Blog ini telah di kemaskini di http://seminarjutawansaham.blogspot.com

My Blog List

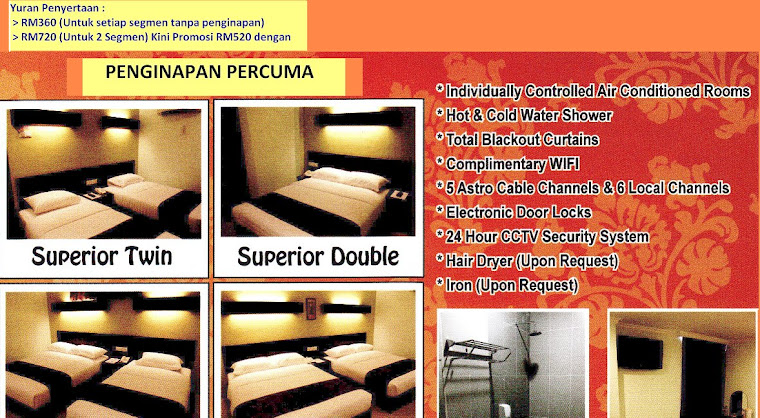

...kini mengadakan promosi bagi peserta yang ingin menyertai seminar untuk dua segmen dengan diskaun sebanyak RM200 serta penginapan percuma (untuk seminar di Pusat Latihan PUABUMI sahaja)......rebutlah peluang mempelajari ilmu pelaburan ini...

Penginapan percuma hanya untuk penyertaan dua segmen di Pusat Latihan PUABUMI Kemaman, Terengganu sahaja...

Barisan Penceramah

Kami bersedia untuk turun padang membongkar rahsia pelaburan di Bursa Malaysia

Destinasi Seminar

Pakej Eksklusif Istimewa ~ Seminar Jutawan Saham dan CPO siri ke 3 adalah pembuka untuk tahun 2011 ini di Pusat Latihan PUABUMI pada 8hb dan 9hb Januari 2011

Seminar Jutawan Saham & CPO akan berada di Santuary Resort Cherating pada 15 Januari 2011 ( segmen ekuiti ) dan 16 Januari 2011 ( segmen CPO )

Kem Pelaburan PUABUMI II akan berada di Hotel Midah Kuala Lumpur pada 13 Ogos 2011 ( segmen CPO ) dan 14 Ogos 2011 ( segmen Ekuiti )

Seminar Jutawan Saham & CPO akan berada di Suria City Hotel, Johor Bahru pada 29 Januari 2011 ( segmen ekuiti ) dan 30 Januari 2011 ( segmen CPO )

Tuesday, December 13, 2011

Friday, December 9, 2011

Monday, December 5, 2011

Seminar Pelaburan - Teknik Goldfinger RM

Atas

sebab-sebab teknikal, Seminar Jutawan CPO Edisi Emas di Sungai Petani

ditangguhkan. Pada mereka yang telah mendaftar sila hubungi 019-200 9622

untuk keterangan lanjut.

Tuesday, November 29, 2011

Friday, January 21, 2011

Market Review

Healthy technical correction? The FBM KLCI ended at 1,566.51, down 3.53 pts on an extended technical sell-off of most counters, especially financial and small-cap stocks. Market breadth was negative, with losers beating winners 545 to 293 while 270 counters were unchanged, 283 untraded and 36 suspended. Among the key market news are the persistently high prices of coal could cut the TNB's 2011 earnings by as much as 20%, OSK eyes Thai brokerage, Perak MB said Vale project may cost up to RM14bn and likely to start in July or August, EPF buys London’s Fleet Street at RM720m, Bina Puri unit wins RM62.8m contract, Puncak Niaga fails to get Indian jobs, OilCorp set to be delisted on 25 Jan 2011, and Nepline Bhd, Maxbiz Corp Bhd and Prime Utilities Bhd reprimanded for breaching various regulations. Overnight, US stocks erased most of their losses as Morgan Stanley, Home Depot Inc. and builders rallied, DJIA closed almost unchanged at 11,811.8. However, as the Singapore and Hong Kong bourses posted their biggest drop in many weeks yesterday, we expect to see some selling pressure in local bourse today.

Wednesday, January 19, 2011

Technical View

The FBM KLCI continued to consolidate healthily following a gain of some 45 pts in the first week of the year. Although the market shed 4.45 pts yesterday, the market action was still confined within the recent consolidation range. Thus far, the market has been able to retain most of the 45 pts of gains. The FBM KLCI has not only been trending sideways in a constructive manner for more than a week, but what is more important is that the index has remained within the uptrend channel. This is because we view market action within the uptrend channel as insignificant as we will continue to expect the FBM KLCI to trend higher as long as it maintains a posture within the channel. Meanwhile, the index’s current constructive posture is a signal that there is a great possibility that it would be able to create a new record high soon. From the current level, the 1,572 pt-level is the immediate resistance. To the downside, immediate support still lies at the 1,551 pt-level, followed by the 1,532 pt-level.

Market Review

Consolidation. The market shed 4.45 points to close at 1,570.04 points, with Petronas Chemical and Petronas Dagangan being the main drag. Market volume moderated marginally to 1.704bn shares traded. Today’s notable corporate headlines are Proton being in talks with various banks to raise RM2.35bn for funding requirements to help revive Lotus, Khazanah Nasional to start inviting bids to divest its 32.2% stake in Pos Malaysia, KPJ Healthcare to acquire two medical centres for RM28.1m, a property company from the Persian Gulf is looking at listing a REIT valued at RM833m on Bursa Malaysia and KNM receiving another 4-year extension for its term loan facility worth RM351.3m with Maybank. Taking the cue from relatively strong set of corporate results released in the US and the positive sentiment on Dow overnight, we expect the overall undertone for our market to remain positive today.

Tuesday, January 18, 2011

Technical View

Last week’s retracement back below the RM3,750 / tonne level indicates that the CPO market had experienced another failed breakout attempt at this level. After CPO prices tumbled sharply in 1Q08, there were actually four major failed rebound attempts at the RM3,750 / tonne level in the 4 months that followed. Hence, last week’s action represents another failed attempt at this level after more than 2 years.

Anyhow, the failed breakout attempt at the RM3,750 / tonne level has not altered the market’s solid rising trend. CPO price are still expected to extend higher aggressively in the near future as long as it stays above the uptrend line as is indicated in the above daily chart.

Even if the uptrend line is violated, the breakdown will not alter our longer-term outlook towards the CPO market. As we mentioned many times before, the breakout from the RM2,800/tonne level, which coincided with the breakout from the “Ascending Triangle”, had substantially improved the CPO futures’ technical landscape. The mid-term technical outlooks of the CPO market will remain bullish as long as prices stay above the RM2,700-RM2,800/tonne area.

From the current level, there is immediate resistance at the RM3,750 / tonne level, followed by the RM4,000 / tonne level. To the downside, immediate support is seen at the RM3,471 / tonne level.

Anyhow, the failed breakout attempt at the RM3,750 / tonne level has not altered the market’s solid rising trend. CPO price are still expected to extend higher aggressively in the near future as long as it stays above the uptrend line as is indicated in the above daily chart.

Even if the uptrend line is violated, the breakdown will not alter our longer-term outlook towards the CPO market. As we mentioned many times before, the breakout from the RM2,800/tonne level, which coincided with the breakout from the “Ascending Triangle”, had substantially improved the CPO futures’ technical landscape. The mid-term technical outlooks of the CPO market will remain bullish as long as prices stay above the RM2,700-RM2,800/tonne area.

From the current level, there is immediate resistance at the RM3,750 / tonne level, followed by the RM4,000 / tonne level. To the downside, immediate support is seen at the RM3,471 / tonne level.

Market Review

Hanging on. The market traded in a typical range bound fashion yesterday but managed to eke out a 4.6-pt gain to close at the new record of 1574.49 pts. The volume of shares traded remained brisk, with the likes of Digi, Petronas Chemicals and Maybank driving the underlying index higher. Among the corporate headlines for today: (i) Hing Yiap has received an unconditional takeover offer from Everest Hectare for RM1.50/share; (ii) SP Setia to undertake a mixed commercial and residential project in Bangsar, and (iii) Southern Steel’s net profit contracted 62.4% y-o-y in 4QFY10 on lower margins. The prevailing bullish undertone should sustain the local bourse’s positive momentum today. Investors will take the cue from the slew of results set to be announced in the US by end of the week to gauge the earnings recovery prospects.

FBM KLCI catat paras tertinggi baru

KUALA LUMPUR 17 Jan - Bursa Malaysia ditutup teguh hari ini dengan

indeks utama berada pada paras tinggi baharu, dirangsang oleh keuntungan

dalam saham-saham kewangan dan saham mewah di celah-celah belian asing

yang menggalakkan, kata para peniaga.

Indek Komposit FTSE Bursa Malaysia KLCI (FBM KLCI) bagi 30 saham

menokok 4.6 mata atau 0.3 peratus untuk ditutup pada 1,574.49, melepasi

paras tinggi 1,572.21 yang dicatatkan pada 7 Jan, 2011.Ia dibuka 3.58

mata lebih tinggi pada 1,573.47.

Indeks Kewangan menokok 65.80 mata kepada 14,385.47 dan Indeks

Perindustrian lebih tinggi 4.64 mata kepada 2,932.94.Indeks Perladangan,

bagaimanapun, susut 9.09 mata kepada 8,230.58.Indeks FBM Emas mengukuh

26.51 mata kepada 10,855.31 dan Indeks FBM Ace menambah 26.51 mata

kepada 10,855.31.Indeks FBM70, bagaimanapun, lebih rendah 0.4 mata

kepada 11,655.43.

Saham-saham untung mengatasi saham rugi dengan 412 berbalas 410

sementara 312 kaunter tidak berubah, 247 tidak diniagakan dan 26 yang

lain digantung.

Jumlah dagangan berkurangan kepada 1.907 bilion saham bernilai

RM2.201 bilion daripada 2.144 bilion saham bernilai RM2.537 bilion

Jumaat lepas.

Mendahului kaunter aktif ialah SAAG Consolidated, yang mengukuh satu

sen kepada 13.5 sen.

