengan jumlah 391 berbanding 241

manakala 289 kaunter tidak berubah, 443 tidak diniagakan dan 28 yang

lain digantung urus niaga. Jumlah dagangan mengecil kepada 619.65 juta saham bernilai RM1.128

bilion daripada 801.666 juta saham bernilai RM1.538 bilion pada

penutupan semalam.Antara saham cergas, Time Dotcom kekal pada 52 sen, Xidelang menambah

1.5 sen kepada 44.5 sen dan Titan Chemicals naik tujuh sen kepada

RM1.85, Maybank dan Maxis turun dua sen setiap satu, kepada RM7.69 dan

RM5.30. Jumlah dagangan Pasaran Utama mengecil kepada 576.92 juta saham

bernilai RM1.121 bilion daripada 734.274 juta saham bernilai RM1.525

bilion semalam. Pasaran Ace menyaksikan perolehan dagangan berkurangan kepada 20.992

juta unit bernilai RM2.764 juta daripada 38.222 juta unit bernilai

RM5.312 juta sebelumnya.Waran susut kepada 19.406 juta saham bernilai

RM2.481 juta daripada 24.446 juta saham bernilai RM4.041 juta semalam. Barangan pengguna menguasai 65.831 juta saham yang diniagakan di

Papan Utama, barangan perusahaan 119.538 juta, pembinaan 74.28 juta,

perdagangan dan perkhidmatan 143.004 juta, teknologi 11.609 juta,

prasarana 53.473 juta, kewangan 48.014 juta, hotel 472,400, harta 38.538

juta, perladangan 12.246 juta, perlombongan tiada, REIT 9.87 juta, dan

dana tertutup 45,600.- Bernama

Thursday, July 15, 2010

Technical View 15 July 2010

The FBM KLCI successfully cracked above the previous peak of 1,335 pts yesterday after a 7-day winning streak. The market may actually return back above the previous major breakdown level and is now only about 10 pts below the peak of the 2009-2010 rally.

As the daily chart is now indeed painting a very positive technical landscape after returning back above the previous major breakdown point, we should have dropped our near-term bearish view by now. However, we are sticking to our bearish view for a while because of the tricky violation of the previous peak at the 1,335 pt-level. This is because the breakout happened after the key index recorded 7 consecutive days of gains. The rally from the recent low of 1,294.37 pts is already overextended. The FBM KLCI should be consolidating very soon and we will see how the market will consolidate before altering our bearish view. Moreover, the DJIA is still trending lower within a broad downtrend channel despite its 7 consecutive days of advances.

From the current level, there is tough resistance at the 1,350 pt-level. Immediate support is now seen at the 1,332-1,336 pt-area, followed by the 1,326 pt-level.

As the daily chart is now indeed painting a very positive technical landscape after returning back above the previous major breakdown point, we should have dropped our near-term bearish view by now. However, we are sticking to our bearish view for a while because of the tricky violation of the previous peak at the 1,335 pt-level. This is because the breakout happened after the key index recorded 7 consecutive days of gains. The rally from the recent low of 1,294.37 pts is already overextended. The FBM KLCI should be consolidating very soon and we will see how the market will consolidate before altering our bearish view. Moreover, the DJIA is still trending lower within a broad downtrend channel despite its 7 consecutive days of advances.

From the current level, there is tough resistance at the 1,350 pt-level. Immediate support is now seen at the 1,332-1,336 pt-area, followed by the 1,326 pt-level.

Market Review

Follow through buying. The FBM KLCI closed 8.21 points higher at 1,341.08, boosted by gains from Sime, Tenaga and Maybank. Volume also surged to 801.7m shares from 574.3m shares the previous day. Today’s corporate news are: Gamuda and MMC JV plans to bid for RM14bn of tunnelling works for the proposed MRT if the project is approved by the Government, Tenaga reported strong 3QFY10 results, boosted by forex translation gains and stronger electricity demand, while UMW plans to assemble the Toyota Camry locally by 2012. Overnight, the Dow Jones closed marginally higher as the Federal Reserves’ latest revised GDP forecast of 3.0 to 3.5% was less downbeat than initially expected.

