The high is nigh. The local bourse climbed another 6.9 points to end at 1524.34 on the back of buying support on index heavyweights such as BAT, Genting and KLK. Trading volume remained light but was higher at 908m compared to the 2 preceding trading days. Renewed concerns over the weak datapoints from the US contributed to bouts of profit taking although this was well absorbed. Today’s major headlines are: (i) TM and Axiata to probe allegations of kickbacks received from Alcatel Lucent for the award of previous contracts; (ii) Mitrajaya bags a RM53.5m contract for the construction of a hangar; and (iii) Proton to decide by early next year on the merger of its manufacturing assets. There is a good possibility that the FBM KLCI will re-attempt to take out the alltime high of 1531.99 pts notched on 9 Nov before the year is out. Overnight, the Dow extended its gain. We wish all our clients and readers a Happy New Year and may 2011 bring greater wealth and prosperity.

Blog ini telah di kemaskini di http://seminarjutawansaham.blogspot.com

My Blog List

...kini mengadakan promosi bagi peserta yang ingin menyertai seminar untuk dua segmen dengan diskaun sebanyak RM200 serta penginapan percuma (untuk seminar di Pusat Latihan PUABUMI sahaja)......rebutlah peluang mempelajari ilmu pelaburan ini...

Penginapan percuma hanya untuk penyertaan dua segmen di Pusat Latihan PUABUMI Kemaman, Terengganu sahaja...

Barisan Penceramah

Kami bersedia untuk turun padang membongkar rahsia pelaburan di Bursa Malaysia

Destinasi Seminar

Pakej Eksklusif Istimewa ~ Seminar Jutawan Saham dan CPO siri ke 3 adalah pembuka untuk tahun 2011 ini di Pusat Latihan PUABUMI pada 8hb dan 9hb Januari 2011

Seminar Jutawan Saham & CPO akan berada di Santuary Resort Cherating pada 15 Januari 2011 ( segmen ekuiti ) dan 16 Januari 2011 ( segmen CPO )

Kem Pelaburan PUABUMI II akan berada di Hotel Midah Kuala Lumpur pada 13 Ogos 2011 ( segmen CPO ) dan 14 Ogos 2011 ( segmen Ekuiti )

Seminar Jutawan Saham & CPO akan berada di Suria City Hotel, Johor Bahru pada 29 Januari 2011 ( segmen ekuiti ) dan 30 Januari 2011 ( segmen CPO )

Thursday, December 30, 2010

Bursa Malaysia ditutup tinggi

KUALA LUMPUR 29 Dis - Harga saham di Bursa Malaysia ditutup

kebanyakannya lebih tinggi hari ini apabila para pelabur terus membeli

saham berwajaran tinggi terpilih, yang memberi isyarat kemungkinan rali

pratahun baru, kata para peniaga.

Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur (FBM KLCI) ditutup

meningkat 6.9 mata kepada 1,524.34, Indeks itu bergerak antara paras

1,520.19 dan 1,526.93 selepas dibuka pada paras 1,520.45. Paras paling

tinggi dicapai indeks itu ialah 1,528.01, yang dicatatkan pada 10 Nov.

Indeks Kewangan meningkat 38.44 mata kepada 13,878.94, Indeks

Perladangan meningkat 43.42 mata kepada 8,076.4 dan Indeks Perusahaan

meningkat 20.38 mata kepada 2,844.35.

Indeks FBM Emas meningkat 49.26 mata kepada 10,407.71, Indeks FBM 70

menokok 56.52 mata kepada 10,935.02 dan Indeks FBM Ace menokok 11.59

mata kepada 4,301.49.

Kaunter untung mengatasi kaunter rugi sebanyak 468 kepada 294

manakala 314 kaunter tidak berubah, 316 tidak diniaga dan 33 yang lain

digantung.

Jumlah dagangan meningkat kepada 908.416 juta saham bernilai RM1.394

bilion daripada 822.881 juta unit bernilai RM1.22 bilion semalam.

Di Pasaran Utama, jumlah dagangan meningkat kepada 648.265 juta unit

bernilai RM1.342 bilion daripada 617.653 juta saham bernilai RM1.178

bilion semasa penutup semalam.

Waran meningkat kepada 171.425 juta unit bernilai RM33.303 juta

daripada 95.63 juta unit bernilai RM18.787 juta yang dicatatkan.

Perolehan di Pasaran ACE merosot kepada 82.025 juta unit bernilai

RM14.296 juta daripada 93.066 juta saham bernilai RM17.997 juta.

Kaunter paling untung ialah British American Tobacco yang meningkat

hampir 2.0 peratus atau 60 sen kepada RM45.48, diikuti oleh Hap Seng

Consolidated yang meningkat 37 sen kepada RM6.96 dan Tradewinds

Plantation yang meningkat 31 sen kepada RM3.41.

Antara saham aktif, Maxbiz Corporation meningkat 14.5 sen kepada 23.5

sen, Tejari Technologies turun 3.0 sen kepada 16.5 sen dan Limahsoon

menokok 2.5 sen kepada 4.0 sen.

Antara saham berwajaran tinggi, CIMB dan Petronas Chemicals turun 1.0

one sen setiap satu masing-masing kepada RM8.54 dan RM5.52 manakala

Maybank menokok 6.0 sen kepada RM8.55.

Sime Darby meningkat 4.0 sen kepada RM8.81, Genting menokok 18 sen

kepada RM11.16 dan Maxis menokok 3.0 sen kepada RM5.35. - Bernama

Wednesday, December 29, 2010

Market Review

Shored up by Heavyweights. The FBM KLCI closed 5.72 points higher at 1,517.44 points on the back of buying interest in key heavyweights Genting, KLK, PPB, Public Bank and Petronas Gas. Today’s corporate news include Jelas Ulung saying it does not plan on asking the Government for an extension in PLUS Expressway’s concession period as part of its RM26bn offer to buy the company and has also stated its commitment to place a RM50m bidding deposit, Wah Seong’s subsidiaries have disposed of their respective stakes in DrilBits International and DrilTools International for RM8.3m and RM14.9m respectively, Sunway City has proposed to acquire 64.3 acres of land near Johor for RM134.5m, and the Selangor Turf Club has granted

Berjaya Land an extension to Jan 2012 to fufill the conditions pursuant to the proposed acquisition of the 244.7-acre leasehold property in Sungei Besi. Taking the cue from the Dow’s overnight positive close, the local bourse could scale higher today.

Berjaya Land an extension to Jan 2012 to fufill the conditions pursuant to the proposed acquisition of the 244.7-acre leasehold property in Sungei Besi. Taking the cue from the Dow’s overnight positive close, the local bourse could scale higher today.

Bursa Malysia kukuh di akhir dagangan

KUALA LUMPUR 28 Dis - Harga saham di Bursa Malaysia ditutup lebih

kukuh hari ini apabila para pelabur membuat pembelian pada kaunter

berkaitan indeks terpilih, yang kebanyakannya kaunter perbankan dan

perladangan, kata para peniaga.

Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur (FBM KLCI) yang

dibuka turun 0.74 mata kepada 1,510.98, bergerak antara 1,509.55 dan

1,525.99 sebelum berakhir pada paras 1,517.44, meningkat 5.72 mata

1,517.44.

Kaunter paling untung kebanyakannya saham perladangan seperti Kuala

Lumpur Kepong yang melonjak 44 sen kepada RM22.64, Hap Seng Consolidated

yang meningkat 36 sen kepada RM6.59 dan PPB Group yang meningkat 34 sen

kepada RM17.10.

Indeks Perladangan meningkat 39.97 mata kepada 8,032.98.Indeks

Kewangan meningkat 34.49 mata kepada 13,840.5 dengan Public Bank

melonjak 16 sen kepada RM12.96, AMMB Holdings menokok 4.0 sen kepada

RM6.99 dan Hong Leong Financial meningkat 9.0 sen kepada RM8.98.

Indeks Perusahaan meningkat 13.30 mata kepada 2,823.97.Indeks FBM

Emas meningkat 36.561 mata kepada 10,358.45, Indeks FBM 70 meningkat

33.59 mata kepada 10,878.5 dan Indeks FBM Ace meningkat 38.78 mata

kepada 4,289.9.

Kaunter untung mengatasi kaunter rugi sebanyak 390 kepada 370

manakala 294 kaunter tidak berubah, 338 tidak diniaga dan 37 digantung.

Jumlah dagangan keseluruhan meningkat kepada 822.881 juta unit

bernilai RM1.22 bilion daripada 773.206 juta saham bernilai RM868.925

juta pada Isnin.

Di Pasaran Utama, jumlah dagangan meningkat kepada 617.653 juta saham

bernilai RM1.178 bilion daripada 530.432 juta unit bernilai RM818.831

juta semasa penutup semalam.

Waran turun kepada 95.63 juta unit bernilai RM18.787 juta berbanding

dengan 135.716 juta saham bernilai RM24.727 juta sebelum ini. Perolehan

di Pasaran ACE meningkat kepada 93.066 juta saham bernilai RM17.997 juta

daripada 84.682 juta bernilai RM20.632 juta semasa penutup Isnin.

Kaunter aktif, Tejari Technologies turun 0.5 sen kepada 19.5 sen,

Integrated Rubber Corp-WA menokok 1.5 sen kepada 14 sen manakala Hubline

tidak berubah pada harga 21 sen. Saham perbankan dan kewangan — Public

Bank melonjak 16 sen kepada RM12.96, AMMB Holdings menokok 4.0 sen

kepada RM6.99 dan Hong Leong Financial meningkat 9.0 sen kepada RM8.98. -

Bernama

Tuesday, December 28, 2010

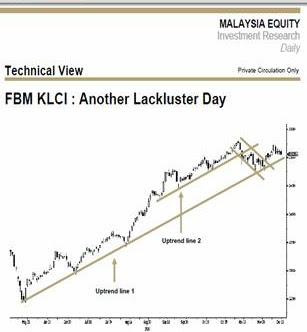

Little has changed after yesterday’s listless trading session, during which the FBM KLCI was stuck within a 4-pt trading range. The index again ended the session with a close at above the 1,510 pt-level.

We have been talking about the importance of breaking above the 1,510 pt-level. Although this level has been violated, the market still needs another round of strong upward momentum to confirm the breakout. If not, there is still a possibility of the index remaining stuck within the recent trading band ranging from the 1,474 pt-level to the 1,510 pt-level.

We will maintain our firmly bullish bias view towards the near-term market until uptrend line 1 is decisively violated.