Benalec yang baharu disenaraikan, sebuah syarikat penyedia

perkhidmatan carter kapal dan pembinaan marin bersepadu, menambah 34 sen

kepada RM1.34.

Ia mula disenaraikan di Pasaran Utama Bursa Malaysia dengan premium

36 sen daripada harga tawaran RM1 sesaham.

KUB mengembang 11 sen kepada 91.5 sen, Ho Wah Genting menokok empat

sen kepada 47.5 sen dan Talam Corp meningkat separuh sen kepada 11 sen.

Di kalangan saham berwajaran tinggi, Maybank naik lapan sen kepada

RM8.97, CIMB Group menambah tujuh sen kepada RM8.80, Sime Darby kekal

pada RM9.35 dan Petronas Chemical lebih tinggi 20 kepada RM6.35.

Di pasaran utama, jumlah dagangan turun kepada 1.644 bilion saham

bernilai RM2.142 bilion daripada 1.821 bilion saham bernilai RM2.466

bilion Jumaat lepas.Perolehan dagangan di Pasaran Ace mengembang kepada

102.497 juta saham bernilai RM14.553 juta daripada 93.226 juta saham

bernilai RM16.416 juta.

Jumlah dagangan waran pula merosot kepada 146.805 juta saham bernilai

RM38.533 juta daripada 216.508 juta saham bernilai RM51.346 juta

sebelumnya.- Bernama

Friday, January 14, 2011

Market Review

A lift from heavyweights. The FBM KLCI jumped 5.07 pts, or 0.32%, to 1,571.56 pts, backed by gains in selected blue chips. Volume increased to 2.7bn shares valued at RM3bn. Today’s key market news are Suria Capital bags a RM1bn job to build a 300MW combined cycle gas turbine gas-fired power plant project in Sabah, the Perak state government is considering setting up its own low-cost carrier terminal (LCCT) in the northern part of the state, JCorp plans a group-wide transformation, MMM’s RM20m debt written off, approval in writing for the Langat 2 plant still pending and standalone brokers can now get 1+1 status. Overnight, US stocks fell, pulling the DJIA to 11,731.9, or 23.54 pts lower, as initial jobless claims rose more than estimated. We expect the market to continue to trade sideways pending major fresh leads.

Saham mewah naik dagangan Bursa tinggi

KUALA LUMPUR 13 Jan - Harga saham di Bursa Malaysia ditutup lebih

tinggi hari ini, selepas disokong oleh kenaikan harga saham berwajaran

tinggi yang diterajui oleh Genting, kata para peniaga.

Sehingga jam 5 petang, FTSE Bursa Malaysia KLCI (FBM KLCI) menokok

5.07 mata atau 0.32 peratus kepada 1,571.56. Ia dibuka meningkat 4.25

mata kepada 1,570.74.Para peniaga berkata keyakinan para pelabur

dirangsang oleh perangkaan ekonomi yang positif dari zon euro dan

pasaran AS.

Indeks Kewangan menokok 37.92 mata kepada 14,341.11, Indeks

Perladangan menokok 35.73 mata kepada 8,243.65 dan Indeks Perusahaan

menokok 16.74 mata kepada 2,923.83.

Indeks FBM Emas menokok 48.70 mata kepada 10,854.89, Indeks FBM70

melonjak 101.58 mata kepada 11,729.77. Indeks FBM Ace pula turun 27.49

mata kepada 4,425.08.

Kaunter untung mengatasi kaunter rugi sebanyak 528 kepada 341

manakala 305 tidak berubah, 210 tidak diniaga dan 31 yang lain

digantung.

Jumlah dagangan meningkat kepada 2.704 bilion saham bernilai RM3.001

bilion berbanding dengan 2.473 bilion saham bernilai RM2.703 bilion

semalam.

Mendahului saham paling aktif ialah Karambunai yang meningkat 1.5 sen

kepada 22.5 sen. SAAG Consolidated turun 0.5 sen kepada 13.5 sen

manakala Compugates tidak berubah pada harga 7.0 sen.

Antara saham paling untung, British American Tobacco melonjak RM1.30

kepada RM48.48, JT International meningkat 35 sen kepada RM6.60,

Mudajaya meningkat 31 sen kepada RM5.20 dan Boustead Holdings menokok 28

sen kepada RM5.91.

Di kalangan saham berwajaran tinggi, CIMB turun 1.0 sen kepada RM8.77

manakala Maybank meningkat 1.0 sen kepada RM8.89.

Sime Darby meningkat 5.0 sen kepada RM9.35, Petronas Chemicals

menokok 1.0 sen kepada RM6.03 dan Axiata menokok 2.0 sen kepada RM4.89.

Di pasaran utama, jumlah dagangan meningkat kepada 2.315 bilion saham

bernilai RM2.911 bilion daripada 2.171 bilion saham bernilai RM2.636

bilion semalam.

Perolehan di Pasaran ACE meningkat kepada 113.475 juta saham bernilai

RM16.341 juta berbanding dengan 100.844 juta saham bernilai RM14.461

sebelum itu.

Jumlah dagangan waran juga melonjak kepada 263.574 juta saham

bernilai RM68.246 juta berbanding dengan 183.557 juta bernilai RM48.534

juta pada Rabu.- Bernama

Thursday, January 13, 2011

Market Review

The FBM KLCI gained 3.5 points yesterday on the back of gains chalked up by Genting, Genting Malaysia, Petchem, Tenaga and CIMB. The increase, though marginal, was in tandem with regional bourses, all of which were in positive territory. Overnight, the Dow jumped 83 points while the European markets were also broadly higher. It is likely that positive momentum will continue to lift the FBM KLCI today. Today’s news headlines are Pembinaan BLT, which is under the Ministry of Finance, is raising RM10bn worth of sukuk to fund the construction of police quarters and facilities, Tenaga Nasional signed two agreements worth RM2.1bn for its Ulu Jelai hydroelectric project, Faber received non-renewal notice for two of its contracts in Abu Dhabi worth RM184m annually, and SP Setia is said to be leading the race for the 30-year concession to build and operate the Penang International Convention Centre.

Belian berterusan Bursa ditutup tinggi

KUALA LUMPUR 12 Jan - Harga-harga saham di Bursa Malaysia ditutup

tinggi hari ini, disokong oleh belian berterusan untuk saham-saham

berwajaran tinggi, kata para peniaga.

Pada pukul 5 petang, KLCI FTSE Bursa Malaysia (FBM KLCI) naik 3.55

mata atau 0.23 peratus kepada 1,566.49, selepas dibuka 1.42 mata lebih

tinggi pada 1,564.36.

Pasaran tempatan memulakan hari dengan nada positif di mana para

pelabur mengambil petunjuk daripada penutup semalaman yang tinggi di

Wall Street.

Indeks Kewangan merosot 5.70 mata kepada 14,303.19, Indeks

Perladangan turun 5.44 mata kepada 8,207.92 dan Indeks Perusahaan lega

4.64 mata kepada 2,907.09.

Sementara itu, Indeks FBM Emas, mengukuh 41.13 mata kepada 10,806.19

dan Indeks FBM70 melonjak 118.35 mata kepada 11,628.19. Indeks FBM Ace

bagaimanapun, turun 1.80 mata kepada 4,452.57.

Saham-saham untung mengatasi saham rugi dengan 460 berbalas 406

sementara 273 tidak berubah, 249 tidak diniagakan dan 39 yang lain

digantung urus niaga.

Jumlah dagangan merosot kepada 2.473 bilion saham bernilai RM2.703

bilion daripada 2.706 bilion saham bernilai RM2.637 bilion semalam.

Antara saham yang paling aktif, Metronic Global merosot setengah sen

kepada enam sen dan Talam Corporation lebih rendah satu sen kepada 11.0

sen tetapi SAAG Consolidated kekal pada 14 sen.

Saham-saham berwajaran tinggi pula, Maybank kerugian enam sen kepada

RM8.88 sementara CIMB Group menokok satu sen kepada RM8.78.

Petronas Chemicals menambah empat sen kepada RM6.02 sementara Genting

menambah 42 sen kepada RM11.84 tetapi Axiata turun satu sen kepada

RM4.87.

Kaunter berkaitan minyak dan gas, SapuraCrest melonjak 33 sen kepada

RM3.78, KNM naik 15 sen kepada RM3.17, Kencana menokok 13 sen kepada

RM2.86 dan Dialog meningkat lima sen kepada RM2.21.

Di pasaran utama, jumlah dagangan berkurangan kepada 2.171 bilion

saham bernilai RM2.636 bilion daripada 2.312 bilion saham bernilai

RM2.550 bilion semalam.

Jumlah dagangan di Pasaran Ace merosot kepada 100.844 juta saham

bernilai RM14.461 juta berbanding 209.847 juta unit bernilai RM35.773

juta sebelumnya.

Jumlah waran, bagaimanapun, mengukuh kepada 183.557 juta bernilai

RM48.534 juta berbanding 171.528 juta saham bernilai RM45.296 juta

sebelumnya.- Bernama

Wednesday, January 12, 2011

Market Review

Buying support kicks in. The FBM KLCI continued to succumb to mild profit taking, closing a marginal 0.58 points lower at 1,562.9 points, dragged down by PLUS. Trading volume on Bursa Malaysia remained high, rising to 2.6bn shares traded compared to 2.3bn the previous day. Today’s corporate news include the Government announcing 19 projects valued at RM67bn under the ETP for approval, Gas Malaysia is said to be looking at a listing on Bursa Malaysia, Top Glove expects to invest RM160m in Cambodia for rubber tree planting purposes and Low Yat group has proposed to purchase the entire assets and liabilities of AP Land for RM305m. Taking the cue from Wall Street’s positive overnight close of 34.4 points on expectations of a stronger than expected earnings reporting season, we expect out market to climb today.

Pengambilan untung Bursa bercampur-campur

KUALA LUMPUR 11 Jan - Harga-harga saham di Bursa Malaysia ditutup

bercampur-campur hari ini dengan indeks utama kekal dalam wilayah

negatif pada sepanjang hari berikutan aktiviti pengambilan untung ke

atas saham-saham berwajaran tinggi terpilih, kata peniaga.