Bursa teguh di akhir dagangan

KUALA LUMPUR 14 Julai - Bursa Malaysia mengakhiri dagangan pada paras

lebih teguh keseluruhannya hari ini, didorong oleh minat belian kerana

pelabur-pelabur menjangkakan beberapa keputusan korporat yang baik mulai

hari ini, kata peniaga.Indeks Komposit Kuala Lumpur FTSE Bursa Malaysia (FBMKLCI) naik 8.21

mata kepada 1,341.08, dengan dibantu oleh peningkatan, kebanyakannya di

tiga kaunter berwajaran tinggi utama iaitu Sime Darby, Tenaga dan

Maybank. FBMKLCI dibuka 3.78 mata lebih tinggi pada 1,336.65 berbanding paras

penutupan 1,332.87 semalam. Indeks Perusahaan mengukuh 17.53 mata kepada 2,663.27, Indeks

Perladangan meningkat 21.32 mata kepada 6,320.25 dan Indeks Kewangan

melonjak 80.04 mata kepada 12,091.59. Indeks FBM Emas naik 61.55 mata kepada 9,053.06, Indeks FBM70 menambah 61.47 mata kepada 9,053.85 dan Indeks FBM Ace menokok 16.8 mata

kepada 3,785.44. Saham untung mengatasi saham rugi dengan jumlah 506 berbanding 194

manakala 269 kaunter tidak berubah, 395 tidak diniagakan dan 23 yang

lain digantung urus niaga. Jumlah dagangan melonjak kepada 801.666 juta saham bernilai RM1.538

bilion daripada 574.317 juta saham bernilai RM1.085 bilion sebelumnya. Bagi saham berwajaran tinggi, Maybank naik tujuh sen kepada RM7.71

dan Sime Darby mengukuh 13 sen kepada RM7.87.CIMB Group kekal pada

RM7.13. Tenaga, yang mencatatkan keuntungan sebelum cukai sebanyak RM1.286 bilion bagi suku ketiga berakhir 31 Mei, 2010 daripada RM1.240

bilion dalam suku yang sama tahun lepas, naik 13 sen kepada RM8.61. Jumlah dagangan Pasaran Utama melonjak kepada 734.274 juta saham

bernilai RM1.525 bilion daripada 526.876 juta saham bernilai RM1.075

bilion semalam. Pasaran ACE perolehan dagangan bertambah kepada 38.222 juta unit

bernilai RM5.312 juta daripada 24.982 juta unit bernilai RM3.251 juta

semalam.Jumlah waran meningkat kepada 24.446 juta saham bernilai RM4.041

juta daripada 17.255 juta saham bernilai RM2.806 juta sebelumnya. Barangan pengguna menyumbang 80.008 juta saham yang diniagakan dalam

Pasaran Utama, barangan perusahaan 136.093 juta, pembinaan 82.817 juta,

perdagangan dan perkhidmatan 232.093 juta, teknologi 26.984 juta,

prasarana 30.67 juta, kewangan 68.789 juta, hotel 586,700, harta 45.116

juta, perladangan 10.868 juta, perlombongan 2,000, REIT 20.222 juta dan dana tertutup 25,000. - Bernama

Wednesday, July 14, 2010

Technical View 14 July 2010

The palm oil futures market completed the massive “Double Peak” structure by violating the “Neckline” support last month. As it took about 6 months to complete the “Double Peak”, the accuracy of this bearish reversal signal should be rather high.

We maintain our firmly bearish bias view on the near-term technical outlook of the palm oil futures market. We can see from the above daily chart that the price has been slowly trending lower since the “Double Peak” was created.