The FBM KLCI’s historic high of 1,532 pts is now the only resistance which we can detect. To the downside, the 1,510 pt-level is still the immediate support while another support is seen at the 1,485- 1,492-pt area.

Dagangan Bursa bercampur-campur

KUALA LUMPUR 27 Dis - Harga saham di Bursa Malaysia ditutup

bercampur-campur hari ini dengan kenaikan sederhana dalam kaunter

wajaran tinggi di tengah-tengah pengambilan untung berterusan dalam

pasaran am, kata para peniaga.

Pada 5 petang, FTSE Bursa Malaysia KLCI (FBM KLCI) naik 0.14 mata

kepada 1,511.72.Indeks petunjuk pasaran itu yang dibuka 0.32 mata lebih

tinggi pada 1,511.9, bergerak antara 1,509.64 dan 1,513.23.

Indeks Kewangan naik 8.62 mata kepada 13,806.01, Indeks Perladangan

menokok 44.8 mata kepada 7,993.01 manakala Indeks Perusahaan berkurangan

7.72 mata kepada 2,810.67.

Indeks FBM Emas turun 6.16 mata kepada 10,321.89, Indeks FBM 70

berkurangan 10.18 mata kepada 10,844.91 dan Indeks FBM susut 3.01 mata

kepada 4,251.12.

Kaunter rugi mengatasi kaunter untung sebanyak 414 berbanding 305,

manakala 273 kaunter tidak berubah, 400 tidak diniagakan dan 33 yang

lain digantung.

Jumlah dagangan berkurangan kepada 773.206 juta saham bernilai

RM868.925 juta daripada 835.211 juta saham bernilai RM904.809 juta.

Di Pasaran Utama, jumlah dagangan jatuh kepada 530.432 juta unit

bernilai RM818.831 juta daripada 640.384 juta saham bernilai RM860.703

juta sebelumnya.

Waran turun kepada 135.716 juta saham bernilai RM24.727 juta daripada

146.982 juta unit bernilai RM29.866 juta. Bagaimanapun, Pasaran ACE

melonjak kepada 84.682 juta saham bernilai RM20.632 juta daripada 45.709

juta saham bernilai RM12.679 juta sebelumnya.

Menerajui kaunter cergas ialah Berjaya Corporation yang naik tujuh

sen kepada RM1.12 manakala Tejari Technologies meningkat 1.5 sen kepada

20 sen dan Pantech Group-ICULS menambah setengah sen kepada 10.5 sen. Di

kalangan kaunter wajaran tinggi, CIMB naik dua sen kepada RM8.57,

Maybank dan Sime Darby kedua-duanya tidak berubah masing-masing pada

RM8.49 dan RM8.73 manakala Petronas Chemicals dan Tenaga turun dua sen

setiap satu masing-masing kepada RM5.53 dan RM8.36. British American

Tobacco merupakan kaunter rugi utama, turun 94 sen kepada RM44.86.

Barangan pengguna menyumbang 39.607 juta saham yang diniagakan di

Pasaran Utama, barangan perusahaan 132.382 juta, pembinaan 51.546 juta,

perdagangan dan perkhidmatan 203.351 juta, teknologi 8.935 juta,

prasarana 7.382 juta, kewangan 21.908 juta, hotel 3.126 juta, harta

43.115 juta, perladangan 16.716 juta, perlombongan 230,200 REITs 2.112

juta dan dana tertutup 21,500. - Bernama

Market Review

Light trading. The FBM KLCI closed in positive territory yesterday on the back of a largely mixed trading session with modest trading volume as most investors were still on their Xmas break. Gainers trailed losers 305 to 414, with 273 stocks traded unchanged. In the news today are: (i) Johor Corp quashing talk that it is putting up its fast food business for sale; (ii) DRB-Hicom exploring the possibility of hiving off its general and life insurance businesses; and (iii) AirAsia said it has no plans to acquire Virgin Atlantic as reported in the British media. There could well be further consolidation on the local bourse today following the Dow’s weaker overnight close as sentiment will be capped by the interest rate increase in China over the weekend.

Monday, December 27, 2010

Technical View

The market ended another week without providing an answer if the 1,510 pt-level has been decisively violated this time. Instead, the FBM KLCI still exhibited signs of struggling to maintain a posture above the 1,510 pt-level.

Although the FBM KLCI stayed above the 1,510 pt-level for the third session in a row since last Wednesday, without another strong push to the upside to confirm the breakout from the 1,510 ptlevel, there is still a possibility of the index remaining stuck within the recent trading band ranging from the 1,474 pt-level to the 1,510 pt-level.

We will maintain our firmly bullish bias view towards the near-term market until uptrend line 1 is decisively violated. The nearly 20-pt gain recorded last Tuesday and Wednesday had improved the market’s near-term technical landscape but the violation of the 1,510 pt-level still needs to be confirmed.

The FBM KLCI’s historic high of 1,532 pts is now the only resistance which we can detect. To the downside, the 1,510 pt-level is still the immediate support while another support is seen at the 1,485- 1,492-pt area.

Although the FBM KLCI stayed above the 1,510 pt-level for the third session in a row since last Wednesday, without another strong push to the upside to confirm the breakout from the 1,510 ptlevel, there is still a possibility of the index remaining stuck within the recent trading band ranging from the 1,474 pt-level to the 1,510 pt-level.

We will maintain our firmly bullish bias view towards the near-term market until uptrend line 1 is decisively violated. The nearly 20-pt gain recorded last Tuesday and Wednesday had improved the market’s near-term technical landscape but the violation of the 1,510 pt-level still needs to be confirmed.

The FBM KLCI’s historic high of 1,532 pts is now the only resistance which we can detect. To the downside, the 1,510 pt-level is still the immediate support while another support is seen at the 1,485- 1,492-pt area.

Market Review

Slightly lower. The FBM KLCI dipped 2.9 points to close at 1,511.58. UEM Land Holdings Bhd has received valid acceptances for 450.9m offer shares representing 91.02% of Sunrise Bhd’s issued and paid-up capital, Petronas has shot down market talk that it will list its 100%-owned exploration and production unit, Petronas Carigali SB in 2011 and Guan Chong Bhd is counting on its new processing plant in Batam, Indonesia to meet strong demand from chocolate manufacturers globally. Meanwhile, Perisai Petroleum Teknologi Bhd has entered into a share sale agreement with Innovative Upstream Technologies SB for the disposal of 100% stake in Orinippon Trading SB, which is involved in design, engineering and patent holding, for RM720k. The US markets were closed on Friday.

Saham diniaga lebih kukuh minggu ini

KUALA LUMPUR 26 Dis. - Harga saham di Bursa

Malaysia kemungkinan diniagakan lebih kukuh pada minggu ini selepas

dirangsang oleh aktiviti hiasan luar apabila sesetengah pelabur cuba

mendapatkan saham lebih baik dan lebih bernilai pada minggu terakhir

2010, kata para peniaga.

Bagaimanapun, aliran masuk dana kemungkinan terhad kerana sesetengah

pelabur telah pergi bercuti panjang seminggu mulai cuti Hari Krismas

yang bermula Jumaat lalu, kata mereka.

Seorang peniaga berkata jika Indeks Komposit FBM Kuala Lumpur (FBM

KLCI) berupaya melepasi paras halangan 1,525 dalam tempoh jangka pendek,

kemungkinan trend menaik akan berterusan sehingga lewat minggu ini.

Pada akhir minggu lalu, FBM KLCI meningkat 11.7 mata kepada 1,511.58

berbanding dengan paras 1,499.88 semasa penutup pada minggu sebelumnya.

Bursa tempatan bermula minggu lalu dengan lembap sebelum meningkat

berikutan beberapa berita positif daripada aktiviti korporat, yang

termasuk usahasama DRB-Hicom dan Volkswagen.

Sementara itu, pada Isnin, PLUS Expressways Bhd. menerima bidaan

pengambil alihan keempat berjumlah RM26 bilion daripada Jelas Ulung Sdn.

Bhd.

Kaunter itu adalah antara kaunter paling aktif apabila minat pelabur

terangsang.

Tarikh bagi mengemukakan tawaran baharu telah dilanjutkan kepada 10

Jananuri depan.

Pada Jumaat, saham PLUS Expressways meningkat 1.0 sen untuk ditutup

kepada RM4.61 dengan 4.047 juta saham bertukar tangan.

Berasaskan mingguan, Indeks FBM Emas melonjak 81.09 mata kepada

10,328.05, Indeks FBM Top 100 melonjak 78.46 mata kepada 10,069.69 dan

Indeks FBM Ace meningkat 10.32 mata kepada 4,254.13.

Indeks Kewangan meningkat 15.37 mata kepada 13,797.39, Indeks

Perusahaan meningkat 13.38 mata kepada 2,818.39 dan Indeks Perladangan

melonjak 73.80 mata kepada 7,948.21.

Jumlah dagangan keseluruhan mingguan merosot kepada 5.747 bilion

saham bernilai RM7.676 bilion berbanding dengan 5.865 bilion saham

bernilai RM8.725 bilion yang dicatatkan pada minggu sebelumnya.

Perolehan di Pasaran Utama meningkat kepada 4.364 bilion unit

bernilai RM7.354 bilion daripada 4.335 bilion saham bernilai RM8.45

bilion.

Perolehan di Pasaran ACE merosot kepada 218.796 juta saham bernilai

RM52.699 juta daripada 303.966 juta unit bernilai RM56.618 juta.

Waran melonjak 1.149 bilion saham bernilai RM260.4 juta daripada

880.353 juta unit bernilai RM206.674 juta sebelum ini. - BERNAMA

Friday, December 24, 2010

Technical View

The market closed marginally lower yesterday but still ended the day above the 1,510 pt-level. We have been using this level to determine if the FBM KLCI could continue to add more points beyond the recent trading range. Yesterday was only the third session during which the index ended above the 1,510 pt-level since 12 Nov 2010.

We still need another strong push to the upside to confirm the breakout of the 1,510 pt-level, especially after the index experienced a failed breakout attempt on 9 Dec 2010. Another failed breakout attempt at the 1,510 pt-level would also see the index continue to trade within the recent trading band ranging from 1,474 pts to 1,510 pts.

We will maintain our firmly bullish bias view towards the near-term market until uptrend line 1 is decisively violated. The nearly 20-pt gain recorded on Tuesday and Wednesday has improved the market’s near-term technical landscape, but the violation of the 1,510 pt-level still needs to be confirmed.

The FBM KLCI’s historic high of 1,532 pts is now the only resistance which we can detect. To the downside, the 1,510 pt-level is still the immediate support while another support is seen at the 1,485-1,492-pt area.