Pada 5 petang, FTSE Bursa Malaysia KLCI (FBM KLCI) susut 0.58 mata

atau 0.04 peratus kepada 1,562.94 selepas dibuka 4.25 mata lebih rendah

pada 1,559.27.

Seorang peniaga berkata pasaran dijangka dalam keadaan pembetulan

minggu ini selepas peningkatan ketara minggu lepas.

Indeks Kewangan susut 31.41 mata kepada 14,308.89, Indeks Perladangan

susut 13.14 mata kepada 8,213.36 dan Indeks Perusahaan turun 4.59 mata

kepada 2,911.73.

Indeks FBM Emas menokok 3.33 mata kepada 10,765.06 dan Indeks FBM70

menambah 2.97 mata kepada 11,509.84.

Indeks FBM Ace bagaimanapun turun 27.89 mata kepada 4,454.37.

Kaunter untung mengatasi kaunter rugi sebanyak 437 berbanding 426

manakala 282 tidak berubah, 244 tidak diniagakan dan 37 digantung.

Jumlah dagangan meningkat kepada 2.706 bilion saham bernilai RM2.637

bilion berbanding 2.226 bilion saham bernilai RM2.800 bilion semalam.

Mengetuai saham untung ialah SAAG Consolidated, yang menokok setengah

sen kepada 14 sen. Talam Corp menambah dua sen kepada 12 sen dan

Karambunai meningkat satu sen kepada 21.5 sen.

Asia Media, yang mula disenarai di Pasaran ACE hari ini, meningkat

5.5 sen kepada 28.5 sen selepas dibuka pada 40 sen, atau 17 sen,

melepasi harga penawaran pada 23 sen.

Antara saham berwajaran tinggi, Maybank dan CIMB Group masing-masing

turun enam sen kepada RM8.94 dan RM8.77 manakala Sime Darby rugi satu

sen kepada RM9.29.

Di Pasaran Utama, jumlah dagangan meningkat 2.312 bilion saham

bernilai RM2.550 bilion berbanding 1.874 bilion saham bernilai RM2.721

bilion semalam.

Jumlah dagangan di Pasaran ACE meningkat kepada 209.847 juta unit

bernilai RM35.773 juta berbanding 135.485 juta unit bernilai RM21.530

juta pada Isnin.

Jumlah waran berkurangan kepada 171.528 juta saham bernilai RM45.296

juta berbanding 206.981 juta saham bernilai RM52.951 juta sebelumnya.

- Bernama

Tuesday, January 11, 2011

Technical View

Unlike the last two sessions, the FBM KLCI eventually failed to hold on to part of the last week’s gains and ended the day with a los off about 9 pts. Nevertheless, yesterday’s retracement was not excessive considering that the index had put on some 45 pts on the first week of 2011.

As we mentioned last week, we have drawn the new resistance line which is projected from the uptrend line. As a result, we have a new uptrend channel on the daily chart. In fact, we will view the market action within the uptrend channel as insignificant as we will continue to expect the FBM KLCI to trend higher as long as it maintains a posture within the channel.

At this stage, the resistance line is still very much at the assumption stage, being simply a projection from uptrend line 1. This is because we would need at least three connecting points to draw a trend line but the September peak is the only point we have now.

From the current level, last Friday’s intra-day high of 1,572 pts is still the immediate resistance. To the downside, immediate support lies at the 1,551 pt-level, followed by the 1,532 pt-level.

As we mentioned last week, we have drawn the new resistance line which is projected from the uptrend line. As a result, we have a new uptrend channel on the daily chart. In fact, we will view the market action within the uptrend channel as insignificant as we will continue to expect the FBM KLCI to trend higher as long as it maintains a posture within the channel.

At this stage, the resistance line is still very much at the assumption stage, being simply a projection from uptrend line 1. This is because we would need at least three connecting points to draw a trend line but the September peak is the only point we have now.

From the current level, last Friday’s intra-day high of 1,572 pts is still the immediate resistance. To the downside, immediate support lies at the 1,551 pt-level, followed by the 1,532 pt-level.

Market Review

The expected correction. After notching up a record high last week, the inevitable correction finally set in yesterday, with the FBM KLCI sliding over 8 points at the close. Regional markets were also not spared a broad sell-down, sparked by renewed concerns over inflationary threats with the Jakarta Composite Index leading the decline. The number of shares traded on Bursa Malaysia remained high at over 2.2bn, indicating possibly strong foreign participation. Jelas Ulung has failed to deposit the RM50m ahead of the 5pm deadline yesterday for its bid to be considered as one of the takeover offers for PLUS; (ii) Transmile will sell 4 aircraft for RM209m; and (iii) a subsidiary of SAAG has inked a RM239m contract to build a 40k tramway in Melaka. The market may trade range bound today in search of fresh leads, with investors also taking the cue from external developments. Strong support is seen at 1551 pts. Overnight, the US markets finished weaker on concerns over European bank debt and the possible bailout of Portugal.A

Pengambilan untung Bursa ditutup tinggi

KUALA LUMPUR 10 Jan - Harga-harga saham di Bursa Malaysia ditutup

lebih rendah hari ini berikutan aktiviti pengambilan untung selepas

peningkatan kukuh lima hari berturut-turut, kata para peniaga.

Pada 5 petang, FTSE Bursa Malaysia KLCI (FBM KLCI) susut 8.69 mata

atau 0.55 peratus kepada 1,563.52 selepas dibuka 2.43 mata lebih tinggi

pada 1,574.64.

Peniaga berkata pasaran bermula positif hari ini tetapi jualan

berterusan saham-saham mewah terpilih didorong saham berkaitan kewangan

menyebabkan indeks utama itu ditutup pada kawasan negatif.

Indeks Kewangan susut 75.71 mata kepada 14,340.30, Indeks Perladangan

susut 21.93 mata kepada 8,226.50 dan Indeks Perusahaan merosot 12.74

mata kepada 2,916.32.

Indeks FBM Emas jatuh 30.14 mata kepada 10,761.73, Indeks FBM Ace

merosot 10.20 mata kepada 4,482.26 tetapi Indeks FBM70 naik 30.04 mata

kepada 11,506.87.

Kaunter jatuh melebihi untung 478 berbanding 427 sementara 233 tidak

berubah, 249 tidak didagangkan dan 38 digantung.

Jumlah dagangan merosot kepada 2.226 bilion saham bernilai RM2.800

bilion daripada 2.536 bilion saham bernilai RM3.454 bilion Jumaat lepas.

Di kalangan saham aktif, SAAG Consolidated naik tiga sen kepada 13.5

sen, Compugates Holdings meningkat setengah sen kepada tujuh sen

sementara Hubline merosot satu sen kepada 23.5 sen.

Di kalangan kaunter berwajaran tinggi, CIMB Group dan Petronas

Chemicals jatuh 10 sen setiap satu kepada RM8.83 dan RM5.86, Sime Darby

merosot tujuh sen kepada RM9.30 dan Genting jatuh empat sen kepada

RM11.26.

Di Pasaran Utama, jumlah dagangan menyusut kepada 1.874 bilion saham

bernilai RM2.721 bilion daripada 2.115 bilion saham bernilai RM3.351

bilion Jumaat lepas.Waran merosot kepada 206.981 juta saham bernilai

RM52.951 juta berbanding 292.271 juta saham bernilai RM74.636 juta

sebelumnya.

Jumlah dagangan di Pasaran ACE, bagaimanapun, naik kepada 135.485

juta saham bernilai RM21.530 juta berbanding 112.671 juta saham bernilai

RM22.547 juta Jumaat lepas.

Barangan pengguna menguasai 96.237 juta saham yang didagangkan di

Pasaran Utama, produk perusahaan 329.424 juta, pembinaan 173.158 juta,

dagangan dan perkhidmatan 843.967 juta, teknologi 35.690 juta, prasarana

17.057 juta, kewangan 100.740 juta, hotel 40.264 juta, harta 197.910

juta, perladangan 35.940 juta, perlombongan 660,800, REIT 2.519 juta dan

dana tertutup 182,400. - Bernama

Friday, January 7, 2011

Technical View

Little has changed as far as the USD/RM’s near-term and mid-term technical outlooks are concerned. The only notable development of late is that the RM had just charted a new high since the introduction of the managed-float system. Not even the strong support floor created at the RM3.07/USD level could defend the selling pressure on the USD.

Our view towards the USD/RM currency market has been relatively straightforward. Thus far, we have been using the downtrend channel for guidance. Although the USD rebounded in November, the rebound only managed to reach the middle point of the downtrend channel. This means that the November rebound was just a bearish rebound within a downtrend. From then, the USD started to depreciate against the RM again.

Hence, with reference to the same downtrend channel drawn in the daily chart many months ago, the USD is expected to continue depreciating against the RM until the channel is violated. Hence, we feel that that the USD/RM outlook will remain firmly bearish as long as USD/RM continues to trade inside the downtrend channel.

From the current level, there is immediate resistance at the RM3.07/USD level, followed by the RM3.11/USD and RM3.19/USD levels. To the downside, there is immediate support at the recent low of RM3.06/USD level.

Our view towards the USD/RM currency market has been relatively straightforward. Thus far, we have been using the downtrend channel for guidance. Although the USD rebounded in November, the rebound only managed to reach the middle point of the downtrend channel. This means that the November rebound was just a bearish rebound within a downtrend. From then, the USD started to depreciate against the RM again.

Hence, with reference to the same downtrend channel drawn in the daily chart many months ago, the USD is expected to continue depreciating against the RM until the channel is violated. Hence, we feel that that the USD/RM outlook will remain firmly bearish as long as USD/RM continues to trade inside the downtrend channel.

From the current level, there is immediate resistance at the RM3.07/USD level, followed by the RM3.11/USD and RM3.19/USD levels. To the downside, there is immediate support at the recent low of RM3.06/USD level.