From the current level, there is a very tough resistance at the “Neckline” situated at the RM2,393 / tonne level, followed by the RM2,400 / tonne psychological level. To the downside, we are eyeing the recent low of M2,270 / tonne level as the immediate support. Technically, the rebound from the recent-low is due to the support provided by an “Upside Window” created in November 2009. Next support is seen at the RM2,215 / tonne level.

We maintain our firmly bearish bias view on the near-term technical outlook of the palm oil futures market. We can see from the above daily chart that the price has been slowly trending lower since the “Double Peak” was created.

From the current level, there is a very tough resistance at the “Neckline” situated at the RM2,393 / tonne level, followed by the RM2,400 / tonne psychological level. To the downside, we are eyeing the recent low of M2,270 / tonne level as the immediate support. Technically, the rebound from the recent-low is due to the support provided by an “Upside Window” created in November 2009. Next support is seen at the RM2,215 / tonne level.

Market Review

Overseas boost. The FBM KLCI gained 6 points to 1332.87 points, boosted by Digi, RHB Cap, HL Bank, Genting and Genting Malaysia. Volume, however, remained thin at 572m shares, with gainers and losers quite evenly matched. Today’s corporate news include M.Mosaic to be taken private at RM2.30 per share cash and LBS Bina will launch its long-delayed Zhuhai project worth RM5bn next year. With Europe and the US benchmarks closing 1% to 2% higher overnight, Malaysian stocks are likely to continue to inch up today. Immediate resistance is expected some 17 points above the current level at 1350 points.

Belian saat akhir rangsang Bursa kukuh

KUALA LUMPUR 13 Julai - Harga saham di Bursa Malaysia ditutup tinggi

hari ini dengan Indeks Komposit Kuala Lumpur FTSE Bursa Malaysia

(FBMKLCI) ditutup pada paras tertingginya bagi hari ini pada 1,332.87,

kata para peniaga. Belian saat-saat akhir di kaunter terpilih seperti Plus Expressways

berjaya melonjakkan indek utama itu 6.13 mata daripada paras 1,326.74

semalam.Pengendali lebuh raya itu ditutup 10 sen lebih tinggi pada

RM3.58. Sepanjang hari dagangan, indeks utama bergerak antara 1,328.71 dan 1,332.87. FBMKLCI dibuka 3.13 mata lebih tinggi pada 1,329.87. Sementara itu, Indeks Perusahaan naik 4.56 mata kepada 2,645.74,

Indeks Perladangan meningkat 21.72 mata kepada 6,298.93 dan Indeks Kewangan menokok 36.03 mata kepada 12,011.55. Indeks FBM Emas naik 35.88 mata kepada 8,991.51, Indeks FBM70

meningkat 27.11 mata kepada 8,992.38 manakala Indeks FBM Ace menambah

27.58 mata kepada 3,768.64. Kaunter untung mengatasi kaunter rugi sebanyak 363 berbanding 283

manakala 290 kaunter tidak berubah, 426 tidak diniagakan dan 24 yang

lain digantung. Urus niagah dagangan berkurangan kepada 574.317 juta saham bernilai

RM1.085 bilion daripada 610.64 juta saham bernilai RM990.825 juta semalam.Jumlah dagangan Pasaran Utama turun kepada 526.876 juta saham

bernilai RM1.075 bilion daripada 561.415 juta saham bernilai RM980.46

juta semalam. Perolehan dagangan di Pasaran ACE berkurangan kepada 24.982 juta unit

bernilai RM3.251 juta daripada 28.059 juta saham bernilai RM3.611 juta

sebelumnya.Bagaimanapun, waran naik kepada 17.255 juta unit bernilai

RM2.806 juta daripada 15.934 juta unit bernilai RM2.647 juta sebelumnya. Di kalangan saham cergas, Scomi Marine menokok enam sen kepada 49

sen, Kenmark Industrial turun 2.5 sen kepada enam sen dan Axiata Group

menambah satu sen kepada RM4.13. Kaunter untung utama, Digi.Com naik 50 sen kepada RM23.48, KFC