We still need another strong push to the upside to confirm the breakout of the 1,510 pt-level, especially after the index experienced a failed breakout attempt on 9 Dec 2010. Another failed breakout attempt at the 1,510 pt-level would also see the index continue to trade within the recent trading band ranging from 1,474 pts to 1,510 pts.

We will maintain our firmly bullish bias view towards the near-term market until uptrend line 1 is decisively violated. The nearly 20-pt gain recorded on Tuesday and Wednesday has improved the market’s near-term technical landscape, but the violation of the 1,510 pt-level still needs to be confirmed.

The FBM KLCI’s historic high of 1,532 pts is now the only resistance which we can detect. To the downside, the 1,510 pt-level is still the immediate support while another support is seen at the 1,485-1,492-pt area.

Aktiviti pengambilan untung Bursa ditutup rendah

KUALA LUMPUR 23 Dis - Harga saham di Bursa Malaysia ditutup rendah

hari ini berikutan aktiviti pengambilan untung apabila para pelabur

enggan menyimpan pegangan besar menjelang cuti Hari Krismas, kata para

peniaga.

Kenaikan dalam beberapa saham wajaran tinggi terpilih berjaya

mengekalkan FTSE Bursa Malaysia KLCI di atas paras 1,500.

Pada 5 petang, KLCI turun 0.57 mata kepada 1,514.48.

Indeks petunjuk pasaran itu yang dibuka 3.64 mata lebih tinggi pada

1,518.69, bergerak antara 1,511.2 dan 1,518.8.

Indeks Kewangan berkurangan 34.38 mata kepada 13,840.01, Indeks

Perladangan susut 1.65 mata kepada 7,920.47 manakala Indeks Perusahaan

naik 5.72 mata kepada 2,816.03.

Indeks FBM Emas turun 7.04 mata kepada 10,348.41, Indeks FBM 70 susut

23.229 mata kepada 10,876.73 manakala Indeks FBM Ace berkurangan

sebanyak 6.16 mata kepada 4,263.22.

Kaunter rugi mengatasi kaunter untung sebanyak 383 berbanding 356,

manakala 305 kaunter tidak berubah, 348 tidak diniagakan dan 30 yang

lain digantung.

Jumlah dagangan berkurangan kepada 1.251 bilion saham bernilai

RM1.646 bilion daripada 1.253 bilion saham bernilai RM1.664 bilion

semalam.

Di Pasaran Utama, jumlah dagangan turun kepada 825.26 juta unit

bernilai RM1.559 bilion daripada 976.982 juta saham bernilai RM1.596

bilion.

Bagaimanapun, waran meningkat kepada 370.065 juta saham bernilai

RM73.64 juta daripada 228.075 juta unit bernilai RM56.218 juta

sebelumnya.

Jumlah dagangan di Pasaran ACE menokok kepada 53.415 juta unit

bernilai RM11.435 juta daripada 43.5 juta saham bernilai RM8.267 juta

semalam.

Di kalangan saham cergas, KNM-CE:CW naik tiga sen kepada 33 sen,

Integrated Rubber Corporation meningkat 4.5 sen kepada 28.5 sen dan

MAS-CA:Cw menambah 6.5 sen kepada 18 sen.

Di kalangan kaunter wajaran tinggi, CIMB turun enam sen kepada

RM8.54, Maybank dan Petronas Chemicals kedua-dua tidak berubah

masing-masing pada RM8.50 dan RM5.57 manakala Tenaga naik sembilan sen

kepada RM8.39.

Barangan pengguna menyumbang 54.231 juta saham yang diniagakan di

Pasaran Utama, barangan perusahaan 226.414 juta, pembinaan 59.643 juta,

perdagangan dan perkhidmatan 272.211 juta, teknologi 36.562 juta,

prasarana 12.705 juta, kewangan 44.016 juta, hotel 2.52 juta, harta

88.698 juta, perladangan 22.396 juta, perlombongan 621,700, REITs 5.172

juta dan dana tertutup 69,800.

- Bernama

Market Review

Profit taking ahead of Christmas holiday? Gains in selected heavyweights yesterday managed to keep the FBM KLCI above the 1,500-pt level. However, the index ended slightly lower by 0.57 pts to 1,514.48 pts. Among the key market news are the Government will set up a SPV to fund the MRT project, PLUS extends the deadline for interested buyers to 10 Jan 2011, Sime Darby files civil suit against ex-CEO, sources said Adventa could be a potential acquisition target by a US healthcare firm, UEM Land receives 91.5% Sunrise shares to date, BToto is in internal discussions to consider possible strategic investors and Pintaras Jaya unit wins a RM26m job. Overnight, the DJIA edged up marginally by 14 pts to 11,573.5 as Americans increased spending in November for a fifth straight month and companies stepped up orders for equipment, more evidence the US economy is gaining momentum heading into 2011. Nonetheless, we expect the local bourse to trade sideways during the year-end holiday season.Wishing our readers a Merry Christmas.

Thursday, December 23, 2010

Technical View

Follow-through buying yesterday buoyed the market to a higher close for the second consecutive session. After the nearly 20-pt gain over the last two sessions, the FBM KLCI is now trading further away from the uptrend line. Another positive development is that the index ended above 1,510 pts for only the second time since 12 Nov 2010.

Although the index closed above the 1,510 pt-level yesterday, this breakout still needs to be confirmed, especially after it experienced a failed breakout attempt on 9 Dec 2010. Whether or not the market could continue to add more points from the current level would determine its immediate outlook. This is because another failed breakout attempt at the 1,510 pt-level would also see the index continue to trade within the recent trading band ranging from 1,474 pts to 1,510 pts.

We will maintain our firmly bullish bias view towards the near-term market until uptrend line 1 is decisively violated. The near-term technical landscape of the FBM KLCI improved with the nearly 20-pt gain but the violation of the 1,510 pt-level still needs to be confirmed.

The FBM KLCI’s historic high of 1,532 pts is now the only resistance which we can detect. To the downside, the 1,510 pt-level is the immediate support while another support is seen at the 1,485- 1,492-pt area.

Market Review

Heavyweights on the rise. The FBM KLCI advanced nearly 10 points yesterday to end at 1515 points. Top gainers among the component stocks were Digi, KLK, BAT, Genting and AMMB. Despite the strong gain on the benchmark index, the broader market was very mixed, with 394 gainers against 374 losers. Today’s news headlines are Land & General enters into a conditional agreement to buy development land in Seremban for RM25m cash, while Boustead Holdings will acquire a 51% stake in MHS Aviation, which has a 10-year contract with Petronas Carigali to provide rotary wing aircraft, equipment and services. Overnight, stocks on the US market continued to creep up, with the Dow putting on 26 points while European markets were mixed. On the back of these developments, the FBM KLCI could strengthen further towards the key resistance of 1532 points today.

Belian saham mewah Bursa kukuh

KUALA LUMPUR 22 Dis - Harga saham di Bursa Malaysia ditutup tinggi

hari ini berikutan minat belian sederhana dalam saham wajaran tinggi

terpilih apabila para pelabur memberikan reaksi positif kepada beberapa

perubahan aktif dalam dunia korporat, kata para peniaga.

FTSE Bursa Malaysia KLCI (FBM KLCI) naik 9.87 mata kepada 1,515.05

berbanding 1,505.18 semalam.

Indeks petunjuk pasaran dibuka 0.69 mata lebih tinggi pada 1,505.87

dan bergerak antara 1,504.9 dan 1,515.05.

ING Funds Bhd, dalam satu kenyataan berkata FBM KLCI dijangka

mencecah paras 1,650 mata pada akhir tahun depan berdasarkan kepada

unjuran pertumbuhan pendapatan korporat 15 peratus bagi 2011,

disandarkan kepada purata nisbah pendapatan harga lima tahun 15.5 kali.

Indeks Kewangan meningkat 51.47 mata kepada 13,821.81, Indeks

Perladangan naik kepada 11.52 mata kepada 7,868.5 dan Indeks Perusahaan

menokok 9.56 mata kepada 2,798.37.

Indeks FBM Emas melonjak 52.58 mata kepada 13,874.39, Indeks FBM 70

naik 23.979 mata kepada 10,899.96 manakala Indeks FBM Ace turun 41.05

mata kepada 4,269.38.

Kaunter untung mengatasi kaunter rugi sebanyak 394 berbanding 374,

manakala 284 kaunter tidak berubah, 340 tidak diniagakan dan 29 yang

lain digantung.

Jumlah dagangan turun kepada 1.253 bilion saham bernilai RM1.664

bilion daripada 1.361 bilion saham bernilai RM1.87 bilion, semalam.

Di Pasaran Utama, jumlah dagangan berkurangan kepada 976.982 juta

saham bernilai RM1.596 bilion daripada 1.094 bilion saham bernilai

RM1.801 bilion.

Waran meningkat kepada 228.075 juta unit bernilai RM56.218 juta

daripada 225.748 juta saham bernilai RM55.379 juta sebelumnya.Jumlah

dagangan di Pasaran ACE naik kepada 43.5 juta saham bernilai RM8.267

juta daripada 39.512 juta unit bernilai RM11.535 yang dicatatkan

sebelumnya.

Antara saham cergas ialah KNM-CE yang naik 7.5 sen kepada 30 sen.

Hubline susut setengah sen kepada 22.5 sen dan Zelan menambah 5.5 sen

kepada 58.5 sen.

Barangan pengguna menyumbang 35.085 juta saham yang diniagakan di

Pasaran Utama, barangan perusahaan 224.626 juta, pembinaan 119.115 juta,

perdagangan dan perkhidmatan 346.685 juta, teknologi 12.769 juta,

prasarana 37.626 juta, kewangan 57.892 juta, hotel 4.372 juta, harta

111.548 juta, perladangan 22.958 juta, perlombongan 1.114 juta, REIT

3.174 juta dan dana tertutup 17,300. -Bernama

Wednesday, December 22, 2010

AEON Credit

On The Right Path

AEON Credit’s annualized 9MFY11 earnings were in line, representing 69.6% and 71.9% of consensus and our full-year forecasts. Revenue and net profit rose by 3.8% and 10.0% y-o-y respectively, mainly attributed to strong growth in personal financing, credit card and other income. NPLs dipped marginally to 1.68% and CAR stood at 23.8%. We are maintaining our BUY call on AEON Credit, with a target price of RM4.35 as we expect the company to maintain its growth momentum.