Market Review

Key index ends higher. FBM KLCI added 2.2 points to 1,568.37, holding up its winning streak for the fourth consecutive day as losses prompted by profit-taking were well absorbed. Gainers led losers 507 to 295 while 284 counters were unchanged, 239 untraded and 34 others were suspended. Trading volume amounted to 2.2bn shares worth RM3.bn. The key market news today are Maybank plans to take over Kim Eng for

up to SGD1.79bn, Selangor makes fresh offers worth over RM9bn to water players, sources said Ramunia is in talks to acquire Syarikat Borcos Shipping SB, Kulim to appoint chairman 5 days before EGM, Hap Seng shares will be suspended today pending the announcement of a major corporate exercise, and Gan Boon Ting resigns as Tasek chief executive. Overnight, the dollar rallied but US equities and oil were lower. The S&P’s 500 Index lost 0.2% to 1,273.85 as earnings valuations climbed to almost 16 times its companies’ operating earnings. We expect investors to stay sidelined pending fresh leads, and thus do not expect major movements in the key index today.

up to SGD1.79bn, Selangor makes fresh offers worth over RM9bn to water players, sources said Ramunia is in talks to acquire Syarikat Borcos Shipping SB, Kulim to appoint chairman 5 days before EGM, Hap Seng shares will be suspended today pending the announcement of a major corporate exercise, and Gan Boon Ting resigns as Tasek chief executive. Overnight, the dollar rallied but US equities and oil were lower. The S&P’s 500 Index lost 0.2% to 1,273.85 as earnings valuations climbed to almost 16 times its companies’ operating earnings. We expect investors to stay sidelined pending fresh leads, and thus do not expect major movements in the key index today.

Bursa Malaysia terus catat rekod

KUALA LUMPUR 9 Jan - FTSE Bursa Malaysia KLCI (FBM KLCI) berjaya

mencapai paras yang lebih tinggi pada saat-saat akhir dagangan,

sekaligus mempertahan arah aliran meningkatnya bagi hari keempat

berturut-turut apabila kejatuhan yang disebabkan oleh pengambilan untung

diserap dengan baik.

Pada pukul 5 petang, FBM KLCI mencatatkan kenaikan 2.2 kepada

1,568.37 daripada 1,566.17 pada akhir dagangan semalamIndeks Kewangan

menokok 21.57 mata kepada 14,425.19, Indeks Perusahaan menambah 0.87

mata kepada 2,927.43 dan Indeks Perladangan meningkat 27.75 mata kepada

8,301.71. Indeks FBM Emas mengukuh 47.9 mata kepada 10,755.98, Indeks

FBM Ace menokok 4.35 mata kepada 4,427.14 dan Indeks FBM70 melonjak

152.07 mata kepada 11,431.74.

Saham untung mengatasi saham rugi dengan jumlah 507 berbanding 295

manakala 284 kaunter tidak berubah, 239 tidak diniagakan dan 34 yang

lain digantung urus niaga.

Saham-saham diurus niaga berjumlah 2.204 bilion bernilai RM3.141

bilion, susut daripada 2.346 bilion bernilai RM3.69 bilion yang

dicatatkan semalam.

Maybank, yang urus niaga sahamnya digantung pagi tadi, mengumumkan

bahawa ia akan membeli 44.6 peratus kepentingan dalam firma broker saham

yang berpangkalan di Singapura, Kim Eng Holdings Ltd, dengan harga

RM1.9 bilion (S$798 juta).

Saham-saham Maybank akan diniagakan semula urus niaga esok pada pukul

9.00 pagi, setelah disebutharga kali terakhir pada RM9.01.

Kemunculan sulung Maxwell International dalam pasaran utama hari ini

menyaksikan kaunter itu mengungguli saham-saham paling cergas hari ini.

Ia naik 2.5 sen kepada 56.5 sen setelah dibuka bagi premium dua sen pada

56 sen.

Bagi saham-saham cergas yang lain, SAAG Consolidated menokok setengah

sen kepada sembilan sen, Ramunia naik 1.5 sen kepada 59.5 sen, Pan

Malaysia menambah 1.5 sen kepada 13.5 sen dan Scomi mengukuh 1.5 sen

kepada 39.5 sen.

Dalam Pasaran Utama, jumlah dagangan bertambah kepada 1.816 bilion

saham bernilai RM3.051 bilion, daripada 1.768 bilion unit bernilai

RM3.549 bilion pada penutupan semalam.

Waran susut kepada 268.861 juta saham, bernilai RM63.991 juta,

daripada 474.062 juta unit, bernilai RM117.192 juta.

Pasaran ACE mencatatkan lonjakan jumlah dagangan kepada 100.726 juta

saham bernilai RM15.693 juta, daripada 88.934 juta unit bernilai

RM16.241 juta. - Bernama

Thursday, January 6, 2011

Technical View

The uptrend line 1 and uptrend line 2 which we have been using primarily in our analysis over the last few months have become less relevant after the FBM KLCI added some 45 pts since the new year began and created a new historic high.

We have now drawn a new resistance line which is projected from uptrend line 1. A basic theory on drawing a trend line is that we need at least three connecting points. In our current scenario, as it is portrayed in the above daily chart, the only connecting point we have is the September peak. Hence, this resistance line is still very much at the assumption stage, being simply a projection from the uptrend line 1.

The FBM KLCI staged a remarkable intra-day rebound yesterday, recouping losses of some 10 pts during the session and ended with a 14.28-pt gains. A market correction which ends on the same day during a strong upward phase is what we normally view as a sign of great conviction on the market’s near-term upside momentum. Despite the 47.3-pt gain recorded over the past three days, the daily RSI only closed at the 75.6 pt-level yesterday. As the FBM KLCI normally gets overbought beyond the 80 pt-level, this means the door is still open for additional gains.

Needless to say, the near-term technical outlook of the FBM KLCI is firmly bullish now as it is now trading at its historic high and continues to trend higher within the uptrend channel.

From the current level, yesterday’s intra-day high of 1,572 pts is the immediate resistance. To the downside, immediate support lies at the 1,551 pt-level, followed by the 1,532 pt-level.

We have now drawn a new resistance line which is projected from uptrend line 1. A basic theory on drawing a trend line is that we need at least three connecting points. In our current scenario, as it is portrayed in the above daily chart, the only connecting point we have is the September peak. Hence, this resistance line is still very much at the assumption stage, being simply a projection from the uptrend line 1.

The FBM KLCI staged a remarkable intra-day rebound yesterday, recouping losses of some 10 pts during the session and ended with a 14.28-pt gains. A market correction which ends on the same day during a strong upward phase is what we normally view as a sign of great conviction on the market’s near-term upside momentum. Despite the 47.3-pt gain recorded over the past three days, the daily RSI only closed at the 75.6 pt-level yesterday. As the FBM KLCI normally gets overbought beyond the 80 pt-level, this means the door is still open for additional gains.

Needless to say, the near-term technical outlook of the FBM KLCI is firmly bullish now as it is now trading at its historic high and continues to trend higher within the uptrend channel.

From the current level, yesterday’s intra-day high of 1,572 pts is the immediate resistance. To the downside, immediate support lies at the 1,551 pt-level, followed by the 1,532 pt-level.

Market Review

Winning streak continues. The FBM KLCI continued to charge higher yesterday, this time lifted by banking stocks CIMB, Maybank and Public Bank. At the close, the benchmark index jumped 14.28 points to 1566.17 points, which was more than 5 points off its best for the day. Market breadth was weaker than the day before, with 547 gainers against 320 losers. This was perhaps not surprising given that most regional markets were in the red yesterday. Overnight, the Dow climbed further with a 32-point gain while Europe closed mixed. There was little in terms of news flow and hence local stocks could continue to scale higher although a different group of stocks could take the lead today in typical rotational play.

Bursa Malaysia di paras tertinggi 3 hari berturut-turut

KUALA LUMPUR 5 Jan. - Pasaran saham tempatan

terus mengukuh pada hari ini apabila terus melonjak ke paras terbaik

dalam tempoh tiga hari berturut-turut.

Indeks Komposit Kuala Lumpur FTSE Bursa Malaysia (FBM KLCI) meningkat

14.28 mata atau 0.9 peratus kepada 1,566.17 mata di akhir dagangan.

FBM KLCI merekodkan paras tertinggi setakat ini pada dagangan tengah

hari apabila mencecah paras 1,571.85 mata.

Penganalisis pasaran tempatan berkata, dengan aliran dana asing ke

dalam pasaran, sentimen pelabur kekal positif.

Katanya, mereka menjangkakan aktiviti pengambilan untung akan berlaku

dalam masa terdekat ini, namun momentum kenaikan ini akan berterusan.

Kemungkinan untuk FBM KLCI mencecah paras 1,600 mata adalah sesuatu

yang tidak mustahil.

Pada penutup dagangan sebanyak 547 kaunter untung, 320 rugi dan 273

diniagakan tidak berubah di Bursa Malaysia.

Sementara itu, pasaran saham Asia gagal mengekalkan rentak positif

tahun baru apabila pelabur mengambil langkah mengaut keuntungan.

Pasaran saham Tokyo yang mencatatkan kenaikan sejak tujuh setengah

bulan, jatuh 0.17 peratus atau 17.33 mata kepada 10,380.77 mata.

Manakala Seoul jatuh 0.12 peratus, Shanghai turun 0.49 peratus,

Taipei merudum sebanyak 2.04 peratus.

Selain itu, Hong Kong meningkat 0.38 peratus dan pasaran saham

Singapura meningkat 0.12 peratus.

Wednesday, January 5, 2011

Technical View

Previously, we had betted on the formidable RM3,750 / tonne level putting a stop to the CPO prices’ rapid rise, at least temporarily. This is because the RM3,750/tonne level was a meaningful level. After CPO prices tumbled sharply in 1Q08, there were actually four major failed rebound attempts at the RM3,750/tonne level in the 4 months that followed. As a result, the RM3,750 became a very tough resistance.

Nevertheless, CPO prices are now trading above the RM3,750 / tonne level. We believe the short consolidation phase in the middle of November helped to propel CPO prices beyond the significant RM3,750 / tonne level with ease.

The prices continued to rally furiously after the consolidation in mid-November. The aggressive price action we are seeing now is basically the extension of the uptrend that started since the market staged a major breakout from the “Ascending Triangle” in October.