Holdings meningkat 32 sen kepada RM10.62 dan United Plantations menokok

30 sen kepada RM14.30. Barangan pengguna menyumbang 75.496 juta saham yang diniagakan di

Pasaran Utama, barangan perusahaan 94.335 juta, pembinaan 42.132 juta,

perdagangan dan perkhidmatan 191.487 juta, teknologi 17.378 juta,

prasarana 15.401 juta, kewangan 37.72 juta, hotel 1.814 juta, harta

31.919 juta, perladangan 13.404 juta, perlombongan 23,500, REITs 5.75

juta dan dana tertutup 17,000. - Bernama

Tuesday, July 13, 2010

Technical View 13 July 2010

Last week, we highlighted the three shrinking white candlesticks that appeared prior to last Friday’s session. The key index’s 8.28-pt gain last Friday has written off the possibility that the rebound starting from the 1,294.37 pt-low could be losing momentum. Yesterday, the FBM KLCI continued to pick up another 2.43 pts. The index’s performance has basically been in line with the strong rebound experienced by the US market over the last four trading days.

Meanwhile, there is no change on our near-term bearish view on the FBM KLCI. The DJIA is obviously still trending downwards within a broad downtrend channel despite the massive gains recorded over the last five sessions. Moreover, the FBM KLCI is still trading at below the recent peak recorded in June.

From the current level, there is immediate resistance at the 1,330 pt-level, followed by the 1,350 ptlevel. Immediate support is seen at the 1,316 pt-level, followed by the 1,307 pt-level.

Meanwhile, there is no change on our near-term bearish view on the FBM KLCI. The DJIA is obviously still trending downwards within a broad downtrend channel despite the massive gains recorded over the last five sessions. Moreover, the FBM KLCI is still trading at below the recent peak recorded in June.

From the current level, there is immediate resistance at the 1,330 pt-level, followed by the 1,350 ptlevel. Immediate support is seen at the 1,316 pt-level, followed by the 1,307 pt-level.

Market Review

External leads. The market kept its composure to close 2 points higher yesterday despite a slow start in the morning. Overall market breadth was positive, with buying interest centered on financial, consumer and telco related stocks. Among the key headlines for today: (i) MMC inked a second supplemental gas supply agreement with Petronas; and (iii) TNB is spending RM120m to replace its ageing fleet of vehicles. In the absence of fresh domestic leads, the local bourse will continue to track external developments. Overnight, Wall Street greeted the start of the earnings on a positive note with better results from Alcoa on stronger aluminium prices.

Ringgit ditutup rendah

KUALA LUMPUR 12 Julai - Ringgit ditutup rendah berbanding dolar

Amerika Syarikat (US) hari ini apabila peniaga mata wang terus

mengurangkan kedudukan berikutan dolar yang lebih kukuh, kata peniaga.

Pada 5 petang, ringgit ditutup pada 3.2030/2070 berbanding dolar US,

susut daripada 3.1970/1000 pada penutup Jumaat. "Dolar mengukuh secara menyeluruh, pulih daripada kejatuhan

berbanding sekumpulan mata wang minggu lepas," kata seorang

peniaga.Beliau berkata kebimbangan berterusan mengenai ujian stres ke atas 91 bank Eropah, turut menyumbang kepada penurunan ringgit. Euro susut berbanding dollar US hari ini, susut daripada paras

tertinggi dalam tempoh dua bulan, susulan kebimbangan mengenai

keberkesanan ujian stres ke atas bank-bank Eropah yang menyebabkan

pelabur mengurangkan kedudukan ke atas mata wang tunggal Eropah itu. Pada penutup hari ini, ringgit tinggi berbanding mata wang utama yang

lain.Ia mengukuh berbanding dollar Singapura kepada 2.3141/3190

daripada 2.3163/3204 Jumaat lepas serta berbanding yen Jepun pada

3.6086/6143 berbanding 3.6153/6195 sebelumnya. Ringgit juga diniagakan tinggi berbanding pound British pada

4.7894/7961 berbanding 4.8575/8624 Jumaat lepas selain euro pada

4.0242/0315 berbanding 4.0520/0566 sebelumnya. - Bernama

Friday, July 9, 2010

Technical View 09 July 2010

Overnight, the DJIA rebounded strongly for another day after the IMF raised its world GDP forecast from 4.2% to 4.6%. The rebound experienced in the US market over the last three trading days is not unexpected as the DJIA had closed lower in nine out of 10 sessions previously. The US market’s rebound led to FBM KLCI exhibiting similar market action.