Still on track. Revenue and net profit for 9MFY11 perked up by 3.8% and 10.0% y-o-y, mainly driven by: i) strong revenue growth from the personal financing (+6%) and credit card segments (+9%), and ii) a 24% y-o-y jump in other income, bolstered by higher transaction fee income (RM5.7m) arising from increased financing transaction volume. This was in tandem with its growing trade receivables, which were higher by 9.7% YTD.

Credit card segment catching up. Revenue from credit cards grew 9% owing to the company’s aggressive card recruitment efforts and enhancements in card benefits. Credit cards in circulation expanded by 20% to 135k, and we believe this number will continue to go up and reach the required breakeven base of 150k in the near term. Meanwhile, its easy payment schemes (revenue: +5%) remained the major revenue contributor, accounting for 60.2% of revenue for 9MFY11.

Asset quality intact. NPLs improved to 1.68% (1HFY11: 1.73%), thanks to prudent risk management and portfolio management to control NPLs, while CAR stood at 23.8% (FY10: 24.8%). Cost of funds hovered at around 4.4%, which is in line with our estimate of 4.5%. Maintain BUY. We expect stronger 2HFY11 results in conjunction with the upcoming major festive seasons and better consumer sentiment (Consumer Sentiment Index - 3QFY10: 115.8 vs 2QFY10: 110.4).

Maintain Buy on AEON credit with an unchanged target price of RM4.35, based on historical 2-year PE band of 8.5x over FY11 EPS.

Wilmar International

Foray Into China’s Real Estate Business

THE BUZZ

OUR TAKE

THE BUZZ

Wilmar International has entered into a master JV agreement with Kerry Properties Ltd and Shangri-la Asia for real estate development, operation, sale, leasing, property management and hotel development, operation and management in Bayuquan, Yingkou City in China’s Liaoning Province. The JV parties have successfully bid for three sites totaling 200k square metres in Bayuguan for USD36m. The total project cost is estimated at USD386m, of which Wilmar’s portion is USD134m by virtue of the group’s 35% stake in the venture.

OUR TAKE

We are negative on Wilmar’s entry into the property market. The investment amount of USD134m is small relative to the size of Wilmar’s balance sheet, which boasts of shareholders funds of USD11.5bn, and we have no doubt about the eventual profitability of the project given Kerry Properties and Shangri-la’s knowledge of the property market. Nevertheless, the entry into the real estate business represents Wilmar’s first ever deviation from its core agribusiness. In the past several years, all of Wilmar’s expansions have been in related businesses such as sugar, rice, flour and mineral water, which leverage on its vast distribution network. We fear this foray into property could mark the start of Wilmar’s loss of business focus and corporate discipline, and do not think that this venture will be well received by the market. We are maintaining our Buy call, however, as we view Wilmar as being inexpensive at 13.5x CY11 earnings.

Market Review

Positive uptrend. The FBM KLCI closed 9.30 points higher at 1,505.2 points, with PLUS, TM, Genting and Public Bank being the key drivers. Today’s corporate news include PLUS Expressway Bhd asking new offerors bidding to acquire its assets to commit to a RM50m refundable deposit, DRB-Hicom has officially signed a

collaboration agreement with Volkswagen to manufacture Volkswagen cars at its plant in Pekan, KNM has secured a RM2bn biomass contract in UK and Genting Malaysia has confirmed that it is currently exploring casino development market opportunities in Vietnam. Given the Dow’s overnight positive close by 0.48%, we expect our market to see positive upside today.

collaboration agreement with Volkswagen to manufacture Volkswagen cars at its plant in Pekan, KNM has secured a RM2bn biomass contract in UK and Genting Malaysia has confirmed that it is currently exploring casino development market opportunities in Vietnam. Given the Dow’s overnight positive close by 0.48%, we expect our market to see positive upside today.

Belian baru rangsang Bursa kukuh

KUALA LUMPUR 21 Dis - Harga saham di Bursa Malaysia ditutup lebih

kukuh hari ini, selepas dirangsang oleh pembelian baharu daripada para

pelabur berikutan kemunculan berita korporat yang positif, yang termasuk

beberapa tawaran pengambilalihan di dalam industri, kata para peniaga.

Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur (FBM KLCI) meningkat

9.3 mata kepada 1,505.18, yang ditolak naik oleh kenaikan harga dalam

PLUS Expressways berikutan bidaan baharu ke-empat semalam yang

melibatkan tawaran pengambilalihan RM26 bilion terhadap pengendali tol

itu.

Selain itu, MTD Capital, yang turut menerima bidaan pengambilalihan

RM1.1 bilion bagi kesemua sahamnya, adalah antara kaunter yang diminati

hari ini.

Sebelum itu, FBM KLCI dibuka meningkat 2.47 mata kepada

1,498.35.Sepanjang hari ini, ia bergerak antara 1,497.81 dan 1,510.24.

Sementara itu, Indeks Kewangan melonjak 51.47 mata kepada 13,821.81,

Indeks Perladangan meningkat 11.52 mata kepada 7,868.5 dan Indeks

Perusahaan meningkat 9.56 mata kepada 2,798.37.

Indeks FBM Emas melonjak 77.989 mata kepada 10,300.47, Indeks FBM 70

meningkat 110.15 mata kepada 10,875.98, FBMT100 meningkat 70.63 mata

kepada 10,040.41 dan Indeks FBM Ace meningkat 66.45 mata kepada

4,310.43.

Kaunter untung mengatasi kaunter rugi sebanyak 539 kepada 256,

manakala 284 kaunter tidak berubah, 313 tidak diniaga dan 29 yang lain

digantung.

Keseluruhan pasaran dicatatkan positif dengan jumlah dagangan

meningkat kepada 1.361 bilion saham bernilai RM1.87 bilion berbanding

dengan jumlah dagangan yang ditutup pada Isnin sebanyak 1.05 bilion

saham bernilai RM1.6 bilion.

Di Pasaran Utama, jumlah dagangan meningkat kepada 1.094 bilion saham

bernilai RM1.801 bilion berbanding 827.86 juta saham bernilai RM1.54

bilion semalam. Perolehan waran turut meningkat kepada 225.748 juta unit

bernilai RM55.379 juta daripada 178.61 juta unit bernilai RM45.3 juta

sebelum itu.

Perolehan di Pasaran ACE meningkat kepada 39.512 juta unit bernilai

RM11.535 juta daripada jumlah dagangan 36.66 juta saham bernilai RM8.78

juta pada Isnin.

Kaunter aktif didahului oleh Hubline di mana sahamnya meningkat 2.5

sen kepada 23 sen manakala Time Dotcom meningkat 8.5 sen kepada 77 sen

dan Petra Perdana menokok 13.5 sen kepada RM1.07.

Di kalangan saham berwajaran tinggi, PLUS Expressways meningkat 24

sen kepada RM4.60, Telekom menokok 16 sen kepada RM3.54 dan Genting

meningkat 12 sen kepada RM10.46.- Bernama

Tuesday, December 21, 2010

Bursa lemah seiring pasaran serantau

KUALA LUMPUR 20 Dis - Harga-harga saham di Bursa Malaysia mengakhiri

dagangan pada paras lebih rendah hari ini sejajar dengan prestasi lemah

pasaran-pasaran saham serantau, kata peniaga.

Pengukur pasaran FTSE Bursa Malaysia KLCI turun empat mata kepada

1,495.88.Ia dibuka 0.42 mata lebih rendah pada 1,499.46 pagi

tadi.Sepanjang hari ini, ia bergerak di antara 1,493.22 dengan 1,500.07.

Seorang peniaga berkata bursa tempatan turun sejajar dengan prestasi

lemah pasaran-pasaran saham Asia yang terjejas oleh ketegangan yang

memuncak di semenanjung Korea dan kebimbangan tentang kemudahan

mendapatkan dana di China.

"Kebanyakan kegiatan menjual adalah atas sebab-sebab luaran dan

kekurangan minat kerana pasaran berada dalam suasana percutian.

"Saham-saham hanya bergerak turun naik manakala pelabur dijangka

menyimpan keuntungan berikutan kenaikan baru-baru ini," katanya.

Indeks Kewangan turun 11.68 mata kepada 13,770.34, Indeks

Perladangan jatuh 17.43 mata kepada 7,856.98 dan Indeks Perusahaan

susut 16.20 mata kepada 2,788.81.

Indeks FTSE Bursa Malaysia Emas jatuh 24.47 mata kepada 10,222.48

dan Indeks FTSE Bursa Malaysia Mid 70 turun 2.67 mata kepada

10,765.83.Bagaimanapun, Indeks FTSE Bursa Malaysia Ace naik 0.17 mata

kepada 4,243.98.

Jumlah dagangan mengecil kepada 1.05 bilion saham bernilai RM1.6

bilion daripada 1.14 bilion saham bernilai RM1.81 bilion Jumaat minggu

lepas.

Saham rugi mengatasi saham untung dengan jumlah 503 berbanding 251 manakala 278 kaunter tidak berubah.

Antara kaunter-kaunter cergas, DRB-Hicom meningkat 15 sen kepada

RM1.93 dan waran opsyen belian DRB-Hicom naik 3.5 sen kepada 43.5

sen.Olympia Industries, bagaimanpun, susut setengah sen kepada 33 sen.

Bagi saham berwajaran tinggi, Maybank luak sesen kepada RM8.50 dan

Sime Darby jatuh lima sen kepada RM8.70.CIMB mengukuh empat sen kepada

RM8.55.

Jumlah dagangan dalam Pasaran Utama susut kepada 827.86 juta saham

bernilai RM1.54 bilion daripada 888.13 juta saham bernilai RM1.75

bilion Jumaat lepas.Waran mencatatkan penyusutan jumlah dagangan kepada

178.61 juta unit bernilai RM45.3 juta daripada 197.56 juta unit

bernilai RM41.02 juta sebelumnya.

Pasaran ACE mencatatkan pengurangan jumlah dagangan kepada 36.66

juta saham bernilai RM8.78 juta daripada 51.27 juta saham bernilai

RM10.2 juta minggu lepas.- Bernama

Monday, December 20, 2010

Market Review

Marginally higher. The FBM KLCI rose 2.36 points to close at 1,499.88 pts last Friday.Gamuda Bhd’s 1QFY11 net profit jumped 20% y-o-y to RM88.5m on higher contributions from its construction and property divisions, IJM Corp Bhd received a contract worth RM460.6m from Naza TTDI Construction SB for superstructure works for the latter’s development in Kuala Lumpur, while Scomi Marine Bhd has proposed to sell 4 companies to its 80.5%-subsidiary, PT Rig Tenders Indonesia Tbk for 323.1bn rupiah (RM538.3m) in a group-related corporate exercise. Finally, the US markets ended little changed on Friday, hovering at two-year highs as President Obama signed a tax-cut plan into law. Crude oil price, meanwhile, rose USD0.32 to end at USD88.02/barrel.