We had said before that the breakout from the RM2,800/tonne level, which coincided with the breakout from the “Ascending Triangle”, had substantially improved the CPO futures’ technical landscape. The mid-term technical outlooks of the CPO market will remain bullish as long as prices stay above the RM2,700- RM2,800/tonne area. As far as the nearer-term outlook is concerned, we have drawn a new short-term uptrend line in the above daily chart to provide guidance. Using this trend line as guidance, we know the near-term technical outlook of the market will remain bullish as long as it continues to extend its uptrend above the line.

From the current level, the RM4,400 / tonne level is the next resistance while additional resistance is seen at the RM4,154 / tonne level. To the downside, we are eyeing the RM3,750 / tonne level as the immediate support while next support is seen at the RM3,471 / tonne level.

Nevertheless, CPO prices are now trading above the RM3,750 / tonne level. We believe the short consolidation phase in the middle of November helped to propel CPO prices beyond the significant RM3,750 / tonne level with ease.

The prices continued to rally furiously after the consolidation in mid-November. The aggressive price action we are seeing now is basically the extension of the uptrend that started since the market staged a major breakout from the “Ascending Triangle” in October.

We had said before that the breakout from the RM2,800/tonne level, which coincided with the breakout from the “Ascending Triangle”, had substantially improved the CPO futures’ technical landscape. The mid-term technical outlooks of the CPO market will remain bullish as long as prices stay above the RM2,700- RM2,800/tonne area. As far as the nearer-term outlook is concerned, we have drawn a new short-term uptrend line in the above daily chart to provide guidance. Using this trend line as guidance, we know the near-term technical outlook of the market will remain bullish as long as it continues to extend its uptrend above the line.

From the current level, the RM4,400 / tonne level is the next resistance while additional resistance is seen at the RM4,154 / tonne level. To the downside, we are eyeing the RM3,750 / tonne level as the immediate support while next support is seen at the RM3,471 / tonne level.

Technical View

Potential consolidation. Yesterday, encouraged by the Dow's 93-point overnight gain, the FBM KLCI rallied another 18.47 points to close at another record high of 1551.89 points. Market breadth was decidedly positive, with 637 gainers against 233 losers. Overnight, the Dow inched up marginally by 20 points but the FTSE rallied by 1.9% while other European bourses rose marginally. Commodities suffered a sell-off last night, with crude oil falling by USD2.35 per barrel to USD89.20. Most other commodities were also lower but the biggest losers were metal, with gold falling 3% and silver, 5%. There was little in terms of news, but with overseas market holding up, the upward momentum should continue to carry local stocks higher in the morning session although profit-taking could set in subsequently after 2 straight days of strong gains.

Bursa Malaysia terus catat sejarah

KUALA LUMPUR 4 Jan - Dalam perkembangan yang belum pernah berlaku,

FTSE Bursa Malaysia KLCI (FBM KLCI) melepasi paras psikologi dan ditutup

pada paras tertinggi baharu buat hari kedua berturut-turut, sebahagian

besarnya dirangsang oleh keuntungan saham-saham perladangan.

Barometer pasaran menokok 18.47 mata atau 1.2 peratus untuk ditutup

pada 1,551.89 dalam dagangan cergas. Ia dibuka 1.15 mata lebih tinggi

pada 1,534.57.

Prestasi positif daripada kebanyakan pasaran ekuiti serantau yang

disokong oleh keuntungan semalaman di Wall Street, merangsang momentum

di sini, kata seorang peniaga.

Di Bursa Malaysia, Indeks Kewangan meningkat 136.87 mata kepada

14,116.32, Indeks Perusahaan menambah 53.84 mata kepada 2,930.08 dan

Indeks Perladangan melonjak 146.28 mata kepada 8,279.61. Indeks FBM Emas

menokok 121.75 mata kepada 10,613.49, Indeks FBM Ace meningkat 35.23

mata kepada 4,394.72 dan Indeks FBM70 menambah 106.67 mata kepada

11,169.58.

Kaunter untung mengatasi kaunter rugi sebanyak 637 berbanding 233

manakala 262 kaunter tidak berubah, 249 tidak diniagakan dan 30 yang

lain digantung.

Jumlah dagangan melonjak kepada 2.011 bilion saham bernilai RM2.88

bilion, beranding 1.608 bilion saham bernilai RM2.09 bilion, semalam.

Kaunter paling untung, British American Tobacco, meningkat 60 sen

kepada RM46.40, Sime Darby menokok 51 sen kepada RM9.46, Nestle menambah

42 sen kepada RM43.84, Ekovest untung 37 sen kepada RM2.74, Kulim

meningkat 28 sen kepada RM12.76 manakala KL Kepong menokok 28 sen kepada

RM22.66.

Antara kaunter aktif, Karambunai meningkat empat sen kepada 21 sen,

Talam menokok setengah sen kepada 9.5 sen, Borneo Oil menambah 7.5 sen

kepada 42 sen dan Malayan United meningkat dua sen kepada 22.5 sen.

Sebaliknya, United Plantation susut 28 sen kepada RM16.92, MAHB turun

21 sen kepada RM5.99 dan The Store rugi 18 sen kepada RM2.42.

Di Pasaran Utama, jumlah dagangan meningkat kepada 1.661 bilion saham

bernilai RM2.792 bilion berbanding 1.297 bilion unit bernilai RM2.015

bilion sebelumnya.

Waran meningkat kepada 269.316 juta saham bernilai RM68.508 juta

berbanding 213.234 juta unit bernilai RM57.886 juta yang direkodkan

sebelumnya.Jumlah dagangan di Pasaran ACE bagaimanapun berkurangan

kepada 63.007 juta saham bernilai RM11.91 juta berbanding 87.767 juta

unit bernilai RM14.631 juta semalam.- Bernama

Tuesday, January 4, 2011

Technical View

The market greeted 2011 with a new historic high by advancing nearly 15 pts, which basically confirmed the violation of the 1,510 pt-level. This means that the FBM KLCI is no longer stuck in the recent trading band ranging from the 1,474 pt-level to the 1,510 pt-level.

From here, the index could continue to create new historic highs in the near future. Our stand can be supported by the recent technical developments we mentioned last week. Firstly, the FBM KLCI has violated the short-term downtrend channel. Secondly, the index is starting to rebound from uptrend line 1. Last but not least, as stated above, the breakout from the 1,510 pt-level wrote off the possibility that the market will remain stuck in the recent sideways trading range.

Needless to say, the near-term technical outlook of the FBM KLCI is firmly bullish now as it is now trading at its historic high and continues to trend above uptrend line 1.

From the current level, the 1,550 psychological mark is the next resistance. The previous historic high of 1,532 pts has now become an immediate support while next support is seen at 1,510 pts.

From here, the index could continue to create new historic highs in the near future. Our stand can be supported by the recent technical developments we mentioned last week. Firstly, the FBM KLCI has violated the short-term downtrend channel. Secondly, the index is starting to rebound from uptrend line 1. Last but not least, as stated above, the breakout from the 1,510 pt-level wrote off the possibility that the market will remain stuck in the recent sideways trading range.

Needless to say, the near-term technical outlook of the FBM KLCI is firmly bullish now as it is now trading at its historic high and continues to trend above uptrend line 1.

From the current level, the 1,550 psychological mark is the next resistance. The previous historic high of 1,532 pts has now become an immediate support while next support is seen at 1,510 pts.

Market Review

2011 takes off with a bang. The local bourse welcomed the new year on a positive note with the FBM KLCI closing at an all-time high of 1533.42 pts on the first day of trading. With investors back in the market after the long New Year weekend, trading volume raced to 1.6bn versus the average of 906m in the previous week. Today’s key corporate headlines are: (i) Petra Energy is close to bagging a RM100m Murphy Oil job for hook up and commissioning works; (ii) MK Land sells 2 plots of land in Sg Buloh for RM130m; and (iii) Sunway inks 3 contracts worth some RM219m. With the underlying index in uncharted territory, the previous high of 1531.99 pts is now effectively a loose support, followed by the 1510 level. There is a possibility of a small pullback to digest the sharp gains yesterday although the overall strong close on the S&P and Dow overnight should generally see the positive trend continue. Crude oil price was steady, closing at USD91.54.

Bursa, ringgit catat rekod

KUALA LUMPUR 3 Jan. – Bursa Malaysia memasuki tahun baharu dengan

penuh gaya apabila melonjak ke paras tertinggi dalam sejarahnya sambil

disokong oleh nilai ringgit yang mencatat nilai paling kukuh sejak 13

tahun lalu.

Bursa saham tempatan dan ringgit juga digalakkan oleh sentimen

positif yang ditunjukkan pasaran serantau dan juga prospek pertumbuhan

yang baik.

Indeks Komposit Kuala Lumpur FTSE Bursa Malaysia (FBM KLCI) meningkat

14.51 mata kepada 1,533.42 manakala nilai mata wang tempatan diniagakan

pada RM3.06 berbanding sedolar Amerika Syarikat (AS)

FBM KLCI pada sesi tengah hari telah berjaya mencatat paras tertinggi

terbaharu iaitu 1,535.02 mata sebelum ditutup pada paras semasa untuk

mengatasi paras tertinggi pada November tahun lalu iaitu 1,528.01 mata.

Para penganalisis tempatan berkata, peningkatan pasaran saham

tempatan itu juga didorong oleh aliran dana asing ke dalam pasaran dan

para peniaga juga menjangka ia berterusan.

‘‘Kita bakal menyaksikan permulaan peningkatan yang digalakkan oleh

kecairan,’’ katanya dan menjangkakan paras pasaran boleh mencecah 1,550

mata dalam masa terdekat.

OSK Research, sebuah firma penyelidikan tempatan berkata, prospek

separuh pertama tahun ini adalah menggalakkan dengan penanda aras bakal

mencecah 1,648 mata.

Katanya, risiko seperti tekanan politik dan inflasi dijangka mungkin

memberi kesan minimum kepada bursa saham tempatan pada separuh pertama

ini.