Anyhow, the DJIA is still obviously channeling downward and it is the same for the FBM KLCI. We still maintain our bearish stance on the near-term technical outlook of the FBM KLCI after the index violated the short-term uptrend line. The immediate trend is obviously still down after the market created the “Bearish Harami”. Also, do not forget that the benchmark index made three failed attempts to break above the 1,350 pt-level, which led to it breaking below the critical “Neckline” support.

Today, we will see how the benchmark index reacts to the DJIA’s 120.71-pt rebound. The FBM KLCI’s performance yesterday was still lackluster even though the DJIA put on a hefty 274.66 pts on Wednesday. Another point worth noting is although the FBM KLCI has been trending higher over the past three sessions, the three white candlesticks are actually shrinking, which could be signaling that the rebound might be losing steam. Anyhow, we should be able to tell if the momentum is indeed slowing down after today’s session.

From the current level, the 1,298-1,303 pt-area is the immediate support while next support is seen at the 200-day MAV line, which now lies at the 1,284 pt-level. To the upside, immediate resistance still lies at 1,318 pt-level, followed by the 1,330 pt-level.

Anyhow, the DJIA is still obviously channeling downward and it is the same for the FBM KLCI. We still maintain our bearish stance on the near-term technical outlook of the FBM KLCI after the index violated the short-term uptrend line. The immediate trend is obviously still down after the market created the “Bearish Harami”. Also, do not forget that the benchmark index made three failed attempts to break above the 1,350 pt-level, which led to it breaking below the critical “Neckline” support.

Today, we will see how the benchmark index reacts to the DJIA’s 120.71-pt rebound. The FBM KLCI’s performance yesterday was still lackluster even though the DJIA put on a hefty 274.66 pts on Wednesday. Another point worth noting is although the FBM KLCI has been trending higher over the past three sessions, the three white candlesticks are actually shrinking, which could be signaling that the rebound might be losing steam. Anyhow, we should be able to tell if the momentum is indeed slowing down after today’s session.

From the current level, the 1,298-1,303 pt-area is the immediate support while next support is seen at the 200-day MAV line, which now lies at the 1,284 pt-level. To the upside, immediate resistance still lies at 1,318 pt-level, followed by the 1,330 pt-level.

Market Review

Boost from Wall Street. FBM KLCI rose 4.28 pts to 1,316.03 as investors took the cue from the strong uptrend on Wall Street. Gainers outnumbered losers by 365 to 242 while 275 counters remained unchanged, 478 untraded and 23 others suspended. Today’s key market news are BNM raised the OPR for the third time this year to 2.75%, May IPI rises 12.5%, Fitch keeps Malaysia's foreign debt rating with a stable outlook, KNM secures overseas contracts worth RM289m, Khazanah extends offer for Parkway Bandar Raya will buy Limitless’ 60% stake in Haute Property SB for RM76m and assumed debt, Iris signs 3 pacts with Senegal and there is a potential RM1.5bn investment from Middle East in a petroleum tank farm and halal industrial park at Penang Port. Overnight, the DJIA advanced 120.71 pts to 10,139.0 as a drop in jobless claims and higher- than-forecast sales of some retailers bolstered confidence in the economic recovery. As such, we expect the positive sentiment to rub off on the local bourse today.