Friday, December 17, 2010

Technical View

Despite the USD/RM’s recent rebound from the lowest level since the managed-float system was introduced, the USD/RM currency market is still stuck within an obvious downtrend channel. We said before that the USD could rebound anytime soon as it was trading in the vicinity of the support line of the downtrend channel. Anyhow, the rebound thus far is still being viewed as a bearish rebound within a downtrend.

With reference to the same downtrend channel drawn in the daily chart many months ago, the USD is expected to continue depreciating against the RM until the channel is violated. Hence, we feel that the USD/RM outlook will remain firmly bearish as long as USD/RM continues to trade inside the downtrend channel.

It looks like the USD/RM has established a rather strong support floor at above the RM3.07/ USD level, which is the lowest point since the introduction of the managed-float system. We will see if the USD could eventually get itself out from the downtrend channel after building a new support base. If not, the USD’s downtrend will eventually extend much lower and when the RM3.07 / USD support floor which took about two months to construct is violated, it is likely to face another round of selling pressure.

From the current level, there is immediate resistance at the RM3.17/USD level, followed by the RM3.19/USD level. To the downside, look for an immediate support at the RM3.12/USD level, followed by the RM3.10/USD level and the RM3.07 / USD level.

With reference to the same downtrend channel drawn in the daily chart many months ago, the USD is expected to continue depreciating against the RM until the channel is violated. Hence, we feel that the USD/RM outlook will remain firmly bearish as long as USD/RM continues to trade inside the downtrend channel.

It looks like the USD/RM has established a rather strong support floor at above the RM3.07/ USD level, which is the lowest point since the introduction of the managed-float system. We will see if the USD could eventually get itself out from the downtrend channel after building a new support base. If not, the USD’s downtrend will eventually extend much lower and when the RM3.07 / USD support floor which took about two months to construct is violated, it is likely to face another round of selling pressure.

From the current level, there is immediate resistance at the RM3.17/USD level, followed by the RM3.19/USD level. To the downside, look for an immediate support at the RM3.12/USD level, followed by the RM3.10/USD level and the RM3.07 / USD level.

Market Review

Settling lower. The FBM KLCI fell 11.58 points to 1,497.52 on extended sell-offs amid weak trading in the global markets. The Securities Commission has made several changes to the Malaysian Takeovers and Merger Code, which now requires more disclosures and more emphasis on the independent directors. MTD Capital Bhd has obtained the go-ahead from the Philippines’ Toll Regulatory Board to raise toll rates on the South Luzon Expressway effective 1 Jan 2011. Air Asia Bhd firmed up its venture in the Philippines after signing a shareholder agreement with its partners there while Tenaga Nasional Bhd formally signed 3 agreements with various companies for jobs worth RM1.16bn for the 250MW Hulu Terengganu hydro project. CIMB Bank Bhd is set to raise RM2bn through a bond sale. Finally, the US markets were higher yesterday as investors looked on the brighter side of mixed reports on housing and jobs. Crude oil price was however lower by USD0.92 at its close of USD87.70/barrel.

Dagangan Bursa lemah seiring pasaran dunia

KUALA LUMPUR 16 Dis - Harga-harga saham ditutup rendah hari ini

berikutan jualan berterusan ketika dagangan lemah di pasaran seluruh

dunia, kata peniaga.

Pada 5 petang, Indeks Komposit FTSE Bursa Malaysia (FBM) susut 11.58

mata atau 0.8 peratus kepada 1,497.52, selepas dibuka 2.0 mata lebih

rendah pada 1,507.1.

Indeks utama bergerak antara 1,495.39 dan 1,507.19.

Seorang peniaga berkata pelabur mengambil petunjuk daripada penurunan

semalaman di Wall Street berikutan kebimbangan baru mengenai hutang

negara zon euro meskipun peningkatan dalam data pengeluaran industri

Amerika Syarikat (US) yang lebih baik daripada yang dijangkakan.

Indeks Kewangan turun 117.83 mata kepada 13,758.02, Indeks Perusahaan

susut 0.64 mata kepada 2,797.72 dan Indeks Perladangan turun 49.87 mata

kepada 7,925.17.Indeks FBM Emas susut 71.3 mata kepada 10,230.45,

Indeks FBM Ace turun 16.6 mata kepada 4,218.91 manakala Indeks FBM70

susut 61.979 mata kepada 10,757.87.

Pasaran berada dalam kedudukan negatif dengan kaunter rugi mengatasi

kaunter untung sebanyak 473 berbanding 256 manakala 296 kaunter tidak

berubah, 368 tidak diniagakan manakala 33 yang lain digantung.

Sejumlah 1.275 bilion saham bernilai RM1.816 bilion diniagakan

berbanding 1.119 bilion saham bernilai RM1.764 bilion semalam.

Antara kaunter paling untung, MTD Capital meningkat 51 sen kepada

RM8.51, Hap Seng menokok 36 sen kepada RM5.78, Fareast menambah 24 sen

kepada RM7.30, Guan Chong menambah 18 sen kepada RM1.98 manakala KFC

untung 17 sen kepada RM3.97.

Jumlah dagangan di Pasaran Utama meningkat kepada 994.217 juta saham

bernilai RM1.749 bilion berbanding 857,785 juta saham bernilai RM1.703

bilion semalam.

Waran meningkat kepada 236.996 juta saham bernilai RM58.779 juta

berbanding 192.519 juta unit bernilai RM42.346 juta sebelumnya.

Jumlah dagangan di Pasaran ACE susut kepada 41.310 juta saham

bernilai RM748.0 juta berbanding 63.773 juta saham bernilai RM15.726

juta pada Rabu.

Barangan pengguna menyumbang sejumlah 31.461 juta saham yang

diniagakan di Pasaran Utama, barangan perusahaan 217.741 juta, pembinaan

56.520 juta, perdagangan dan perkhidmatan 424.559 juta, teknologi

23.271 juta, infrastruktur 9.139 juta, kewangan 64.621 juta, hotel

13.583 juta, hartanah 116.869 juta, perladangan 25.536 juta,

perlombongan 5.042 juta, REIT 5.814 juta dan dana tertutup 61,900. -

Bernama

Thursday, December 16, 2010

The performance of the FBM KLCI has been lackluster since last Friday, having given up all the 11.23 pts it gained last Thursday. Yesterday, the market again ended below the 1,510 pt-level. With the exception of last Thursday, the index has closed below the 1,510 pt-level in every session since 11 Dec 2010.

The FBM KLCI has to take out the 1,510 pt-level, failing which the market is expected to remain stuck in the recent trading band ranging from the 1,474 pt-level to the 1,510 pt-level, albeit the short-term downtrend channel has been violated.

Meanwhile, we maintain our near-term bullish view as the market is still trading at above uptrend line 1. Last month’s rebound off uptrend line 1 also signaled the market’s intention to continue extending its uptrend.

Immediate resistance is still seen at the 1,510 pt-level, after which the historic high is the only resistance we can detect. To the downside, there is immediate support at the 1,500 pt-level, followed by the 1,485-1,492 pts area.

The FBM KLCI has to take out the 1,510 pt-level, failing which the market is expected to remain stuck in the recent trading band ranging from the 1,474 pt-level to the 1,510 pt-level, albeit the short-term downtrend channel has been violated.

Meanwhile, we maintain our near-term bullish view as the market is still trading at above uptrend line 1. Last month’s rebound off uptrend line 1 also signaled the market’s intention to continue extending its uptrend.

Immediate resistance is still seen at the 1,510 pt-level, after which the historic high is the only resistance we can detect. To the downside, there is immediate support at the 1,500 pt-level, followed by the 1,485-1,492 pts area.

Market Review

Range bound trading. The FBM KLCI closed 1.48 points lower yesterday, largely dragged down by Genting Bhd but the downside was well supported by a continued uptrend in finance stocks such as CIMB, Maybank, RHBCap and AMMB. Today’s key corporate headlines include Top Glove reported a 44.6% y-o-y decline in 1QFY11 earnings, MRCB and IJM Land agreeing to extend their MOU on a potential merger until Dec 29 this year, Digi and Celcom may ink a definitive agreement on network collaboration by next month and DRB-Hicom has signed an MOU with Russian truck maker Kamaz group to assemble and distribute its trucks in Malaysia. Meanwhile, Wall Street’s lower overnight close may set the tone for our market today.

Bursa ditutup rendah berikutan tekanan jualan

KUALA LUMPUR 15 Dis - Harga-harga saham ditutup rendah hari ini

berikutan tekanan jualan, selari dengan kerugian di bursa-bursa

serantau, kata peniaga.

Pada 5 petang, Indeks Komposit FTSE Bursa Malaysia (FBM) susut 1.48

mata atau 0.1 peratus kepada 1,509.10, selepas dibuka 0.89 mata lebih

tinggi pada 1,511.47.

Indeks utama bergerak antara 1,504.75 dan 1,514.24 Peniaga

bagaimanapun berkata, minat berterusan dalam saham berwajaran tinggi

seperti CIMB, Maybank, RHB Capital dan AMMB serta kaunter berharga

rendah, membantu mengurangkan kerugian secara menyeluruh.

Dow Jones Industrial Average menokok 0.42 peratus kepada 11476.54,

Nasdaq Composite meningkat 0.11 peratus kepada 2627.72 dan Standard

& Poor"s 500 menambah 0.09 peratus kepada 1241.59.

Indeks Kewangan meningkat 95.199 mata kepada 13,875.85, Indeks

Perusahaan susut 9.5 mata kepada 2,798.36 dan Indeks Perladangan

berkurangan 14 mata kepada 7,975.04.

Sentimen pasaran kini negatif dengan kaunter rugi mengatasi kaunter

untung sebanyak 439 berbanding 330 manakala 287 kaunter tidak berubah,

337 tidak diniagakan manakala 32 yang lain digantung.

Sejumlah 1.119 bilion saham bernilai RM1.764 bilion diniagakan berbanding 1.173 bilion saham bernilai RM1.677 bilion semalam.

Antara saham paling untung, Aeon menokok 28 sen kepada RM6.50,

Lafarge menambah 27 sen kepada RM7.80, MHB menokok 25 sen kepada

RM5.39, Dutch Lady meningkat 20 sen kepada RM18.00 dan Jaya Tiasa

meningkat 17 sen kepada RM4.30.