Menurut Pengarah Eksekutif Urusniaga Jupiter Securities Sdn. Bhd.,

Nazzary Rosli berkata, lonjakan indeks pasaran modal tempatan sering

berlaku pada permulaan tahun baru ekoran kegiatan para pengurus dana

sedang menyusun semula portfolio pelaburan mereka.

‘‘Pada kebiasaannya, pengurus-pengurus dana ini mula memasuki pasaran

dan membeli saham-saham yang berpotensi di awal tahun baru. Disebabkan

aktiviti tersebut telah merancakkan keadaan pasaran pada hari ini.

‘‘Selain itu, keadaan pemulihan ekonomi yang dijangka berterusan

terutama di Amerika Syarikat (AS) pada tahun ini juga merupakan faktor

penyumbang kepada keadaan pasaran saham tempatan. Sebarang kesan positif

yang berlaku di sana akan meninggalkan kesan kepada pasaran saham

rantau dan Malaysia,’’ katanya kepada Utusan Malaysia.

Tambah Nazzary, keadaan itu akan berlanjutan untuk minggu ini kerana

aktiviti penyusunan semula portfolio pelaburan baru bermula dan ia akan

memakan masa.

‘‘Minggu hadapan ia akan kembali stabil apabila pelabur jangka pendek

akan mula menjual saham mereka bagi mendapatkan keuntungan berikutan

pasaran positif ini,’’ jelasnya.

Sementara itu, pasaran saham tempatan juga mendapat faedah daripada

prospek menggalakkan bursa-bursa utama di Asia yang yakin bahawa

pemulihan ekonomi global akan berterusan pada tahun ini.

Ini kerana pada separuh pertama tahun ini, bursa saham AS akan terus

berada dalam keadaan baik ekoran pemulihan ekonomi di negara berkenaan

sekali gus memberikan tempiasnya kepada Asia.

Di pasaran serantau, Indeks Hang Seng Hong Kong menokok 1.74 peratus,

Indeks Kospi , South Korea bertambah 0.93 peratus lebih tinggi dan

Indeks Straits Times, Singapura menambah 1.20 peratus.

Bagaimanapun, pasaran saham Australia, Jepun, New Zealand, Thailand

dan Vietnam pula ditutup sempena kelepasan am.

Monday, January 3, 2011

Technical View

The FBM KLCI ended the last day of 2010 with a slightly more than 5-pt loss. Nevertheless, the benchmark index still ended the session at above the 1,510 pt-level. We mentioned last Thursday that as the index was already more than 14 pts above the 1,510 pt-level, this level can be considered as having been violated. However, we also said that a break above last Wednesday’s intra-day high of 1,526 pts would make us more comfortable with the violation of the 1,510 pt-level. This is because market action such as the evaporating of more than 50% of last Tuesday’s gains on that day is normally viewed as a sign of weakness.

Regardless of the market action in the vicinity of 1,510 pts, our view towards the near-term market has been straight-forward. We will maintain our firmly bullish bias view towards the near-term market until uptrend line 1 is decisively violated.

The FBM KLCI’s historic high of 1,532 pts is still the only resistance which we can detect. To the downside, the 1,510 pt-level is still the immediate support while another support is seen at the 1,485- 1,492-pt area.

Regardless of the market action in the vicinity of 1,510 pts, our view towards the near-term market has been straight-forward. We will maintain our firmly bullish bias view towards the near-term market until uptrend line 1 is decisively violated.

The FBM KLCI’s historic high of 1,532 pts is still the only resistance which we can detect. To the downside, the 1,510 pt-level is still the immediate support while another support is seen at the 1,485- 1,492-pt area.

Market Review

A lower finish. The FBM KLCI lost 5.43 points to close at 1,518.91 on Thursday, which was the year’s last trading day. According to Bank Negara, net financing to the private sector grew at a slower pace in November, expanding by RM8.8bn, or 10.8% y-o-y, versus RM11.7bn, or 11.2% y-o-y, in October on fewer private debt securities issuances. IJM Land Bhd and Malaysian Resources Corp Bhd, which earlier announced plans to merge and potentially become the second largest property player in Malaysia, have aborted the plan. Dialog Group Bhd’s subsidiary Dialog E&C SB has been awarded a RM64.6m contract by Asean Bintulu Fertilizer SB for the provision of engineering, procurement, construction and commissioning of a new cooling tower. Meanwhile, the US markets ended the year mixed on Friday. Crude oil price, however, jumped USD1.54 to USD91.38.

Tuesday, December 13, 2011

Friday, December 9, 2011

Monday, December 5, 2011

Seminar Pelaburan - Teknik Goldfinger RM

Atas

sebab-sebab teknikal, Seminar Jutawan CPO Edisi Emas di Sungai Petani

ditangguhkan. Pada mereka yang telah mendaftar sila hubungi 019-200 9622

untuk keterangan lanjut.

Tuesday, November 29, 2011

Friday, January 21, 2011

Market Review

Healthy technical correction? The FBM KLCI ended at 1,566.51, down 3.53 pts on an extended technical sell-off of most counters, especially financial and small-cap stocks. Market breadth was negative, with losers beating winners 545 to 293 while 270 counters were unchanged, 283 untraded and 36 suspended. Among the key market news are the persistently high prices of coal could cut the TNB's 2011 earnings by as much as 20%, OSK eyes Thai brokerage, Perak MB said Vale project may cost up to RM14bn and likely to start in July or August, EPF buys London’s Fleet Street at RM720m, Bina Puri unit wins RM62.8m contract, Puncak Niaga fails to get Indian jobs, OilCorp set to be delisted on 25 Jan 2011, and Nepline Bhd, Maxbiz Corp Bhd and Prime Utilities Bhd reprimanded for breaching various regulations. Overnight, US stocks erased most of their losses as Morgan Stanley, Home Depot Inc. and builders rallied, DJIA closed almost unchanged at 11,811.8. However, as the Singapore and Hong Kong bourses posted their biggest drop in many weeks yesterday, we expect to see some selling pressure in local bourse today.

Wednesday, January 19, 2011

Technical View

The FBM KLCI continued to consolidate healthily following a gain of some 45 pts in the first week of the year. Although the market shed 4.45 pts yesterday, the market action was still confined within the recent consolidation range. Thus far, the market has been able to retain most of the 45 pts of gains. The FBM KLCI has not only been trending sideways in a constructive manner for more than a week, but what is more important is that the index has remained within the uptrend channel. This is because we view market action within the uptrend channel as insignificant as we will continue to expect the FBM KLCI to trend higher as long as it maintains a posture within the channel. Meanwhile, the index’s current constructive posture is a signal that there is a great possibility that it would be able to create a new record high soon. From the current level, the 1,572 pt-level is the immediate resistance. To the downside, immediate support still lies at the 1,551 pt-level, followed by the 1,532 pt-level.

Market Review

Consolidation. The market shed 4.45 points to close at 1,570.04 points, with Petronas Chemical and Petronas Dagangan being the main drag. Market volume moderated marginally to 1.704bn shares traded. Today’s notable corporate headlines are Proton being in talks with various banks to raise RM2.35bn for funding requirements to help revive Lotus, Khazanah Nasional to start inviting bids to divest its 32.2% stake in Pos Malaysia, KPJ Healthcare to acquire two medical centres for RM28.1m, a property company from the Persian Gulf is looking at listing a REIT valued at RM833m on Bursa Malaysia and KNM receiving another 4-year extension for its term loan facility worth RM351.3m with Maybank. Taking the cue from relatively strong set of corporate results released in the US and the positive sentiment on Dow overnight, we expect the overall undertone for our market to remain positive today.

Tuesday, January 18, 2011

Technical View

Last week’s retracement back below the RM3,750 / tonne level indicates that the CPO market had experienced another failed breakout attempt at this level. After CPO prices tumbled sharply in 1Q08, there were actually four major failed rebound attempts at the RM3,750 / tonne level in the 4 months that followed. Hence, last week’s action represents another failed attempt at this level after more than 2 years.

Anyhow, the failed breakout attempt at the RM3,750 / tonne level has not altered the market’s solid rising trend. CPO price are still expected to extend higher aggressively in the near future as long as it stays above the uptrend line as is indicated in the above daily chart.

Even if the uptrend line is violated, the breakdown will not alter our longer-term outlook towards the CPO market. As we mentioned many times before, the breakout from the RM2,800/tonne level, which coincided with the breakout from the “Ascending Triangle”, had substantially improved the CPO futures’ technical landscape. The mid-term technical outlooks of the CPO market will remain bullish as long as prices stay above the RM2,700-RM2,800/tonne area.

From the current level, there is immediate resistance at the RM3,750 / tonne level, followed by the RM4,000 / tonne level. To the downside, immediate support is seen at the RM3,471 / tonne level.

Anyhow, the failed breakout attempt at the RM3,750 / tonne level has not altered the market’s solid rising trend. CPO price are still expected to extend higher aggressively in the near future as long as it stays above the uptrend line as is indicated in the above daily chart.

Even if the uptrend line is violated, the breakdown will not alter our longer-term outlook towards the CPO market. As we mentioned many times before, the breakout from the RM2,800/tonne level, which coincided with the breakout from the “Ascending Triangle”, had substantially improved the CPO futures’ technical landscape. The mid-term technical outlooks of the CPO market will remain bullish as long as prices stay above the RM2,700-RM2,800/tonne area.

From the current level, there is immediate resistance at the RM3,750 / tonne level, followed by the RM4,000 / tonne level. To the downside, immediate support is seen at the RM3,471 / tonne level.

Market Review

Hanging on. The market traded in a typical range bound fashion yesterday but managed to eke out a 4.6-pt gain to close at the new record of 1574.49 pts. The volume of shares traded remained brisk, with the likes of Digi, Petronas Chemicals and Maybank driving the underlying index higher. Among the corporate headlines for today: (i) Hing Yiap has received an unconditional takeover offer from Everest Hectare for RM1.50/share; (ii) SP Setia to undertake a mixed commercial and residential project in Bangsar, and (iii) Southern Steel’s net profit contracted 62.4% y-o-y in 4QFY10 on lower margins. The prevailing bullish undertone should sustain the local bourse’s positive momentum today. Investors will take the cue from the slew of results set to be announced in the US by end of the week to gauge the earnings recovery prospects.