Bursa kukuh seiring pasaran Wall Street

KUALA LUMPUR 8 Julai - Harga-harga saham di Bursa Malaysia ditutup

tinggi sedikit hari ini dengan para pelabur mengambil petunjuk daripada

trend menaik yang kukuh dalam prestasi semalaman Wall Street, kata para

peniaga. Pada pukul 5 petang, Indeks Komposit FTSE Bursa Malaysia (FBM) Kuala

Lumpur yang dibuka 2.87 mata lebih tinggi pada 1,314.62, naik 4.28 mata

kepada 1,316.03 berbanding penutup semalam iaitu 1,311.75.Para peniaga berkata indeks utama dirangsang oleh perolehan yang

dicatatkan oleh konglomerat Sime Darby sebanyak lapan sen kepada RM7.72

dan CIMB lima sen kepada RM7.05. Di pasaran tempatan, terdapat banyak lagi ruang untuk keyakinan

pasaran dan paras sokongan untuk indeks utama ialah pada 1,300 dan

halangan 1,320, kata peniaga itu. Indeks Perusahaan menokok 12.02 mata kepada 2,601.27, Indeks

Perladangan menambah 3.47 mata kepada 6,249.78 dan Indeks Kewangan lebih tinggi 52.2 mata kepada 11,892.76. Indeks FBM Emas menokok 33.12 mata kepada 8,878.09, Indeks FBM70

meningkat 54.98 mata kepada 8,887.03 dan Indeks FBM Ace menambah 12.48

mata kepada 3,769.85. Saham-saham untung mengatasi saham rugi dengan 365 berbalas 242

sementara 275 kaunter tidak berubah, 478 tidak diniagakan dan 23 yang

lain digantung urus niaga. Jumlah dagangan turun kepada 532.634 juta saham tetapi nilai

mengembang kepada RM971.134 juta berbanding 539.611 juta saham bernilai

RM919.148 juta semalam. Antara saham aktif, Sunway REIT kerugian 1.5 sen kepada 88.5 sen,

Sinotop OR turun satu sen kepada satu sen, SAAG Consolidated naik

setengah sen kepada lapan sen dan PJI Holding lebih rendah setengah sen

kepada 12 sen. Jumlah dagangan di Pasaran Utama meningkat kepada 489.382 juta saham

bernilai RM963.515 juta berbanding 478.591 juta saham bernilai RM907.679

juta semalam. Perolehan dagangan di Pasaran ACE, bagaimanapun susut kepada 26.461

juta unit bernilai RM3.996 juta daripada 45.947 juta unit bernilai

RM8.967 juta. Waran pula lebih tinggi pada 14.23 juta bernilai RM1.706

juta daripada 12.334 juta bernilai RM1.295 juta. Produk-produk pengguna menguasai 60.245 juta saham yang diniagakan di

Pasaran Utama, produk perusahaan 71.833 juta, pembinaan 34.817 juta,

urus niaga dan perkhidmatan 145.605 juta, teknologi 18.711 juta,

infrastruktur 8.599 juta, kewangan 32.566 juta, perhotelan 525,400,

hartanah 26.136 juta, perladangan 16.687 juta, perlombongan 28,000, REIT

73.527 dan dana tertutup 103,700. - Bernama

Thursday, July 8, 2010

Technical View 08 July 2010

Most of the regional stock markets recorded marginal losses yesterday, which could reflect the disappointment over the US market’s performance on Tuesday as the key indices failed to hold on to most of their impressive gains towards the closing. Anyhow, the FBM KLCI still experienced a bit of follow-through buying yesterday.

We still maintain our bearish stance on the near-term technical outlook of the FBM KLCI after the index violated the short-term uptrend line. The immediate trend is obviously still down after the market created the “Bearish Harami”. Also do not forget that the benchmark made three failed attempts to break above the 1,350 pt-level, which led to it breaking below the critical “Neckline” support.

From the current level, the 1,298-1,303 pt-area is the immediate support while next support is seen at the 200-day MAV line, which now lies at the 1,284 pt-level. To the upside, immediate resistance lies at 1,318 pt-level, followed by the 1,330 pt-level.