Jumlah dagangan di Pasaran Utama berkurangan kepada 857,785 juta

saham bernilai RM1.703 bilion berbanding 973,342 juta saham bernilai

RM1.636 bilion semalam.

Waran meningkat kepada 192.519 juta unit bernilai RM42.346 juta berbanding 120.676 juta unit bernilai RM26.813 juta sebelumnya.

Jumlah dagangan di Pasaran ACE berkurangan kepada 63.773 juta saham

bernilai RM15.726 juta berbanding 75.696 juta saham bernilai RM12.871

juta pada Selasa.

Barangan pengguna menyumbang sebanyak 29.917 juta saham yang

diniagakan di Pasaran Utama, barangan perusahaan 196.509 juta,

pembinaan 49.441 juta, perdagangan dan perkhidmatan 278.668 juta,

teknikal 23.313 juta, infrastruktur 19.202 juta, kewangan 82.428 juta,

hotel 9.557 juta, hartanah 99.954 juta, perladangan 52.924 juta,

perlombongan 1.358 juta, REIT 14.413 juta dan dana tertutup 101,600. -

Bernama

Wednesday, December 15, 2010

Technical View

There has been no follow-through buying interest in the market since last Thursday’s 11.23-pt gain. Even worse, all of last Thursday’s gains quickly evaporated last Friday. Since then, the index has been trading in lackluster fashion at below the meaningful 1,510 pt-level.

As we mentioned previously, except for last Thursday, the index has ended every session between the 1,474 pt-level and the 1,510 pt-level since 11 Dec 2010. The FBM KLCI has to take out the 1,510 pt-level, failing which the market is expected to remain stuck in the recent trading band ranging from the 1,474 pt-level to the 1,510 pt-level, albeit the short-term downtrend channel has been violated.

Meanwhile, we maintain our near-term bullish view as the market is still trading at above the uptrend line 1. Last month’s rebound off uptrend line 1 also signaled the market’s intention to continue extending its uptrend. Immediate resistance is still seen at the 1,510 pt-level, after which the historic high is the only resistance we can detect. To the downside, there is immediate support at the 1,500 pt-level, followed by the 1,485-1,492 pts area.

As we mentioned previously, except for last Thursday, the index has ended every session between the 1,474 pt-level and the 1,510 pt-level since 11 Dec 2010. The FBM KLCI has to take out the 1,510 pt-level, failing which the market is expected to remain stuck in the recent trading band ranging from the 1,474 pt-level to the 1,510 pt-level, albeit the short-term downtrend channel has been violated.

Meanwhile, we maintain our near-term bullish view as the market is still trading at above the uptrend line 1. Last month’s rebound off uptrend line 1 also signaled the market’s intention to continue extending its uptrend. Immediate resistance is still seen at the 1,510 pt-level, after which the historic high is the only resistance we can detect. To the downside, there is immediate support at the 1,500 pt-level, followed by the 1,485-1,492 pts area.

Market Review

Caught in a tight range. The FBM KLCI ended flat at 1510.58 points yesterday, continuing on with its range-bound trading. Gainers and losers were also quite evenly matched. Today’s news headlines include Starhill REIT buying nine properties from YTL Group for RM1,054m to be paid for in cash and new Starhill REIT units, Time dot Com to supply international and domestic fibre leases/bandwidth for 3 years to Digi, KNM Group to form JV with Petrosab Logistik to target oil and gas projects in Sabah, Hiap Teck Ventures made a RM1.2m loss in its 1QFY11, Heitech Padu wins the Road Transport Department's contract for computer maintenance valued at RM36.8m, YTL Power bought a 30% stake in Estonian state oil company Eesti Energia's oil share project in Jordan, and DRB-Hicom signs an MOU with to assemble and distribute Russia's Kamaz trucks. Overnight, Wall Street was mildly higher, which should have little bearing on today's market direction.

Dagangan Bursa Malaysia kukuh

KUALA LUMPUR 14 Dis - Harga saham ditutup kukuh hari ini dalam

dagangan jajaran kecil selepas kenaikan baru-baru ini, kata para

peniaga.

Pada 5 petang, Indeks Komposit FTSE Bursa Malaysia (FBM KLCI) naik

0.79 mata, atau 0.05 peratus kepada 1,510.58, selepas dibuka tinggi 0.98

mata kepada 1,510.77. Indeks utama itu bergerak antara 1,506.03 dan

1,512.82.

Bursa tempatan memberikan reaksi positif kepada pasaran luar negara

yang lebih baik semalaman sebelum aktiviti pengambilan untung sederhana

berlaku. Bagaimanapun, ia berada dalam aliran meningkat ke arah sesi

penutup.

Indeks Kewangan naik 54.21 mata kepada 13,780.65, Indeks Perusahaan

meningkat 7.26 mata kepada 2,807.86 dan Indeks Perladangan menokok 62.25

mata kepada 7,989.04.

Indeks FBM Emas menambah 17.12 mata kepada 10,301.75 dan Indeks FBM

70 naik 44.69 mata kepada 10,771.62.Bagaimanapun, Indeks FBM Ace turun

28.04 mata kepada 4,278.02.

Suasana pasaran positif dengan kaunter untung mengatasi kaunter rugi

sebanyak 390 berbanding 347 manakala 309 kaunter tidak berubah dan 347

tidak diniagakan.

Sejumlah 1.173 billion saham bernilai RM1.677 bilion diniagakan

berbanding 1.158 bilion saham bernilai RM1.662 bilionDi kalangan kaunter

untung utama, Land & General yang diniagakan cergas meningkat 1.5

sen kepada 48.5 sen, Olympia turun satu sen kepada 30.5 sen, KNM-CE naik

2.5 sen kepada 14.5 sen, Carotech menokok satu sen kepada tujuh sen dan

Petronas Chemicals tidak berubah pada RM5.55.

Jumlah dagangan di Pasaran Utama meningkat kepada 973,342 juta saham

bernilai RM1.636 bilion daripada 951.355 juta sah

Waran turun kepada 120.676 juta unit bernilai RM26.813 juta daripada

132.602 juta unit bernilai RM37.72 juta sebelumnya.

Perolehan dagangan di Pasaran ACE naik kepada 75.696 juta saham

bernilai RM12.871 juta daripada 71.917 juta saham bernilai RM12.34 juta

pada Isnin.

Barangan pengguna menyumbang 39.596 juta saham yang diniagakan di

Pasaran Utama, barangan perusahaan 200.004 juta, pembinaan 53.194 juta,

perdagangan dan perkhidmatan 326.138 juta, teknologi 20.992 juta,

prasarana 22.053 juta, kewangan 64.751 juta, hotel 9.647 juta, hartanah

148.263 juta, perladangan 68.453 juta, perlombongan 2.574 juta, REITs

17.42 juta dan dana tertutup 256,900 - Bernama

Monday, December 13, 2010

Technical View

The FBM KLCI is trying to break out from

the recent trading zone ranging from 1,474 pts to 1,510 pts.

Unfortunately, there was no follow-through interest in the market

following last Thursday’s rally. Instead, the index ended the day back

below the 1,510 pt-level. The market would need another strong push to

the upside to confirm that the index is going to extend its uptrend

further after violating the downtrend channel. If not, there is a

possibility that the benchmark will be stuck between the 1,474-pt and

1,510-pt trading range.

Meanwhile, we maintain our near-term bullish view as the market is still trading at above the uptrend line 1. Needless to say, the longer-term outlook remains bullish as the index continues to extend its rising trend since March 2009.

Immediate resistance is still seen at the 1,510 pt-level. After the 1,510 pt-level, the historic high is the only resistance we can detect. To the downside, there is immediate support at the 1,500 pt-level, followed by the 1,485-1,492 pts area.

Market Review

Range bound trading. The FBM KLCI staged a mild follow-through technical rebound over last week’s trading, with the key index ending the week at 1,507.28 pts, posting a w-o-w gain of 6.3 pts. Among the key market news are Jan-Sept FDIs in Malaysia jumped to RM17bn, DRB-HICOM is scheduled to sign a definitive agreement on 21 Dec 2010 with Volkswagen AG to assemble VW cars in Malaysia, Petronas denies report on RM8bn bid for UK firm, Parkson to take up anchor tenancy for Nu Sentral, Southern Acids’ 2Q net profit surges 19-fold, SapuraCrest’s Q3 net profit rises marginally, and BToto’s 2Q earnings decline 36.7% y-o-y. US stocks closed last Friday with solid gains and at two-year highs as investors welcomed a surprise narrowing of the trade deficit that raised hopes of a boost to economic growth. The DJIA rose 40.26 pts to 11,410.32, while the S&P 500 climbed 7.40 pts to 1,240.40. Therefore, we expect the local bourse to trade in positive territory today.

Dagangan teguh minggu ini

KUALA LUMPUR 12 Dis. - Harga-harga saham di Bursa Malaysia dijangka

bergerak teguh minggu ini dengan lebih banyak aliran masuk dana meskipun

terdapatnya kelemahan jangka pendek dan kebimbangan berhubung dasar

monetari China dan krisis zon Euro.

Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur (FBM KLCI) kekal

melepasi 1,500 dengan jumlah dagangan yang menggalakkan terus memberikan

kewibawaan kukuh kepada daya ketahanannya, kata ketua penyelidik runcit

Affin Investment Bank, Dr. Nazri Khan.

Pada minggu lalu, petunjuk pasaran utama mengukuh 6.3 mata kepada

1,507.28 selepas mencatatkan kenaikan tinggi dalam sejarah iaitu

1,528.01 pada hari Khamis, didorong oleh minat belian kukuh ke atas

saham-saham mewah penting.

Bagaimanapun, ia tidak bertahan lama dan susut ekoran kegiatan

pengambilan untung sehari kemudian kerana para pelabur memilih untuk

menjual ketika harga tinggi.

"Walaupun terdapatnya kelemahan jangka pendek pada hari Jumaat dan

kebimbangan di China/Eropah, kami menyaksikan tingkah laku risiko

pelabur yang positif di pasaran ekuiti, kemungkinan didorong oleh

pendapatan korporat yang baik dan 'ura-ura' berhubung langkah

pengukuhan," katanya.

Faktor lain termasuklah pilihan raya, harga komoditi yang kukuh dan

perolehan bon tempatan yang menarik.

Selain daripada itu, hakikat yang Dow Jones berada pada paras tinggi

dua tahun dan Nikkei pula pada paras tinggi tujuh bulan juga boleh

menjadi pendorong untuk menolak naik indeks-indkes Asia termasuk FBM

KLCI.