FBM KLCI catat paras tertinggi baru

KUALA LUMPUR 17 Jan - Bursa Malaysia ditutup teguh hari ini dengan

indeks utama berada pada paras tinggi baharu, dirangsang oleh keuntungan

dalam saham-saham kewangan dan saham mewah di celah-celah belian asing

yang menggalakkan, kata para peniaga.

Indek Komposit FTSE Bursa Malaysia KLCI (FBM KLCI) bagi 30 saham

menokok 4.6 mata atau 0.3 peratus untuk ditutup pada 1,574.49, melepasi

paras tinggi 1,572.21 yang dicatatkan pada 7 Jan, 2011.Ia dibuka 3.58

mata lebih tinggi pada 1,573.47.

Indeks Kewangan menokok 65.80 mata kepada 14,385.47 dan Indeks

Perindustrian lebih tinggi 4.64 mata kepada 2,932.94.Indeks Perladangan,

bagaimanapun, susut 9.09 mata kepada 8,230.58.Indeks FBM Emas mengukuh

26.51 mata kepada 10,855.31 dan Indeks FBM Ace menambah 26.51 mata

kepada 10,855.31.Indeks FBM70, bagaimanapun, lebih rendah 0.4 mata

kepada 11,655.43.

Saham-saham untung mengatasi saham rugi dengan 412 berbalas 410

sementara 312 kaunter tidak berubah, 247 tidak diniagakan dan 26 yang

lain digantung.

Jumlah dagangan berkurangan kepada 1.907 bilion saham bernilai

RM2.201 bilion daripada 2.144 bilion saham bernilai RM2.537 bilion

Jumaat lepas.

Mendahului kaunter aktif ialah SAAG Consolidated, yang mengukuh satu

sen kepada 13.5 sen.

Benalec yang baharu disenaraikan, sebuah syarikat penyedia

perkhidmatan carter kapal dan pembinaan marin bersepadu, menambah 34 sen

kepada RM1.34.

Ia mula disenaraikan di Pasaran Utama Bursa Malaysia dengan premium

36 sen daripada harga tawaran RM1 sesaham.

KUB mengembang 11 sen kepada 91.5 sen, Ho Wah Genting menokok empat

sen kepada 47.5 sen dan Talam Corp meningkat separuh sen kepada 11 sen.

Di kalangan saham berwajaran tinggi, Maybank naik lapan sen kepada

RM8.97, CIMB Group menambah tujuh sen kepada RM8.80, Sime Darby kekal

pada RM9.35 dan Petronas Chemical lebih tinggi 20 kepada RM6.35.

Di pasaran utama, jumlah dagangan turun kepada 1.644 bilion saham

bernilai RM2.142 bilion daripada 1.821 bilion saham bernilai RM2.466

bilion Jumaat lepas.Perolehan dagangan di Pasaran Ace mengembang kepada

102.497 juta saham bernilai RM14.553 juta daripada 93.226 juta saham

bernilai RM16.416 juta.

Jumlah dagangan waran pula merosot kepada 146.805 juta saham bernilai

RM38.533 juta daripada 216.508 juta saham bernilai RM51.346 juta

sebelumnya.- Bernama

Friday, January 14, 2011

Market Review

A lift from heavyweights. The FBM KLCI jumped 5.07 pts, or 0.32%, to 1,571.56 pts, backed by gains in selected blue chips. Volume increased to 2.7bn shares valued at RM3bn. Today’s key market news are Suria Capital bags a RM1bn job to build a 300MW combined cycle gas turbine gas-fired power plant project in Sabah, the Perak state government is considering setting up its own low-cost carrier terminal (LCCT) in the northern part of the state, JCorp plans a group-wide transformation, MMM’s RM20m debt written off, approval in writing for the Langat 2 plant still pending and standalone brokers can now get 1+1 status. Overnight, US stocks fell, pulling the DJIA to 11,731.9, or 23.54 pts lower, as initial jobless claims rose more than estimated. We expect the market to continue to trade sideways pending major fresh leads.

Saham mewah naik dagangan Bursa tinggi

KUALA LUMPUR 13 Jan - Harga saham di Bursa Malaysia ditutup lebih

tinggi hari ini, selepas disokong oleh kenaikan harga saham berwajaran

tinggi yang diterajui oleh Genting, kata para peniaga.

Sehingga jam 5 petang, FTSE Bursa Malaysia KLCI (FBM KLCI) menokok

5.07 mata atau 0.32 peratus kepada 1,571.56. Ia dibuka meningkat 4.25

mata kepada 1,570.74.Para peniaga berkata keyakinan para pelabur

dirangsang oleh perangkaan ekonomi yang positif dari zon euro dan

pasaran AS.

Indeks Kewangan menokok 37.92 mata kepada 14,341.11, Indeks

Perladangan menokok 35.73 mata kepada 8,243.65 dan Indeks Perusahaan

menokok 16.74 mata kepada 2,923.83.

Indeks FBM Emas menokok 48.70 mata kepada 10,854.89, Indeks FBM70

melonjak 101.58 mata kepada 11,729.77. Indeks FBM Ace pula turun 27.49

mata kepada 4,425.08.

Kaunter untung mengatasi kaunter rugi sebanyak 528 kepada 341

manakala 305 tidak berubah, 210 tidak diniaga dan 31 yang lain

digantung.

Jumlah dagangan meningkat kepada 2.704 bilion saham bernilai RM3.001

bilion berbanding dengan 2.473 bilion saham bernilai RM2.703 bilion

semalam.

Mendahului saham paling aktif ialah Karambunai yang meningkat 1.5 sen

kepada 22.5 sen. SAAG Consolidated turun 0.5 sen kepada 13.5 sen

manakala Compugates tidak berubah pada harga 7.0 sen.

Antara saham paling untung, British American Tobacco melonjak RM1.30

kepada RM48.48, JT International meningkat 35 sen kepada RM6.60,

Mudajaya meningkat 31 sen kepada RM5.20 dan Boustead Holdings menokok 28

sen kepada RM5.91.

Di kalangan saham berwajaran tinggi, CIMB turun 1.0 sen kepada RM8.77

manakala Maybank meningkat 1.0 sen kepada RM8.89.

Sime Darby meningkat 5.0 sen kepada RM9.35, Petronas Chemicals

menokok 1.0 sen kepada RM6.03 dan Axiata menokok 2.0 sen kepada RM4.89.

Di pasaran utama, jumlah dagangan meningkat kepada 2.315 bilion saham

bernilai RM2.911 bilion daripada 2.171 bilion saham bernilai RM2.636

bilion semalam.

Perolehan di Pasaran ACE meningkat kepada 113.475 juta saham bernilai

RM16.341 juta berbanding dengan 100.844 juta saham bernilai RM14.461

sebelum itu.

Jumlah dagangan waran juga melonjak kepada 263.574 juta saham

bernilai RM68.246 juta berbanding dengan 183.557 juta bernilai RM48.534

juta pada Rabu.- Bernama

Thursday, January 13, 2011

Market Review

The FBM KLCI gained 3.5 points yesterday on the back of gains chalked up by Genting, Genting Malaysia, Petchem, Tenaga and CIMB. The increase, though marginal, was in tandem with regional bourses, all of which were in positive territory. Overnight, the Dow jumped 83 points while the European markets were also broadly higher. It is likely that positive momentum will continue to lift the FBM KLCI today. Today’s news headlines are Pembinaan BLT, which is under the Ministry of Finance, is raising RM10bn worth of sukuk to fund the construction of police quarters and facilities, Tenaga Nasional signed two agreements worth RM2.1bn for its Ulu Jelai hydroelectric project, Faber received non-renewal notice for two of its contracts in Abu Dhabi worth RM184m annually, and SP Setia is said to be leading the race for the 30-year concession to build and operate the Penang International Convention Centre.

Belian berterusan Bursa ditutup tinggi

KUALA LUMPUR 12 Jan - Harga-harga saham di Bursa Malaysia ditutup

tinggi hari ini, disokong oleh belian berterusan untuk saham-saham

berwajaran tinggi, kata para peniaga.

Pada pukul 5 petang, KLCI FTSE Bursa Malaysia (FBM KLCI) naik 3.55

mata atau 0.23 peratus kepada 1,566.49, selepas dibuka 1.42 mata lebih

tinggi pada 1,564.36.

Pasaran tempatan memulakan hari dengan nada positif di mana para

pelabur mengambil petunjuk daripada penutup semalaman yang tinggi di

Wall Street.

Indeks Kewangan merosot 5.70 mata kepada 14,303.19, Indeks

Perladangan turun 5.44 mata kepada 8,207.92 dan Indeks Perusahaan lega

4.64 mata kepada 2,907.09.

Sementara itu, Indeks FBM Emas, mengukuh 41.13 mata kepada 10,806.19

dan Indeks FBM70 melonjak 118.35 mata kepada 11,628.19. Indeks FBM Ace

bagaimanapun, turun 1.80 mata kepada 4,452.57.

Saham-saham untung mengatasi saham rugi dengan 460 berbalas 406

sementara 273 tidak berubah, 249 tidak diniagakan dan 39 yang lain

digantung urus niaga.

Jumlah dagangan merosot kepada 2.473 bilion saham bernilai RM2.703

bilion daripada 2.706 bilion saham bernilai RM2.637 bilion semalam.

Antara saham yang paling aktif, Metronic Global merosot setengah sen

kepada enam sen dan Talam Corporation lebih rendah satu sen kepada 11.0

sen tetapi SAAG Consolidated kekal pada 14 sen.

Saham-saham berwajaran tinggi pula, Maybank kerugian enam sen kepada

RM8.88 sementara CIMB Group menokok satu sen kepada RM8.78.

Petronas Chemicals menambah empat sen kepada RM6.02 sementara Genting

menambah 42 sen kepada RM11.84 tetapi Axiata turun satu sen kepada

RM4.87.

Kaunter berkaitan minyak dan gas, SapuraCrest melonjak 33 sen kepada

RM3.78, KNM naik 15 sen kepada RM3.17, Kencana menokok 13 sen kepada

RM2.86 dan Dialog meningkat lima sen kepada RM2.21.

Di pasaran utama, jumlah dagangan berkurangan kepada 2.171 bilion

saham bernilai RM2.636 bilion daripada 2.312 bilion saham bernilai

RM2.550 bilion semalam.

Jumlah dagangan di Pasaran Ace merosot kepada 100.844 juta saham

bernilai RM14.461 juta berbanding 209.847 juta unit bernilai RM35.773

juta sebelumnya.

Jumlah waran, bagaimanapun, mengukuh kepada 183.557 juta bernilai

RM48.534 juta berbanding 171.528 juta saham bernilai RM45.296 juta

sebelumnya.- Bernama

Wednesday, January 12, 2011

Market Review

Buying support kicks in. The FBM KLCI continued to succumb to mild profit taking, closing a marginal 0.58 points lower at 1,562.9 points, dragged down by PLUS. Trading volume on Bursa Malaysia remained high, rising to 2.6bn shares traded compared to 2.3bn the previous day. Today’s corporate news include the Government announcing 19 projects valued at RM67bn under the ETP for approval, Gas Malaysia is said to be looking at a listing on Bursa Malaysia, Top Glove expects to invest RM160m in Cambodia for rubber tree planting purposes and Low Yat group has proposed to purchase the entire assets and liabilities of AP Land for RM305m. Taking the cue from Wall Street’s positive overnight close of 34.4 points on expectations of a stronger than expected earnings reporting season, we expect out market to climb today.

Pengambilan untung Bursa bercampur-campur

KUALA LUMPUR 11 Jan - Harga-harga saham di Bursa Malaysia ditutup

bercampur-campur hari ini dengan indeks utama kekal dalam wilayah

negatif pada sepanjang hari berikutan aktiviti pengambilan untung ke

atas saham-saham berwajaran tinggi terpilih, kata peniaga.

Pada 5 petang, FTSE Bursa Malaysia KLCI (FBM KLCI) susut 0.58 mata

atau 0.04 peratus kepada 1,562.94 selepas dibuka 4.25 mata lebih rendah

pada 1,559.27.

Seorang peniaga berkata pasaran dijangka dalam keadaan pembetulan

minggu ini selepas peningkatan ketara minggu lepas.

Indeks Kewangan susut 31.41 mata kepada 14,308.89, Indeks Perladangan

susut 13.14 mata kepada 8,213.36 dan Indeks Perusahaan turun 4.59 mata

kepada 2,911.73.

Indeks FBM Emas menokok 3.33 mata kepada 10,765.06 dan Indeks FBM70

menambah 2.97 mata kepada 11,509.84.

Indeks FBM Ace bagaimanapun turun 27.89 mata kepada 4,454.37.

Kaunter untung mengatasi kaunter rugi sebanyak 437 berbanding 426

manakala 282 tidak berubah, 244 tidak diniagakan dan 37 digantung.

Jumlah dagangan meningkat kepada 2.706 bilion saham bernilai RM2.637

bilion berbanding 2.226 bilion saham bernilai RM2.800 bilion semalam.

Mengetuai saham untung ialah SAAG Consolidated, yang menokok setengah

sen kepada 14 sen. Talam Corp menambah dua sen kepada 12 sen dan

Karambunai meningkat satu sen kepada 21.5 sen.

Asia Media, yang mula disenarai di Pasaran ACE hari ini, meningkat

5.5 sen kepada 28.5 sen selepas dibuka pada 40 sen, atau 17 sen,

melepasi harga penawaran pada 23 sen.

Antara saham berwajaran tinggi, Maybank dan CIMB Group masing-masing

turun enam sen kepada RM8.94 dan RM8.77 manakala Sime Darby rugi satu

sen kepada RM9.29.

Di Pasaran Utama, jumlah dagangan meningkat 2.312 bilion saham

bernilai RM2.550 bilion berbanding 1.874 bilion saham bernilai RM2.721

bilion semalam.

Jumlah dagangan di Pasaran ACE meningkat kepada 209.847 juta unit

bernilai RM35.773 juta berbanding 135.485 juta unit bernilai RM21.530

juta pada Isnin.

Jumlah waran berkurangan kepada 171.528 juta saham bernilai RM45.296

juta berbanding 206.981 juta saham bernilai RM52.951 juta sebelumnya.

- Bernama

Tuesday, January 11, 2011

Technical View

Unlike the last two sessions, the FBM KLCI eventually failed to hold on to part of the last week’s gains and ended the day with a los off about 9 pts. Nevertheless, yesterday’s retracement was not excessive considering that the index had put on some 45 pts on the first week of 2011.

As we mentioned last week, we have drawn the new resistance line which is projected from the uptrend line. As a result, we have a new uptrend channel on the daily chart. In fact, we will view the market action within the uptrend channel as insignificant as we will continue to expect the FBM KLCI to trend higher as long as it maintains a posture within the channel.

At this stage, the resistance line is still very much at the assumption stage, being simply a projection from uptrend line 1. This is because we would need at least three connecting points to draw a trend line but the September peak is the only point we have now.

From the current level, last Friday’s intra-day high of 1,572 pts is still the immediate resistance. To the downside, immediate support lies at the 1,551 pt-level, followed by the 1,532 pt-level.

As we mentioned last week, we have drawn the new resistance line which is projected from the uptrend line. As a result, we have a new uptrend channel on the daily chart. In fact, we will view the market action within the uptrend channel as insignificant as we will continue to expect the FBM KLCI to trend higher as long as it maintains a posture within the channel.

At this stage, the resistance line is still very much at the assumption stage, being simply a projection from uptrend line 1. This is because we would need at least three connecting points to draw a trend line but the September peak is the only point we have now.

From the current level, last Friday’s intra-day high of 1,572 pts is still the immediate resistance. To the downside, immediate support lies at the 1,551 pt-level, followed by the 1,532 pt-level.

Market Review

The expected correction. After notching up a record high last week, the inevitable correction finally set in yesterday, with the FBM KLCI sliding over 8 points at the close. Regional markets were also not spared a broad sell-down, sparked by renewed concerns over inflationary threats with the Jakarta Composite Index leading the decline. The number of shares traded on Bursa Malaysia remained high at over 2.2bn, indicating possibly strong foreign participation. Jelas Ulung has failed to deposit the RM50m ahead of the 5pm deadline yesterday for its bid to be considered as one of the takeover offers for PLUS; (ii) Transmile will sell 4 aircraft for RM209m; and (iii) a subsidiary of SAAG has inked a RM239m contract to build a 40k tramway in Melaka. The market may trade range bound today in search of fresh leads, with investors also taking the cue from external developments. Strong support is seen at 1551 pts. Overnight, the US markets finished weaker on concerns over European bank debt and the possible bailout of Portugal.A

Pengambilan untung Bursa ditutup tinggi

KUALA LUMPUR 10 Jan - Harga-harga saham di Bursa Malaysia ditutup

lebih rendah hari ini berikutan aktiviti pengambilan untung selepas

peningkatan kukuh lima hari berturut-turut, kata para peniaga.

Pada 5 petang, FTSE Bursa Malaysia KLCI (FBM KLCI) susut 8.69 mata

atau 0.55 peratus kepada 1,563.52 selepas dibuka 2.43 mata lebih tinggi

pada 1,574.64.

Peniaga berkata pasaran bermula positif hari ini tetapi jualan

berterusan saham-saham mewah terpilih didorong saham berkaitan kewangan

menyebabkan indeks utama itu ditutup pada kawasan negatif.

Indeks Kewangan susut 75.71 mata kepada 14,340.30, Indeks Perladangan

susut 21.93 mata kepada 8,226.50 dan Indeks Perusahaan merosot 12.74

mata kepada 2,916.32.

Indeks FBM Emas jatuh 30.14 mata kepada 10,761.73, Indeks FBM Ace

merosot 10.20 mata kepada 4,482.26 tetapi Indeks FBM70 naik 30.04 mata

kepada 11,506.87.

Kaunter jatuh melebihi untung 478 berbanding 427 sementara 233 tidak

berubah, 249 tidak didagangkan dan 38 digantung.

Jumlah dagangan merosot kepada 2.226 bilion saham bernilai RM2.800

bilion daripada 2.536 bilion saham bernilai RM3.454 bilion Jumaat lepas.

Di kalangan saham aktif, SAAG Consolidated naik tiga sen kepada 13.5

sen, Compugates Holdings meningkat setengah sen kepada tujuh sen

sementara Hubline merosot satu sen kepada 23.5 sen.

Di kalangan kaunter berwajaran tinggi, CIMB Group dan Petronas

Chemicals jatuh 10 sen setiap satu kepada RM8.83 dan RM5.86, Sime Darby

merosot tujuh sen kepada RM9.30 dan Genting jatuh empat sen kepada

RM11.26.

Di Pasaran Utama, jumlah dagangan menyusut kepada 1.874 bilion saham

bernilai RM2.721 bilion daripada 2.115 bilion saham bernilai RM3.351

bilion Jumaat lepas.Waran merosot kepada 206.981 juta saham bernilai

RM52.951 juta berbanding 292.271 juta saham bernilai RM74.636 juta

sebelumnya.

Jumlah dagangan di Pasaran ACE, bagaimanapun, naik kepada 135.485

juta saham bernilai RM21.530 juta berbanding 112.671 juta saham bernilai

RM22.547 juta Jumaat lepas.

Barangan pengguna menguasai 96.237 juta saham yang didagangkan di

Pasaran Utama, produk perusahaan 329.424 juta, pembinaan 173.158 juta,

dagangan dan perkhidmatan 843.967 juta, teknologi 35.690 juta, prasarana

17.057 juta, kewangan 100.740 juta, hotel 40.264 juta, harta 197.910

juta, perladangan 35.940 juta, perlombongan 660,800, REIT 2.519 juta dan

dana tertutup 182,400. - Bernama

Friday, January 7, 2011

Technical View

Little has changed as far as the USD/RM’s near-term and mid-term technical outlooks are concerned. The only notable development of late is that the RM had just charted a new high since the introduction of the managed-float system. Not even the strong support floor created at the RM3.07/USD level could defend the selling pressure on the USD.