"Kami juga menjangkakan kemudahruapan ekuiti yang berkurangan untuk

baki bulan ini untuk menyokong FBM KLCI meningkat," kata beliau.

'Impak Januari' yang ketara dengan pengumpulan akhir tahun

saham-saham mewah terpilih dalam beberapa minggu akhir tahun ini turut

menyokong pasaran tempatan.

"Pada masa ini, kami melihat sektor hartanah dan pembinaan (dengan

fokus kepada kaunter berkaitan pilihan raya yang mempunyai kaitan

politik) sebagai dua sektor yang menguasai 'impak Januari' di bursa

tempatan, kata beliau.

Memandangkan indeks-indeks hartanah/pembinaan kekal menghampiri paras

tinggi tiga tahun, terdapatnya jangkaan untuk melihat lebih banyak

pengukuhan ke atas sektor-sektor ini untuk menolak naik FBM KLCI.

"Bergerak ke hadapan, kami percaya yang pasaran tempatan kemungkinan

menunjukkan daya tahan dengan potensi menaik minggu depan.

"Dengan mudah tunai yang banyak pada masa ini, kami tidak terperanjat

untuk melihat FBM KLCI menuju ke arah 1,530 dalam tempoh terdekat,"

katanya.

Apa-apa sahaja yang melepasi 1,530 akan menjuruskan FBM KLCI kepada

kerancakan yang baik dan seterusnya ke paras tinggi terbaharu 1,550 pada

bahagian awal tahun depan, tambah beliau. Pasaran ditutup pada hari

Selasa sempena cuti sambutan Maal Hijrah.

Berdasarkan kepada mingguan, Indeks FBM Emas menokok 84.98 mata

kepada 10,255.42, Indeks FBM Top 100 naik 66.2 mata kepada 10,010.48 dan

Indeks FBM Ace melonjak 68.28 mata kepada 4,261.36.

Indeks Kewangan pula mengembang 217.25 mata kepada 13,767.5 sementara

indeks Perusahaan lebih rendah sebanyak 66.96 mata kepada 2,786.66 dan

Indeks Perladangan lebih tinggi 35.76 mata kepada 7,862.13.

Petronas Chemicals ialah antara saham yang bergerak aktif sepanjang

minggu urus niaga. Ia ditutup empat sen lebih tinggi pada RM5.58 pada

Jumaat.

Pada minggu sebelumnya, syarikat induknya Petronas memeterai

Memorandum Persefahaman dengan BASF untuk mengendalikan kajian

kemungkinan untuk menghasilkan kimia khusus di dalam negara dengan

pelaburan bersama berjumlah sehingga RM4 bilion.

Tenaga Nasional, yang memaklumkan ia akan meminta kerajaan untuk

menyemak kembali tarif gas asli jika harga arang batu meningkat dengan

ketara dan seterusnya menjadi beban kewangan, susut 19 sen kepada

RM8.60.

Harga purata arang batu telah mengukuh kepada melebihi US$110 (RM341)

setan, yang sudah pasti akan menjejaskan pendapatan gergasi utilitinya.

DRB-Hicom juga diniagakan aktif walaupun ia berkata ia tidak tahu

mengenai ura-ura berhubung sebarang cadangan penswastaan. Ia naik 15 sen

kepada RM1.80.

Terdapat juga laporan yang menyatakan, Tan Sri Syed Mokhtar Al

Bukhary dipercayai sedang mempertimbangkan untuk mengambil secara

persendirian kumpulan auto dan perbankan.

Jumlah dagangan mingguan melonjak kepada 4.968 bilion saham bernilai

RM8.94 bilion daripada 4.89 bilion saham bernilai RM9 bilion minggu

lepas.

Jumlah dagangan di Pasaran Utama turun kepada 3.754 bilion unit

bernilai RM8.612 bilion daripada 4.23 bilion unit bernilai RM8.85 bilion

sebelumnya.

Jumlah dagangan di pasaran ACE menambah kepada 375.025 juta saham

bernilai RM84.661 juta daripada 298.08 juta saham bernilai RM84.46 juta

Jumaat sebelumnya.

Jumlah dagangan waran meningkat kepada 827.357 juta unit bernilai

RM233.123 juta daripada 347.79 juta unit bernilai RM61.13 juta minggu

sebelumnya. - Bernama

Friday, December 10, 2010

Market Review

Strength begets strength. As expected, the FBM KLCI rallied 11 points yesterday, piercing through its 1512 to 1514-point resistance zone. Big gainers among the component stocks were Tenaga, Genting, CIMB, Petronas Chemicals and PPB Group. Market breadth was also positive, with gainers beating losers by 494 to 307. Today’s news headlines are Malaysia's Industrial Production Index rose by 3.0% in October with manufacturing up 4.5%, electricity 5% but mining fell by 1.1%, SP Setia reported RM75.2m in net profit in its fiscal 4Q, Bolton disposes of its 100% stake in Lim Thiam Leong Realty, which holds the Campbell Complex, for RM50m cash. Overnight, the Dow as well as the European bourses were little changed. Hence, yesterday's bullish sentiment on the Malaysian stock exchange should spill over to the morning session, although profit-taking could possibly set in in the afternoon

Bursa kukuh seiring pasaran serantau

KUALA LUMPUR 9 Dis - Harga saham di Bursa Malaysia meningkat ekoran

bantuan CIMB dan Petronas Chemicals, yang dirangsang oleh sentimen

positif di dalam pasaran serantau serta perangkaan jualan pengeluaran

negara ini, kata seorang peniaga.

Semasa ditutup, Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur (FBM

KLCI) menokok 11.23 mata kepada 1,521.29, yang menghampiri paras

tertinggi 1,528.01, selepas dibuka meningkat 2.73 mata kepada 1,512.79.

Indeks Kewangan meningkat 123.17 mata kepada 13,853.62, Indeks

Perusahaan menokok 10.53 mata kepada 2,833.86 dan Indeks Perladangan

meningkat 22.59 mata kepada 7,925.57.

Indeks FBM Emas melonjak 75.84 mata kepada 10,329.8, Indeks FBM 70

meningkat 54.05 mata kepada 10,715.4 dan Indeks FBM Ace naik 34.29 mata

kepada 4,185.82.

Dagangan keseluruhan meningkat kepada 1.5257 bilion saham bernilai

RM2.481 bilion daripada 1.084 bilion saham bernilai RM2.176 bilion, yang

dicatatkan pada Rabu.

Petronas Chemicals dan kaunter berkaitannya adalah antara saham aktif

hari ini. Petronas Chemicals meningkat 13 sen kepada RM5.54 dan waran

panggilannya melonjak 14.5 sen kepada 38.5 sen.

Kaunter aktif yang lain ialah DRB-Hicom selepas muncul berita bahawa

Tan Sri Syed Mokhtar Al Bukhary dipercayai sedang menimbangkan

menjadikan kumpulan perbankan dan automotif itu sebagai syarikat

persendirian. DRB-Hicom turun 5.0 sen kepada RM1.65 dan warannya turun

4.0 sen kepada 37.5 sen.

Jumlah dagangan di pasaran utama meningkat kepada 1.082 bilion saham

bernilai RM2.354 bilion daripada 869.099 juta saham bernilai RM2.127

bilion, yang dicatatkan pada Rabu.

Perolehan waran meningkat kepada 341.316 juta unit bernilai RM99.897

juta, daripada 118.733 juta unit bernilai RM27.099 juta, yang diniagakan

sebelum ini.

Bagaimana pun, dagangan di Pasaran ACE turun kepada 87.07 juta saham

bernilai RM23.249 juta, daripada 92.7 juta saham, bernilai RM19.687

juta, pada minggu lepas.

Produk pengguna mencatatkan 44.557 juta saham diniagakan di Pasaran

Utama, produk perusahaan 301.141 juta, pembinaan 82.125 juta, dagang dan

perkhidmatan 297.608 juta, teknologi 24.459 juta, prasarana 25.502

juta, kewangan 65.263 juta, hotel 5.541 juta, hartanah 206.505 juta,

perladangan 26.364 juta, perlombongan 427,300, REIT 3.248 juta dan dana

tertutup 83,700.

- Bernama

Thursday, December 9, 2010

Market Review

Against all odds. The FBM KLCI bucked the trend yesterday, closing with an 8-point gain at 1510 points although regional markets were in the red. The jump was also supported by positive market breadth, with 458 gainers against 310 losers. Today’s news headline are the Cabinet has agreed to a revision of electricity tariff but has not decided on the timing, Shangri-la Hotels (Malaysia) will collaborate with a Khazanah Nasional-controlled company to jointly develop a 5-star resort in Langkawi, Kedah, Dayang Enterprise Holdings entered into a conditional agreement with AWH Equity Holdings for the sale of its 40% stake in Syarikat Borcos Shipping for RM135m cash, an Sri Syed Mokhtar is believed to be considering taking DRB-HICOM private. With the Dow making mild gains last night, the FBM KLCI should continue to charge higher today, possibly clearing above the 1512–1514 pt resistance area.

Bursa kukuh di akhir dagangan

KUALA LUMPUR 8 Dis - Harga saham di Bursa Malaysia ditutup lebih

tinggi dengan pembelian berterusan saham CIMB dan Tenaga Nasional telah

membantu meningkatkan pengukur pasaran walau pun bursa serantau

mencatatkan prestasi bercampur-campur, kata seorang peniaga.

Semasa ditutup, Indeks Komposit FTSE Bursa Malaysia (FBM KLCI)

menokok 8.32 mata kepada 1,510.06, selepas dibuka meningkat 2.78 mata

kepada 1,504.52.Ia mencecah ketinggian pada paras 1,513.24 pada awal

hari ini.

Indeks Kewangan melonjak 108.04 mata kepada 13,730.45, Indeks

Perusahaan turun 25.4 mata kepada 2,823.33 dan Indeks Perladangan

menokok 32.84 mata kepada 7,902.98.

Indeks FBM Emas melonjak 64.26 mata kepada 10,253.96, Indeks FBM 70

meningkat 99.75 mata kepada 10,253.96 dan Indeks FBM Ace meningkat 7.78

mata kepada 4,151.53.

Jumlah dagangan meningkat kepada 1.084 bilion saham, bernilai RM2.176

bilion, daripada 846.115 juta saham, bernilai RM1.56 bilion, yang

dicatatkan pada Isnin.

Pasaran ditutup bagi perayaan Maal Hijrah pada Selasa. Di kaunter

aktif, Petronas Chemical menokok 2.0 sen kepada RM5.41, DRB-Hicom

melonjak 17 sen kepada RM1.70, Axiata meningkat 6.0 sen kepada RM4.73

dan Careplus menokok 7.0 sen kepada 34 sen.

Di kaunter paling untung, MTD Capital meningkat 86 sen kepada RM7.91,

BLD Plantation melonjak 40 sen kepada RM5.00 dan British American

Tobacco menokok 38 sen kepada RM45.86.Antara saham berwajaran tinggi,

CIMB meningkat 23 sen kepada RM8.70, Maybank turun 1.0 sen kepada

RM8.40, Sime Darby menambah 4.0 sen kepada RM8.78, Tenaga Nasional

meningkat 14 sen kepada RM8.58 dan Genting menokok 10 sen kepada

RM10.80.

Jumlah dagangan di pasaran utama merosot kepada 869.099 juta saham,

bernilai RM2.127 bilion, daripada 672.870 juta saham, bernilai RM1.522

bilion, yang dicatatkan pada Isnin.

Perolehan waran merosot kepada 118.733 juta unit, bernilai RM27.099

juta, daripada 66.741 juta unit, bernilai RM13.866 juta, yang diniagakan

sebelum ini. Perolehan di Pasaran ACE merosot kepada 92.700 juta saham,

bernilai RM19.687 juta, daripada 100.147 juta saham, bernilai RM20.626

juta, pada minggu lepas.

Produk pengguna mencatatkan 51.826 juta saham diniagakan di Pasaran

Utama, produk perusahaan 207.855 juta, pembinaan 68.652 juta, dagang dan

perkhidmatan 307.228 juta, teknologi 20.194 juta, prasarana 15.158

juta, kewangan 69.794 juta, hotel 808,300, hartanah 86.069 juta,

perladangan 35.941 juta, perlombongan 914,200, REIT 4.579 juta dan dana

tertutup 75,700.- Bernama

Wednesday, December 8, 2010

Market Review

Drifting sideways. The FBM KLCI managed to close marginally higher at 0.76 points to 1,501.74 points on Monday led by buying interest in selected financials. Corporate newsflow includes: AirAsia plans to form a Philippines unit by mid of next year, Spritzer in talks with JV partners to produce bottled mineral waters in China and Australia,Hartalega has said that its factory operation in the district of Ijok is still in operation despite reports of the government having ordered a shutdown, Alam Martim may have to write off RM30m in debts and the tussle for Carrefour Malaysian operations has intensified with Tan Sri Abdul Aziz Shamsuddin having launched a RM1.2bn bid.Overnight, Dow’s lacklustre performance which closed 3.03 points lower on concerns of the Fed’s ballooning budget deficit is likely to weigh down on our market sentiment today.

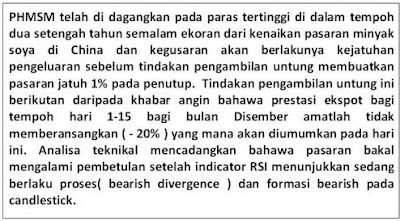

Technical View

The CPO prices resumed its uptrend in earnest after the two weeks of consolidation phase in mid-November came to an end by violating the short-term downtrend line. Having been stuck in between the RM2,700-RM2,800 / tonne area for more than a year, the prices started to rally furiously in recent months following the major breakout from the “Ascending Triangle”.

Both the near-term and mid-term technical outlook of the CPO market will remain bullish as long as prices stay above the RM2,700-RM2,800 / tonne area. The fast appreciation of CPO prices since October this year basically reaffirms our view that the breakout from the RM2,800 /tonne level had substantially improved the futures market’s technical landscape.

Nevertheless, the market will soon be facing a very tough challenge at the formidable RM3,750 /tonne level. After the CPO prices sharply tumbled in 1Q08, four major failed rebound attempts were seen at the RM3,750 / tonne level in the subsequent 4 months. As a result, the RM3,750 has become a very tough resistance and the market is now trading not too far away from this level. We might see the uptrend taking a breather at around this level. However, should this level be taken out, we are eyeing the RM4,000 / tonne level as the next resistance. To the downside, look for an immediate support at the RM3,452 / tonne level followed by the RM3,100 / tonne level.

Both the near-term and mid-term technical outlook of the CPO market will remain bullish as long as prices stay above the RM2,700-RM2,800 / tonne area. The fast appreciation of CPO prices since October this year basically reaffirms our view that the breakout from the RM2,800 /tonne level had substantially improved the futures market’s technical landscape.

Nevertheless, the market will soon be facing a very tough challenge at the formidable RM3,750 /tonne level. After the CPO prices sharply tumbled in 1Q08, four major failed rebound attempts were seen at the RM3,750 / tonne level in the subsequent 4 months. As a result, the RM3,750 has become a very tough resistance and the market is now trading not too far away from this level. We might see the uptrend taking a breather at around this level. However, should this level be taken out, we are eyeing the RM4,000 / tonne level as the next resistance. To the downside, look for an immediate support at the RM3,452 / tonne level followed by the RM3,100 / tonne level.

Monday, December 6, 2010

Bursa Malaysia diramal diniagakan tinggi

KUALA LUMPUR 5 Dis. - Bursa Malaysia dijangka

diniagakan tinggi minggu depan dengan Indeks Komposit FTSE Bursa

Malaysia Kuala Lumpur (FBM KLCI) meningkat ke paras 1,530 mata, kata

peniaga.

Ketua Penyelidik Runcit Affin Investment Bank Dr. Nazri Khan berkata,

indeks petunjuk pasaran dijangka memperoleh limpahan positif daripada

kenaikan harga-harga saham di Eropah dan Amerika Syarikat (AS).

"Data pekerjaan yang mencatatkan angka terbaik dalam tempoh tiga

tahun serta lanjutan potongan cukai di AS dijangka menyokong pasaran

Asia, termasuk bursa tempatan," katanya dalam unjuran teknikalnya di

sini.

Beliau berkata, kenaikan dijangkakan minggu depan kerana kebanyakan

indeks serantau mengatasi indeks utama - Hang Seng melepasi 23,000 mata,

Nikkei melepasi 10,000 mata dan Taiwan Index melepasi 8,500 mata.

"Kami yakin ketegangan global sudah diambil kira berdasarkan

pembetulan pada minggu lepas. Kemasukan semula dana jangka pendek dengan

pembelian saham berharga rendah mendorong harga saham meningkat,"

katanya. Nazri berkata, pengukuhan ringgit dan minyak sawit mentah juga

akan merangsang indeks petunjuk pasaran.

"Kami mendapati kerancakan prapilihan raya sudah bermula dalam

pasaran apabila Perdana Menteri, Datuk Seri Najib Tun Razak pada minggu

lepas, mengumumkan pemilihan Umno akan ditangguhkan selama 18 bulan.

"Kami mengunjurkan belian saham-saham perbankan berkaitan Program

Transformasi Ekonomi serta saham pembinaan berkaitan pilihan raya,

secara bergilir-gilir, dengan saham berkaitan politik akan meningkatkan

lagi indeks utama minggu depan," katanya.

Pada minggu yang baru berakhir, petunjuk pasaran FBM KLCI kebanyakan

tinggi.

Bagaimanapun, ia susut pada Jumaat berikutan aktiviti pengambilan

untung, namun berjaya kekal melepasi paras psikologi yang penting pada

1,500 mata.

Petunjuk pasaran FBM KLCI meningkat 8.93 mata kepada 1,500.98

berbanding 1,492.05 pada Jumaat lepas. Indeks FBM Emas meningkat 52.25

mata kepada 10,170.44 dan Indeks FBM 70 menokok 57.46 mata kepada

10,499.19. Indeks FBM Ace bagaimanapun turun 75.75 mata kepada 4,192.98.

Indeks Kewangan susut 55.07 mata kepada 13,550.25 manakala Indeks

Perusahaan meningkat 2.36 mata kepada 2,853.62 manakala Indeks

Perladangan melonjak 159.14 mata kepada 7,826.37.

Jumlah dagangan mingguan berkurangan kepada 4.89 bilion saham

bernilai RM9 bilion berbanding 6.18 bilion saham bernilai RM11.32 bilion

minggu lepas.

Jumlah dagangan di Pasaran Utama susut kepada 4.23 bilion unit

bernilai RM8.85 bilion berbanding 5.08 bilion unit bernilai RM11.13

bilion sebelumnya.

Jumlah dagangan di pasaran ACE susut kepada 298.08 juta saham

bernilai RM84.46 juta berbanding 358.82 juta saham bernilai RM114.55

juta Jumaat lepas.

Jumlah dagangan waran meningkat kepada 347.79 juta unit bernilai

RM61.13 juta berbanding 323.06 juta unit bernilai RM55.8 juta minggu

lepas. - Bernama

Thursday, December 30, 2010

Market Review

The high is nigh. The local bourse climbed another 6.9 points to end at 1524.34 on the back of buying support on index heavyweights such as BAT, Genting and KLK. Trading volume remained light but was higher at 908m compared to the 2 preceding trading days. Renewed concerns over the weak datapoints from the US contributed to bouts of profit taking although this was well absorbed. Today’s major headlines are: (i) TM and Axiata to probe allegations of kickbacks received from Alcatel Lucent for the award of previous contracts; (ii) Mitrajaya bags a RM53.5m contract for the construction of a hangar; and (iii) Proton to decide by early next year on the merger of its manufacturing assets. There is a good possibility that the FBM KLCI will re-attempt to take out the alltime high of 1531.99 pts notched on 9 Nov before the year is out. Overnight, the Dow extended its gain. We wish all our clients and readers a Happy New Year and may 2011 bring greater wealth and prosperity.

Bursa Malaysia ditutup tinggi

KUALA LUMPUR 29 Dis - Harga saham di Bursa Malaysia ditutup

kebanyakannya lebih tinggi hari ini apabila para pelabur terus membeli

saham berwajaran tinggi terpilih, yang memberi isyarat kemungkinan rali

pratahun baru, kata para peniaga.

Indeks Komposit FTSE Bursa Malaysia Kuala Lumpur (FBM KLCI) ditutup

meningkat 6.9 mata kepada 1,524.34, Indeks itu bergerak antara paras

1,520.19 dan 1,526.93 selepas dibuka pada paras 1,520.45. Paras paling

tinggi dicapai indeks itu ialah 1,528.01, yang dicatatkan pada 10 Nov.

Indeks Kewangan meningkat 38.44 mata kepada 13,878.94, Indeks

Perladangan meningkat 43.42 mata kepada 8,076.4 dan Indeks Perusahaan

meningkat 20.38 mata kepada 2,844.35.